Understanding Insurance Benefits: What You Need to Know

Insurance benefits are a critical component of any insurance policy, providing financial support to individuals and families during times of need. These benefits are designed to protect against the financial burden of unexpected events such as medical emergencies, accidents, or property damage. Understanding what insurance benefits are and how they work can help you make informed decisions about your coverage.

What Are Insurance Benefits?

Insurance benefits refer to the financial advantages or compensations provided by an insurance policy to the policyholder or their beneficiaries when certain covered events occur. These benefits can include reimbursement for medical expenses, a lump sum payment upon death, or coverage for property damage. The specific benefits depend on the type of insurance policy and the terms outlined in the contract.

For example, health insurance may provide benefits to cover the cost of medical treatment, while life insurance provides a lump sum payment to beneficiaries after the policyholder’s death. The goal of these benefits is to offer a safety net that helps individuals and families manage the financial impact of unexpected circumstances.

Types of Insurance Benefits

There are several types of insurance benefits, each tailored to different needs and situations:

- Health Insurance Benefits: These typically cover medical expenses such as hospital stays, surgeries, and prescription medications.

- Life Insurance Benefits: These provide a lump sum payment to beneficiaries upon the policyholder’s death, helping to cover funeral costs, outstanding debts, or other financial obligations.

- Property & Casualty Insurance Benefits: These cover damages to personal or commercial property due to accidents, theft, or natural disasters.

- Disability Insurance Benefits: These provide income replacement if the policyholder becomes disabled and unable to work.

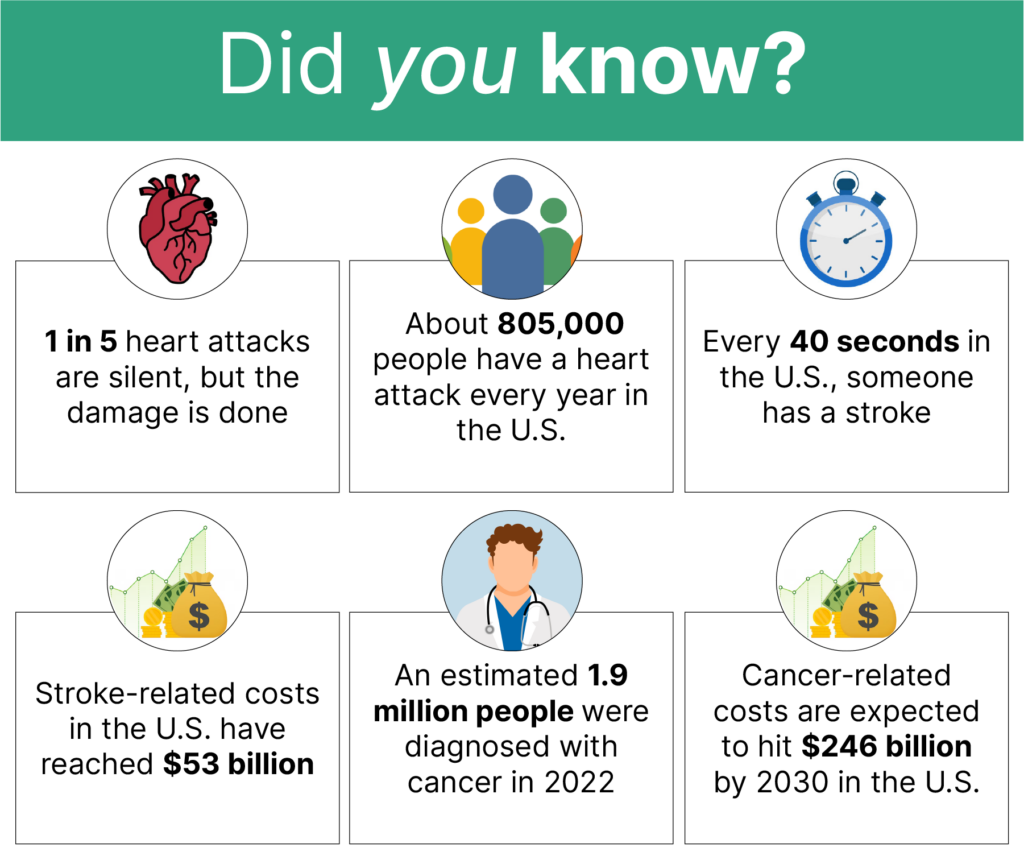

- Critical Illness Insurance Benefits: These offer a cash payout for diagnosed serious illnesses, such as cancer or heart disease, to help cover treatment costs and living expenses.

Each type of insurance benefit serves a unique purpose and is designed to address specific risks and financial needs.

Why Are Insurance Benefits Important?

Insurance benefits are essential because they offer financial security and peace of mind to individuals and families. By providing coverage for a range of potential risks and unforeseen events, insurance benefits ensure that policyholders can manage the costs associated with these events without depleting their savings or going into debt.

For individuals, insurance benefits serve as a safety net, offering financial support when they need it most. For businesses, providing insurance benefits as part of employee health or life insurance packages can improve employee satisfaction, retention, and overall productivity. Additionally, insurance benefits help spread the financial risks of life, such as healthcare expenses or unexpected death, across a larger pool of policyholders, making it more affordable for everyone involved.

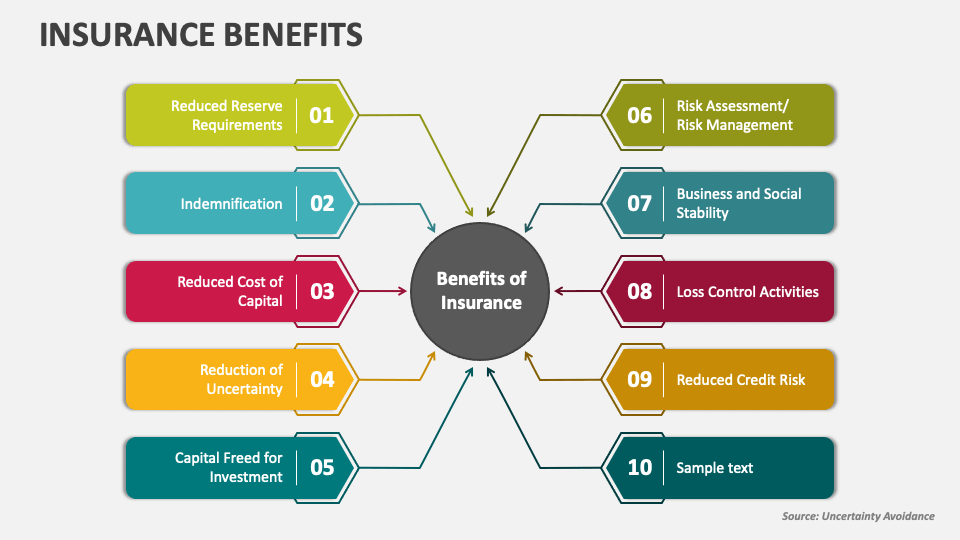

Key Benefits of Insurance

- Financial Protection: Insurance benefits help protect against the high costs of medical care, property damage, and other unexpected events.

- Peace of Mind: Knowing that you have coverage can reduce stress and anxiety during difficult times.

- Risk Management: Insurance benefits allow individuals and businesses to manage risks effectively by transferring the financial burden to the insurer.

- Support During Emergencies: In times of crisis, insurance benefits can provide the necessary funds to cover immediate expenses and long-term needs.

How to Understand Your Insurance Benefits

Understanding your insurance benefits requires careful review of your policy documents and a clear understanding of the terms and conditions. Here are some steps to help you navigate your insurance benefits:

- Review Your Policy Documents: Take the time to read through your insurance policy carefully. Pay attention to the details of the benefits, exclusions, and any conditions that may affect your coverage.

- Understand Coverage Limits: Each insurance policy has specific limits on the amount of coverage provided. Be aware of these limits and how they apply to your situation.

- Know Your Deductibles and Co-Pays: Many insurance policies require you to pay a deductible or co-pay before the insurance company begins covering the costs. Understand how these amounts are calculated and when they apply.

- Consult with Your Insurance Provider: If you have questions about your benefits, contact your insurance provider for clarification. They can help you understand your coverage and answer any questions you may have.

- Consider Additional Coverage Options: Depending on your needs, you may want to consider additional coverage options, such as critical illness insurance or disability insurance, to enhance your protection.

Common Insurance Benefits Explained

Here are some of the most common insurance benefits and what they cover:

- Health Insurance Benefits: Cover medical expenses such as doctor visits, hospital stays, and prescription medications.

- Life Insurance Benefits: Provide a lump sum payment to beneficiaries upon the policyholder’s death.

- Auto Insurance Benefits: Cover costs related to car accidents, theft, or damage from natural disasters.

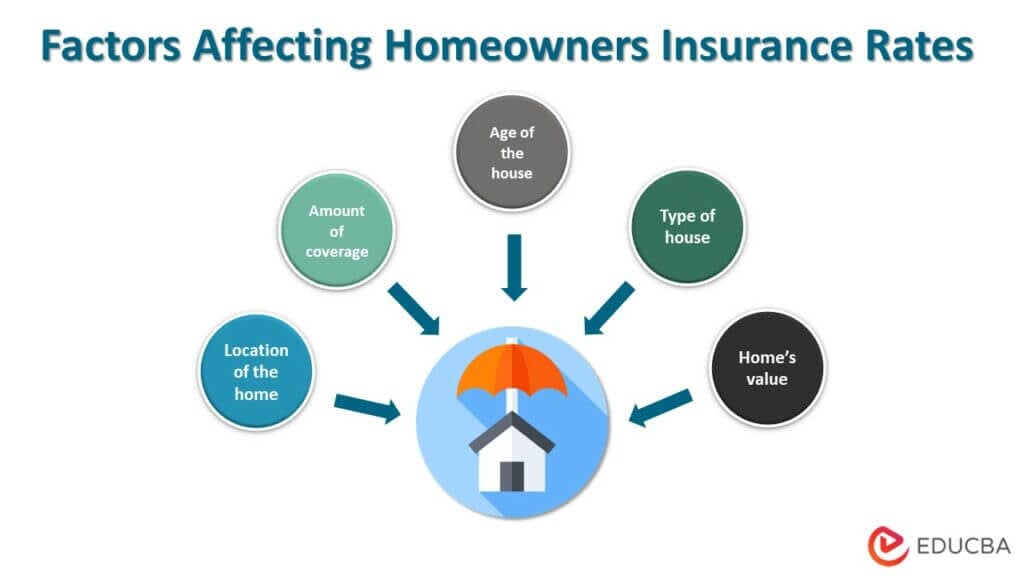

- Homeowners Insurance Benefits: Protect against damage to your home and personal belongings.

- Disability Insurance Benefits: Replace income if the policyholder becomes disabled and unable to work.

- Travel Insurance Benefits: Cover trip cancellations, lost luggage, and medical emergencies during travel.

Conclusion

Insurance benefits play a vital role in protecting individuals and families from the financial impact of unexpected events. Whether it’s health care, life events, or property damage, these benefits offer a safety net that helps manage the costs associated with these situations. Understanding the details of your insurance benefits and the coverage provided by different policies is crucial for ensuring financial security and peace of mind.

By taking the time to understand your insurance benefits, you can make informed decisions about your coverage and ensure that you are adequately protected. Remember to review your policy documents, understand your coverage limits, and consult with your insurance provider to get the most out of your insurance benefits.