How to Plan for Early Retirement in the UK: A Comprehensive Guide

Retiring early is a dream for many, but it requires careful planning and financial discipline. In the United Kingdom, where the state pension age is gradually increasing, many individuals are exploring ways to retire before the traditional retirement age of 65. This article provides an in-depth look at how to plan for early retirement, focusing on key steps such as estimating savings, creating a budget, investing wisely, and making lifestyle adjustments.

Understanding the Savings Requirements

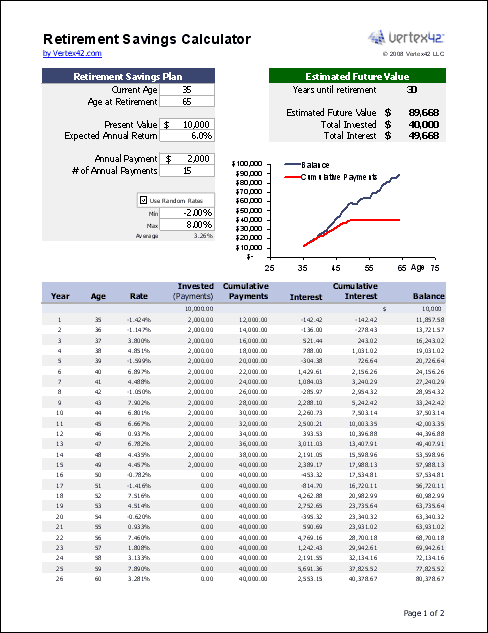

The first step in planning for early retirement is to estimate how much money you need to save. According to Fidelity’s guidelines, the amount you should aim to save depends on several factors, including your expected rate of return, inflation, and your annual expenses. For example, if you plan to retire before age 62, Fidelity suggests saving 33 times your annual expenses. If your annual expenses are £75,000, this would mean aiming for a total of £2.475 million.

For those retiring at the standard state pension age of 67, a more conservative withdrawal rate of 4% to 5% is typically recommended. However, for early retirees, a lower withdrawal rate may be necessary to ensure that your savings last throughout your retirement. Working with a financial professional can help you determine the right withdrawal rate based on your individual circumstances.

Creating a Mock Retirement Budget

Before you start calculating how much you need to save, it’s essential to create a mock retirement budget. This involves estimating your monthly expenses in retirement and adjusting them based on your lifestyle goals. For instance, if you plan to travel frequently or maintain a high level of spending, your budget will be significantly higher than if you prefer a more modest lifestyle.

One important consideration is to pay off any existing debt, including your mortgage, before retiring. Debt can quickly drain your retirement savings and limit your financial flexibility. Additionally, you should factor in the cost of health insurance, which can be a significant expense if you retire before qualifying for Medicare (which is not available in the UK, but similar considerations apply for private health coverage).

Evaluating Your Current Financial Situation

To build a solid foundation for early retirement, you need to evaluate your current financial situation. This includes assessing your income, savings, investments, and debts. The Ramsey Solutions’ Baby Steps provide a useful framework for this process:

- Save £1,000 for an emergency fund.

- Pay off all debt (except the house) using the debt snowball method.

- Build a fully funded emergency fund covering 3–6 months of expenses.

- Invest 15% of your household income in retirement.

- Save for your children’s college fund.

- Pay off your home early.

- Build wealth and give.

By following these steps, you can create a strong financial base that supports your goal of retiring early.

Investing in a Bridge Account

If you’re planning to retire before the age of 59½, it’s important to consider a bridge account. This is a taxable investment account that allows you to access your funds without facing early withdrawal penalties. Brokerage accounts are ideal for this purpose, as they offer flexibility and no contribution limits.

However, it’s important to note that gains from these accounts are subject to capital gains tax. To minimize tax liability, consider investing in low-turnover mutual funds, such as S&P 500 index funds, which have lower expenses and are less likely to trigger capital gains taxes.

Real Estate Investment as an Alternative

Another strategy for early retirement is investing in real estate. Rental properties can generate a steady stream of income, providing financial security during retirement. However, this approach requires careful planning and a solid financial foundation.

Before investing in real estate, ensure that you’ve paid off your own home and have a fully funded emergency fund. It’s also crucial to invest in properties with cash, avoiding debt to reduce risk. Hiring a knowledgeable real estate agent can help you find the best opportunities and negotiate favorable terms.

Lifestyle Adjustments for Early Retirement

Retiring early often requires significant lifestyle changes. This includes cutting back on discretionary spending, such as dining out, entertainment, and subscriptions. Even small reductions in these areas can add up over time, contributing to your retirement savings.

Additionally, consider downsizing your home or relocating to a more affordable area to reduce living costs. These adjustments can help stretch your savings further and increase your chances of achieving financial independence.

Final Considerations

When you’re ready to retire, it’s important to revisit your retirement plans and make sure they align with your current goals and expectations. This includes considering your retirement location, whether you want to continue working part-time, and how you’ll manage your income streams.

Health insurance is another critical factor, as retiring before the state pension age may require private coverage. Finally, regular consultations with a financial advisor can help you stay on track and make informed decisions about your retirement strategy.

In conclusion, retiring early in the UK is achievable with proper planning, disciplined saving, and smart investing. By following the steps outlined in this guide, you can create a secure financial future and enjoy the freedom of early retirement.