How to Get the Best Insurance Quotes in 2024

Insurance is a crucial aspect of financial planning, offering protection against unexpected events and ensuring peace of mind. However, with so many insurance providers and policies available, it can be overwhelming to determine which one is right for you. The key to finding the best insurance quotes lies in understanding your needs, comparing options, and leveraging tools that simplify the process. In 2024, the landscape of insurance has evolved with more digital tools, better transparency, and increased competition among providers. This article will guide you through the steps to secure the best insurance quotes tailored to your unique situation.

Understand Your Insurance Needs

Before diving into the world of insurance quotes, it’s essential to evaluate what kind of coverage you need. Different types of insurance—such as auto, home, health, life, and renters’ insurance—serve distinct purposes. Here are some key considerations:

- Auto Insurance: Protects you financially in case of accidents, theft, or damage to your vehicle.

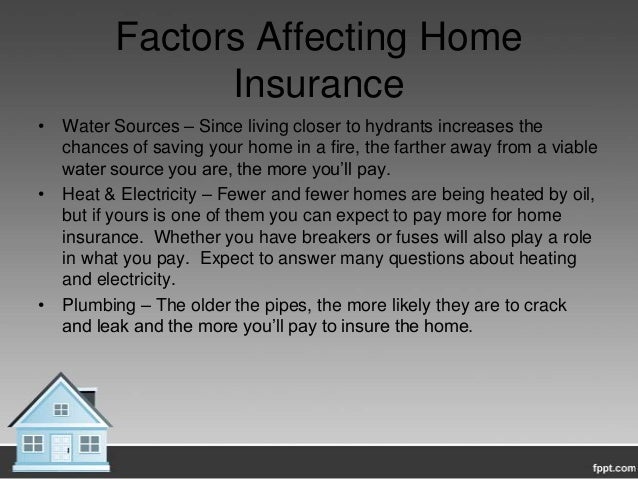

- Home Insurance: Covers your property and belongings against risks like fire, theft, and natural disasters.

- Health Insurance: Helps cover medical expenses, including doctor visits, prescriptions, and hospital stays.

- Life Insurance: Provides financial support to your dependents after your passing.

- Renters Insurance: Offers coverage for personal belongings and liability if you rent a home.

Understanding your specific needs will help you narrow down the type of insurance you require and avoid paying for unnecessary coverage.

Research and Compare Insurance Providers

Once you have a clear idea of your insurance needs, the next step is to research and compare different insurance providers. Several platforms offer tools to compare insurance quotes quickly and efficiently. Some popular options include:

- Policygenius: An independent insurance marketplace that connects users with multiple insurers, allowing for easy comparison of policies and rates.

- MoneyGeek: Offers car insurance calculators and detailed insights into how various factors affect your premium.

- InsuranceQuotes.com: A platform that helps users find affordable insurance by connecting them with top local and national providers.

These platforms often provide free, no-obligation quotes, making it easier to compare prices and features without any pressure to commit immediately.

Use Online Tools and Calculators

In 2024, online tools and calculators have become invaluable resources for anyone seeking insurance quotes. These tools allow you to input your personal information and receive instant estimates based on your profile. For example, MoneyGeek’s car insurance calculator considers factors such as your ZIP code, age, vehicle make and model, and credit score to generate accurate estimates. Similarly, InsuranceQuotes.com offers a user-friendly interface where you can enter your details and compare quotes from multiple providers in seconds.

Using these tools not only saves time but also ensures that you get a comprehensive view of your options. Additionally, many platforms provide educational resources to help you understand the different types of coverage and how they impact your premiums.

Consider Your Driving History and Credit Score

Your driving history and credit score play a significant role in determining your insurance rates. Insurance companies assess these factors to evaluate the level of risk associated with insuring you. For instance, a clean driving record with no accidents or traffic violations typically results in lower premiums. Conversely, a history of accidents or tickets may lead to higher rates.

Similarly, your credit score can influence your insurance costs. While some states, like California and Michigan, have banned the use of credit scores in determining insurance rates, others still consider them a factor. Maintaining a good credit score can help you qualify for lower premiums, especially for auto and home insurance.

Explore Discounts and Special Offers

Many insurance providers offer discounts that can significantly reduce your premiums. Common discounts include:

- Safe Driver Discount: For drivers with a clean record.

- Multi-Policy Discount: For bundling multiple insurance policies (e.g., auto and home).

- Good Student Discount: For students with high grades.

- Anti-Theft Device Discount: For vehicles equipped with anti-theft systems.

- Loyalty Discount: For long-term customers.

Be sure to ask your insurance provider about available discounts and how you can qualify for them. Taking advantage of these offers can help you save money while still maintaining adequate coverage.

Read Reviews and Check Reputation

When selecting an insurance provider, it’s important to consider their reputation and customer service. Reading reviews from other policyholders can give you insight into the company’s reliability, claim processing speed, and overall satisfaction. Platforms like the Better Business Bureau (BBB) and consumer review sites can help you gauge the quality of service offered by different insurers.

Additionally, checking the financial strength of the insurance company is crucial. A financially stable insurer is more likely to be able to pay claims when needed. You can look up ratings from organizations like A.M. Best or Standard & Poor’s to assess the company’s stability.

Consult with Licensed Professionals

While online tools and calculators are incredibly useful, there may be instances where consulting with a licensed insurance professional is beneficial. Agents can provide personalized advice based on your specific needs and help you navigate the complexities of insurance policies. They can also assist you in understanding the fine print and ensuring that you’re getting the best value for your money.

Many platforms, such as InsuranceQuotes.com, offer access to a team of licensed agents who are ready to answer your questions and guide you through the process. Don’t hesitate to reach out for expert assistance if you feel overwhelmed by the choices available.

Finalize Your Policy and Review Regularly

Once you’ve found the best insurance quotes that meet your needs and budget, it’s time to finalize your policy. Be sure to review the terms and conditions carefully, and don’t forget to check for any additional fees or exclusions. It’s also a good idea to revisit your insurance needs periodically, especially after major life changes such as buying a new car, moving to a different state, or starting a family.

By staying informed and proactive, you can ensure that your insurance coverage remains adequate and cost-effective over time.