The Ultimate Guide to Fintech: Innovations, Trends, and Future Outlook

Fintech, short for financial technology, has become a cornerstone of the modern economy. It represents the intersection of finance and technology, where innovative solutions are reshaping how we manage money, invest, and conduct transactions. From mobile banking to blockchain and cryptocurrency, fintech is driving a revolution that is both empowering consumers and transforming traditional financial institutions. This guide explores the latest innovations, trends, and future outlook for the fintech industry.

What is Fintech?

Fintech refers to the use of technology to enhance or automate financial services and operations. It combines “finance” and “technology” to create more efficient, accessible, and secure financial solutions. Fintech encompasses a wide range of applications, including mobile banking, digital payments, investment platforms, insurance tech, and even cryptocurrency. Its goal is to improve the user experience while reducing costs and increasing transparency.

Key Fintech Statistics 2025

The fintech market is growing at an impressive pace. According to projections, the global fintech market will exceed $340 billion in 2025 and reach $1,152 billion by 2032, with a compound annual growth rate (CAGR) of 16.5%. The Open Banking market is also expected to grow significantly, reaching $51 billion by 2025, up from $19 billion in 2021. Additionally, the digital assets market, which includes cryptocurrencies and blockchain-based solutions, is projected to have an asset under management (AUM) of $93.99 billion in 2025.

How Does the Fintech Industry Work?

Fintech operates by leveraging advanced technologies such as artificial intelligence (AI), machine learning, blockchain, and data analytics. These tools enable companies to streamline processes, reduce fraud, and offer personalized financial services. For example, robo-advisors use algorithms to provide investment recommendations, while blockchain ensures secure and transparent transactions.

Fintech startups are disrupting traditional financial institutions by offering faster, cheaper, and more convenient alternatives. They are redefining how people save, invest, and borrow money. For instance, digital-only lenders can approve loan applications within minutes, whereas traditional banks may take days or even weeks.

Benefits of Fintech

Fintech offers numerous benefits to both individuals and businesses. Here are some of the key advantages:

- Increased Accessibility: Fintech makes financial services available to a broader audience, including those in underserved regions.

- Cost Efficiency: By automating processes, fintech reduces operational costs, allowing businesses to offer lower fees to customers.

- Enhanced Security: Advanced encryption and biometric authentication protect users’ financial data from cyber threats.

- Improved User Experience: Fintech platforms provide intuitive interfaces that make managing finances easier and more engaging.

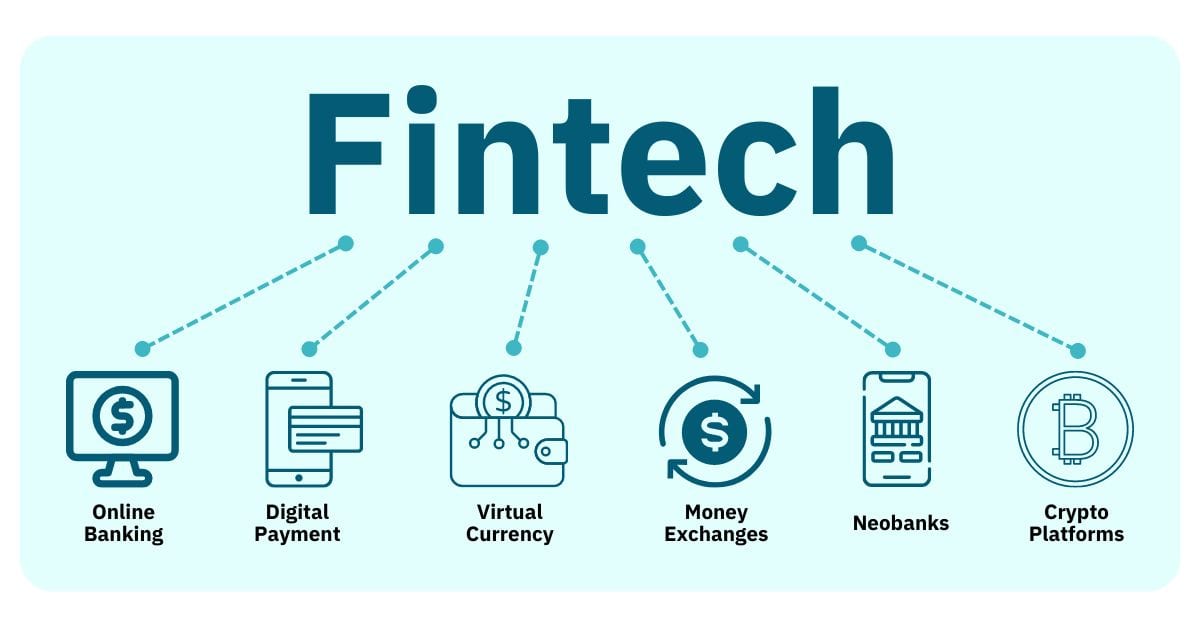

Types of Fintech

There are several categories of fintech, each addressing different aspects of financial services:

1. Banking

Fintech has transformed traditional banking by introducing digital-only banks, no-fee debit cards, and faster credit card acceptance. Companies like Green Dot are leading the way in providing modern banking solutions.

2. Cryptocurrency and Blockchain

Cryptocurrency exchanges like Coinbase are popular fintech platforms that allow users to buy, sell, and store digital currencies. Blockchain technology ensures secure and transparent transactions.

3. Payments

Fintech companies are revolutionizing the way people send and receive money. Peer-to-peer (P2P) payment apps eliminate the need for traditional banks, offering lower fees and faster transfers.

4. Investments and Savings

Robo-advisors and algorithm-driven investment platforms help users make informed financial decisions. High-yield savings accounts and automated investment tools are becoming increasingly popular.

5. Insurance

Fintech is also making waves in the insurance sector. Insurtech companies are using data analytics and AI to offer personalized insurance products and streamline claims processing.

The Future of Fintech

The future of fintech looks promising, with several emerging trends shaping the industry:

- Artificial Intelligence and Machine Learning: These technologies will continue to play a crucial role in fraud detection, customer service, and personalized financial advice.

- Decentralized Finance (DeFi): DeFi platforms are challenging traditional financial systems by offering decentralized lending, borrowing, and trading options.

- Regulatory Technology (RegTech): As regulations evolve, fintech companies are investing in regtech solutions to ensure compliance and reduce risks.

Challenges and Risks

Despite its rapid growth, fintech faces several challenges, including:

- Security Concerns: The vast amount of user data collected by fintech companies poses a risk of data breaches and cyberattacks.

- Regulatory Hurdles: Navigating complex regulatory environments can be a barrier for new fintech startups.

- Lack of Human Interaction: Some users prefer face-to-face interactions, and the absence of human support in fintech apps can lead to lower engagement.

Conclusion

Fintech is here to stay, and its impact on the financial industry is undeniable. As technology continues to evolve, so will the ways in which we interact with money. Whether you’re a consumer looking for more convenient financial services or a business seeking to streamline operations, fintech offers a wealth of opportunities. By staying informed about the latest trends and innovations, you can make the most of what this dynamic industry has to offer.