How to Get the Best Car Loan: A Complete Guide for 2024

Getting a car loan can be a daunting process, but with the right knowledge and preparation, it can also be a smooth and rewarding experience. Whether you’re looking to purchase a new or used vehicle, understanding how to secure the best car loan is essential. This guide will walk you through the key steps to help you make an informed decision and find the most favorable terms.

Assess Your Financial Standing

Before applying for a car loan, it’s crucial to take a close look at your financial situation. Start by evaluating all your income sources, such as salaries, bonuses, and investments. Then, break down your monthly expenses into fixed (like rent, utilities, and insurance) and variable costs (such as dining out and entertainment). Understanding your cash flow will help you determine how much you can afford to spend on a car loan without overextending yourself.

Create a detailed budget that outlines your disposable income—the amount left after covering your essential expenses. This figure will serve as a baseline for determining how much you can comfortably pay each month toward your car loan.

Know Your Credit Score

Your credit score plays a significant role in determining your eligibility for a car loan and the interest rate you’ll receive. In the United States, credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Lenders use this score to assess your ability to repay debt, so it’s important to check your credit report regularly for errors or inaccuracies.

You can obtain your credit report for free once a year from major credit bureaus like Experian, Equifax, and TransUnion. Review the details carefully, including your payment history, existing debts, and any negative marks. If you find any discrepancies, dispute them immediately to improve your score.

Research Different Lenders

Once you have a clear picture of your finances and credit score, it’s time to start shopping around for the best car loan options. Consider various lenders, including banks, non-banking financial institutions (NBFCs), and online lenders. Each may offer different interest rates, loan terms, and fees, so it’s essential to compare offers carefully.

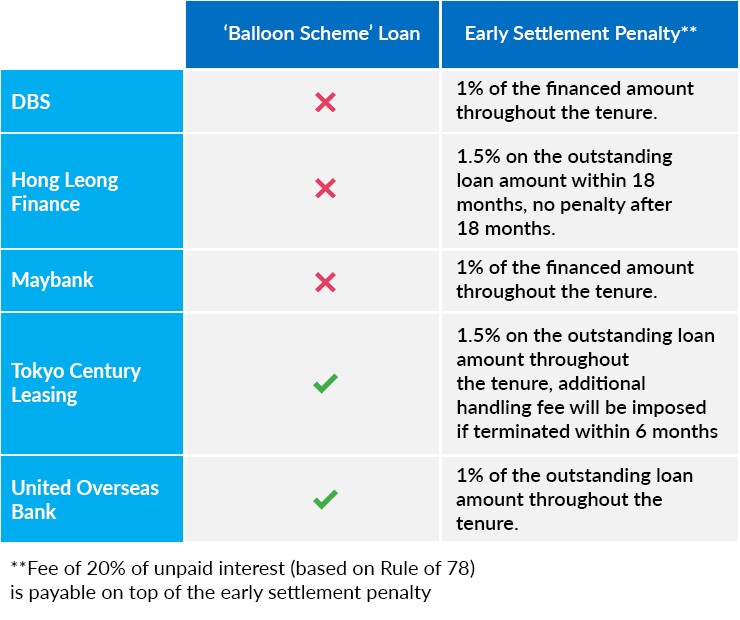

When evaluating lenders, don’t just focus on the interest rate. Also consider factors like processing fees, prepayment penalties, and customer service reputation. Some lenders may offer faster approvals or more flexible terms, which could be beneficial depending on your needs.

Understand Loan Terms and Conditions

It’s vital to fully understand the terms and conditions of any car loan you’re considering. Key elements to review include:

- Interest Rate: This determines the cost of borrowing and affects both your monthly payments and the total amount repaid over the loan term.

- Loan Term: The length of the loan impacts your monthly EMI and the total interest paid. Longer terms mean lower monthly payments but higher overall costs.

- Processing Fees: These are charges levied by lenders to cover administrative costs. Be sure to factor these into your total loan cost.

- Prepayment Penalties: Some lenders charge fees if you pay off the loan early. Check whether this applies and what the terms are.

Always read the fine print and consult with a financial advisor if needed.

Choose the Right Loan Type

There are several types of car loans available, each with its own advantages. The two main categories are:

- Fixed-Rate Loans: These offer a consistent interest rate throughout the loan term, making budgeting easier and protecting you from rate fluctuations.

- Floating-Rate Loans: These have interest rates that can change over time, potentially leading to lower initial payments but with more uncertainty.

Some lenders also offer hybrid loans that combine features of both fixed and floating rates. Consider your risk tolerance and financial goals when choosing the right type of loan.

Consider Making a Down Payment

While it’s possible to finance the entire cost of a car, making a down payment can offer several benefits. A down payment reduces the loan amount, which can lead to lower monthly payments and less interest over time. It also demonstrates to lenders that you’re committed to the loan, potentially improving your chances of approval and securing better terms.

The ideal down payment percentage varies, but aiming for at least 10% of the car’s price is a good starting point.

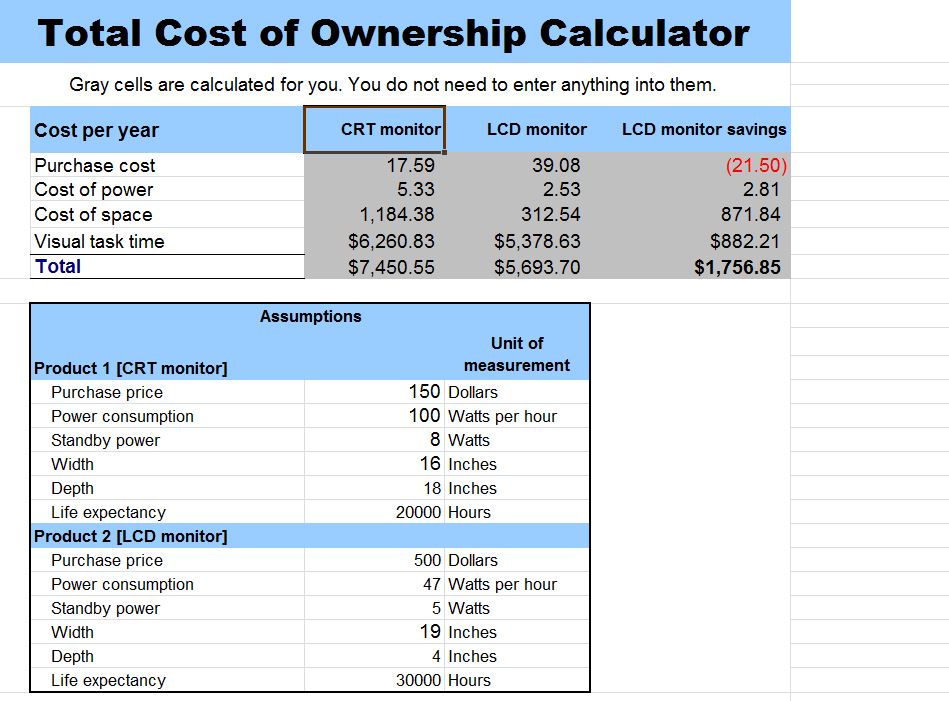

Calculate the Total Cost of Ownership

Beyond the loan itself, consider the total cost of owning a car. This includes:

- Insurance Premiums

- Fuel Costs

- Maintenance and Repair Expenses

- Depreciation

These costs can add up significantly over time, so it’s important to factor them into your budget. Additionally, if you plan to sell the car later, consider its resale value and how it might offset some of these expenses.

Read the Fine Print

Before signing any loan agreement, thoroughly review the terms and conditions. Pay attention to clauses related to:

- Loan Tenure

- EMI Payments

- Prepayment Penalties

- Hidden Fees

If anything is unclear, seek clarification from the lender or consult a legal expert. Understanding every detail of the loan can prevent surprises down the line.

Plan for Contingencies

Life is unpredictable, and unexpected events can impact your ability to make loan payments. To protect yourself, build an emergency fund that covers at least two to five months of living expenses. This financial safety net can help you stay on track even if you face temporary setbacks.

Additionally, consider purchasing loan insurance, which can provide peace of mind in case of job loss, illness, or other unforeseen circumstances. While there is a cost associated with this, it can offer valuable protection.

By following these steps, you can increase your chances of securing the best car loan for your needs. With careful planning, research, and attention to detail, you’ll be well on your way to driving away in your dream car.