Understanding Auto Loans in the United Kingdom: A Comprehensive Guide

Auto loans are a common way for UK residents to finance the purchase of a vehicle. Whether you’re buying a new or used car, understanding how auto loans work is essential to making informed decisions and securing the best deal. This article explores the mechanics of auto loans, factors that influence interest rates, and tips for finding the right lender.

How Auto Loans Work in the United Kingdom

When applying for an auto loan, you become the borrower and must be approved by a lender. In the UK, lenders can include banks, credit unions, online lenders, or even the car dealership itself. Once approved, the lender provides a lump sum to purchase the vehicle, which you then repay in fixed monthly installments over an agreed period, known as the loan term. Typically, these terms range from 24 to 84 months.

Auto loans are usually “secured,” meaning the lender holds the title to the car until the loan is fully repaid. If payments are missed, the lender has the right to repossess the vehicle. Once the loan is paid off, the title is transferred to your name, and you fully own the car.

Comparing Auto Loan Rates and Lenders

To ensure you get the best possible deal, it’s crucial to compare rates and lenders. Several factors determine the interest rate and payment amount, including your credit history, income, and the type of vehicle you’re purchasing. Different lenders may use varying criteria, so the rate and payment you receive can vary significantly.

Key factors to consider when comparing lenders include:

- Credit and financial situation: Lenders evaluate your credit score, income, employment history, and debt-to-income ratio.

- Vehicle type and loan amount: New cars often come with lower interest rates than used vehicles, while private sales may have higher rates.

- Loan term: Longer terms result in lower monthly payments but more total interest over time.

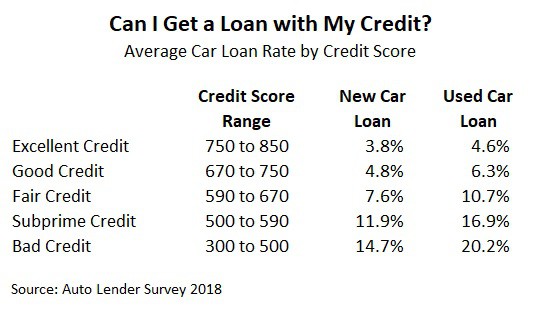

Understanding Credit Scores and Interest Rates

Your credit score plays a significant role in determining your auto loan approval and interest rate. In the UK, credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Lenders may also use industry-specific scoring models to assess risk.

To improve your chances of securing a favorable rate, consider the following steps:

- Check your credit report: Ensure all information is accurate and dispute any errors.

- Get your credit score: Many lenders offer free credit score checks through their services.

- Look for lenders that consider more than just credit scores: Some lenders take into account factors like education or employment stability.

The Impact of Loan Terms on Your Payment

The length of your loan term affects both your monthly payment and the total interest you’ll pay. Common terms in the UK range from 24 to 84 months. While longer terms reduce monthly payments, they increase the overall cost of the loan due to accumulated interest.

For example, a £35,000 loan at 9% APR would result in the following costs based on different terms:

- 24 months: Monthly payment of £1,599, total interest of £3,375

- 84 months: Monthly payment of £563, total interest of £12,302

Average Auto Loan Rates in the UK

As of the second quarter of 2025, average auto loan interest rates in the UK were approximately 6.80% for new cars and 11.54% for used cars. These rates vary depending on your credit score, with higher scores generally resulting in lower rates. For instance:

- Superprime (781-850): 5.27% for new cars, 7.15% for used cars

- Subprime (501-600): 13.38% for new cars, 18.90% for used cars

Pre-Qualification and Pre-Approval

Before finalizing your loan, consider getting pre-qualified or pre-approved by multiple lenders. Pre-qualification involves a soft credit check and gives an estimate of your potential loan terms. Pre-approval requires more detailed information and a hard credit check, offering a stronger indication of your eligibility.

Types of Auto Loans Available

In addition to standard new and used car loans, other options include:

- Refinancing: Replace your current loan with a new one to secure a better rate.

- Cash-out refinancing: Borrow additional money against your car’s equity.

- Lease buyout: Purchase a leased vehicle.

- Bad credit loans: Available for borrowers with lower credit scores, though at higher interest rates.

Steps to Secure the Best Auto Loan

To ensure a smooth and successful auto loan experience, follow these steps:

- Know your budget and needs before shopping for a car or loan.

- Explore different financing options, including dealerships and online lenders.

- Negotiate terms to secure the best interest rate and payment plan.

- Review all paperwork carefully before signing to avoid surprises.

By understanding the intricacies of auto loans and taking the time to compare offers, UK residents can make informed decisions that align with their financial goals. Whether you’re buying a new or used vehicle, the right loan can help you drive away with confidence.