The Ultimate Guide to Low Interest Credit Cards in 2025

In today’s financial landscape, credit cards have become an essential tool for managing personal finances. However, with the right knowledge and strategy, you can choose a card that not only offers convenience but also helps you save money. One of the most valuable types of credit cards is the low interest credit card, which can be a game-changer for those who carry balances or want to avoid high-interest charges.

What Is a Low Interest Credit Card?

A low interest credit card is designed to offer a below-average Annual Percentage Rate (APR) compared to other credit cards on the market. These cards are ideal for individuals who frequently carry a balance from month to month or plan to make large purchases that they intend to pay off over time. Unlike 0% APR cards, which offer introductory periods with no interest, low interest cards typically provide a consistent, lower rate throughout the life of the account.

As of 2025, the average APR for all credit card accounts is around 15.13%. Therefore, any card with an APR below this figure could be considered a good option for those looking to minimize interest costs.

Why Choose a Low Interest Credit Card?

1. Save Money on Interest Charges

If you carry a balance on your credit card, even a small difference in APR can lead to significant savings over time. A low interest credit card ensures that the amount you pay in interest is minimized, allowing you to pay down your debt more efficiently.

2. Better for Long-Term Debt Management

For those who need to finance large purchases, such as a car or home improvement, a low interest credit card can help reduce the total cost of borrowing. This makes it easier to manage monthly payments without being burdened by high interest rates.

3. Flexible Repayment Options

Many low interest credit cards offer features like balance transfer options, which allow you to move high-interest debt to a card with a lower rate. This can be especially useful if you’re trying to consolidate debt or reduce the overall interest you’re paying.

Key Features to Look For in a Low Interest Credit Card

When choosing a low interest credit card, there are several key features to consider:

1. Annual Percentage Rate (APR)

This is the most important factor when evaluating a low interest credit card. Look for cards with an APR that is significantly lower than the average. Some cards may offer a 0% introductory APR for a limited period, which can be beneficial if you plan to pay off your balance before the promotion ends.

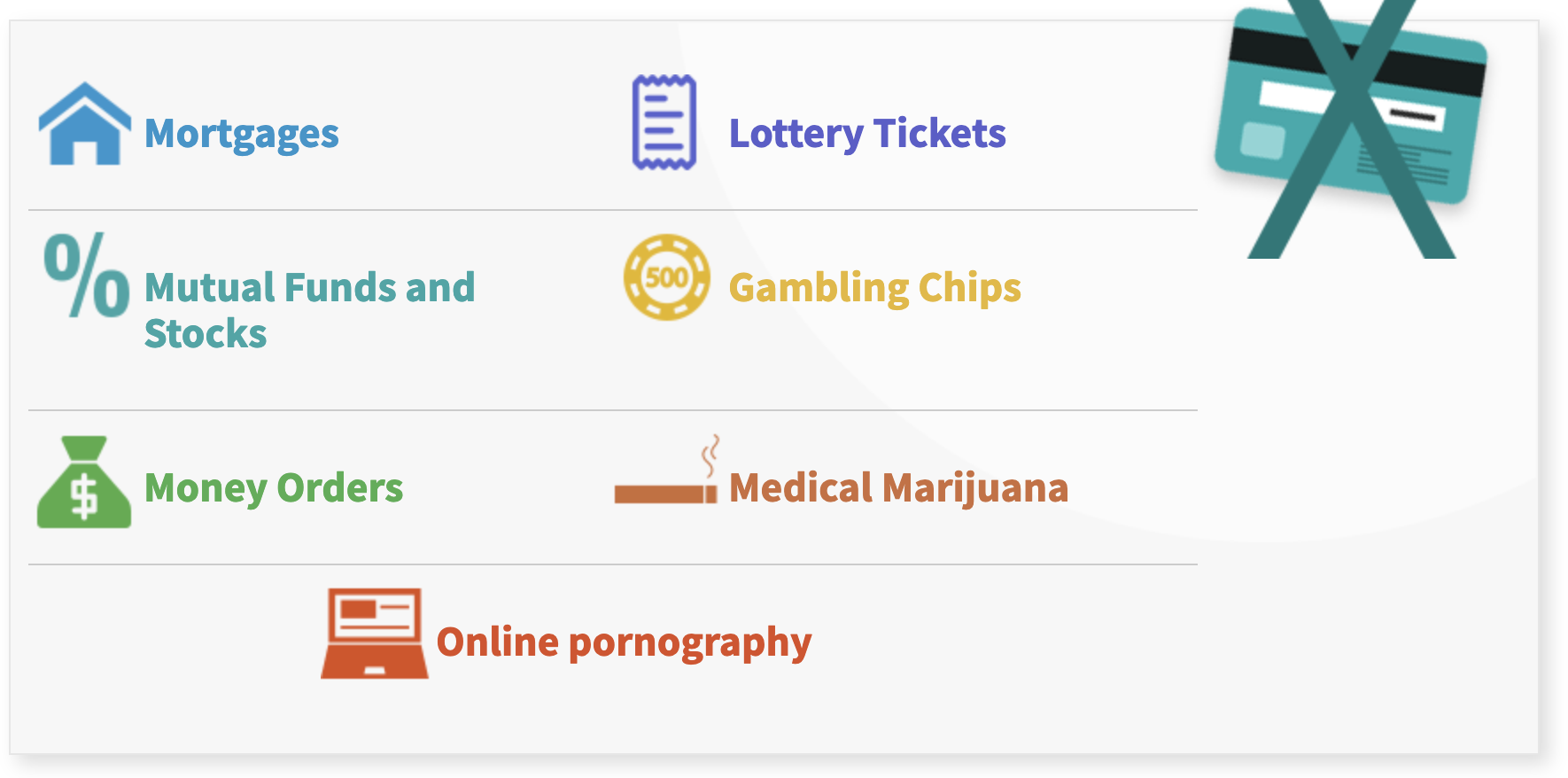

2. Fees

While low interest rates are crucial, it’s also important to consider other fees associated with the card. These may include annual fees, balance transfer fees, cash advance fees, and foreign transaction fees. Opt for a card that has minimal or no fees, especially if you don’t plan to use the card for international transactions.

3. Rewards Programs

Some low interest credit cards also come with rewards programs, such as cash back, points, or travel miles. While these aren’t the main focus of a low interest card, they can add value if you use the card regularly for everyday expenses.

4. Credit Score Requirements

Most low interest credit cards require a good to excellent credit score (typically 670 or higher). If your credit score is lower, you may need to look for a secured credit card or a credit-building card that can help you improve your credit over time.

Top Low Interest Credit Cards in 2025

Here are some of the best low interest credit cards available in 2025:

1. Capital One VentureOne Rewards Credit Card

- Intro APR: 0% for 15 months on purchases and balance transfers

- Regular APR: 18.99% – 28.99% variable

- Annual Fee: $0

- Rewards: 1.25X miles on every purchase, 5X miles on hotel and rental car bookings through Capital One Travel

This card is ideal for those who want to earn travel rewards while enjoying a low interest rate during the introductory period.

2. Wells Fargo Reflect® Card

- Intro APR: 0% for 21 months on purchases and balance transfers

- Regular APR: 16.99%, 23.49%, or 28.74% variable

- Annual Fee: $0

- Rewards: No traditional rewards program, but includes cell phone protection

This card is perfect for those who want a long introductory period to pay off existing debt or finance new purchases.

3. Platinum Mastercard® from First Tech Federal Credit Union

- Intro APR: None

- Regular APR: 11.49% – 18.00% variable

- Annual Fee: $0

- Rewards: None

This card is great for those who prioritize low interest rates and don’t need rewards. It’s also ideal for individuals who are members of First Tech Federal Credit Union.

4. Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union

- Intro APR: None

- Regular APR: 13.99% – 18.00% variable

- Annual Fee: $0

- Rewards: 3X points on gas and grocery purchases, 1.5X on other purchases

This card is an excellent choice for those who spend heavily on gas and groceries and want to earn rewards while keeping interest costs low.

How to Choose the Right Low Interest Credit Card

1. Check Your Credit Score

Before applying for any credit card, check your credit score. A good to excellent score will give you access to the best interest rates and card options.

2. Compare APRs and Fees

Use online comparison tools to evaluate different low interest credit cards based on their APR, annual fees, and other potential charges.

3. Consider Your Spending Habits

Choose a card that aligns with your spending patterns. For example, if you frequently travel, a card with travel rewards may be more beneficial than one with no rewards.

4. Read the Fine Print

Always review the terms and conditions of the card, including any promotional offers, balance transfer fees, and redemption policies.

Conclusion

Low interest credit cards can be a powerful tool for managing your finances effectively. By understanding how these cards work and choosing the right one for your needs, you can save money on interest charges, build better financial habits, and achieve your long-term goals.

Whether you’re looking to pay off debt, finance a major purchase, or simply manage your daily expenses, a low interest credit card can provide the flexibility and affordability you need in 2025. With careful research and planning, you can find the perfect card that fits your lifestyle and financial situation.