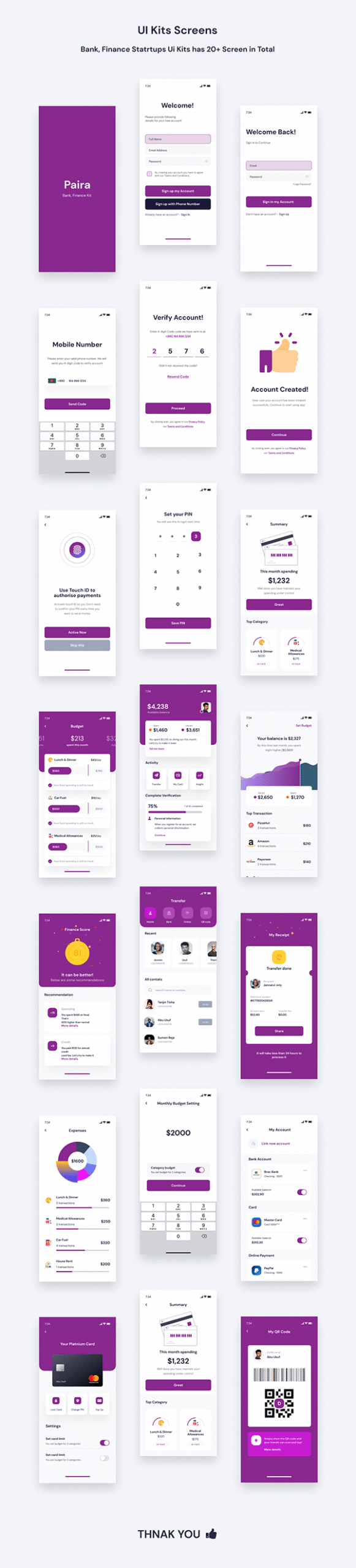

What Is a Digital Wallet? A Complete Guide to Understanding and Using Digital Payment Solutions

Digital wallets have revolutionized the way we handle financial transactions, offering a secure and convenient alternative to traditional payment methods. As technology continues to evolve, digital wallets are becoming an essential part of everyday life for many people. This article explores what a digital wallet is, how it works, its benefits, and some potential drawbacks.

What Is a Digital Wallet?

A digital wallet, also known as an electronic wallet, is a software application that stores your payment details and passwords, enabling seamless transactions on connected devices, chiefly mobile phones. By securely holding your financial data, digital wallets remove the necessity for physical wallets. You simply load your credit, debit, or bank account information into the application, allowing you to conduct purchases directly via your device without the need to carry physical cards.

Digital wallets can also store:

- Gift cards

- Membership cards

- Loyalty cards

- Coupons

- Event tickets

- Plane and transit tickets

- Hotel reservations

- Driver’s license (only in some states as of now, AZ, CO, GA, MD)

- Identification cards

- Cryptocurrency

- Car keys

How Do Digital Wallets Work?

Digital wallets use a mobile device’s wireless capabilities like Bluetooth, WiFi, and magnetic signals to transmit payment data securely from your device to a point of sale designed to read the data and connect via these signals.

Mobile devices and digital wallets currently use these technologies:

- QR codes: Quick response codes are matrix bar codes that store information. You use your device’s camera and the wallet’s scanning system to initiate payment.

- Near field communication (NFC): NFC is a technology that allows two smart devices to connect and transfer information using electromagnetic signals. It requires two devices to be close to each other to connect.

- Magnetic secure transmission (MST): This is primarily for Samsung mobile phone users. It is the same technology used by magnetic card readers that read your card when you swipe it through a slot at a point of sale. Your phone generates this encrypted field that the point of sale can read. Samsung has phased out MST features for Samsung phones from 2021 onwards to focus on NFC, which is more prevalent.

Your stored card info is sent from your device to the point-of-sale terminal that connects to payment processors. Then, through processors, gateways, acquirers, and other third parties, your payment travels through card networks and banks to complete the transaction.

Different Types of Digital Wallets

Many digital wallets are available. Here are some well-known ones:

- Cash App

- Apple Pay

- Google Wallet

- Samsung Wallet

- PayPal

- Venmo

- AliPay

- Walmart Pay

- Vodafone M-PESA

Most wallets attempt to distinguish themselves from their competitors with different methods. For example, Google’s digital wallet service allows you to add funds to the wallet on your phone or device. Apple, on the other hand, entered into a strategic partnership with Goldman Sachs to issue Apple credit cards and expand its Apple Pay services.

Advantages and Disadvantages of Digital Wallets

Advantages

- Limits exposure for financial and personal information: Having a digital wallet adds security for your credit cards and identification.

- Ends carrying a physical wallet and cards: Possessing forms of payment and ID in your mobile device means you can carry less, avoiding the chance of losing those items.

- Can improve financial services access: The availability of digital wallets gives people in underserved areas more options for payment and commerce.

Disadvantages

- May not be accepted everywhere: Smaller shops or less-developed areas may not be set up to accept payment via a digital wallet.

- May not work if Bluetooth or WiFi isn’t available: If an Internet setup or electronic point-of-sale network isn’t functioning, it may not be possible to pay using a digital wallet.

- Vulnerable to identity theft or fraud: If your mobile device is stolen and isn’t protected by a password or biometric data, or if your digital wallet is hacked, you could suffer criminal use of the information.

Security Tips for Digital Wallet Users

Keeping your digital wallet secure comes down to following some basic security practices. Here are essential steps to protect your financial information:

- Use strong, unique passwords: Create passwords for your wallet apps that avoid easily guessed information like birthdays, pet names or simple number sequences.

- Enable multi-factor authentication: Add an extra layer of protection with a second form of verification when logging in from new devices.

- Download only official apps: Get wallet apps exclusively from legitimate app stores to avoid fake apps designed to steal your information.

- Keep software updated: Regularly update your device’s operating system and digital wallet apps to ensure you have the latest security patches.

- Review transactions regularly: Check your transaction history frequently and report anything unfamiliar immediately to your wallet provider and bank.

Conclusion

Digital wallets combine the convenience of having all your payment methods in one place with security features that often exceed traditional cards. Whether you’re using them for quick purchases, online shopping, or splitting expenses with friends, digital wallets can simplify your financial life and provide better visibility into your spending habits. As technology continues to advance, digital wallets will likely become even more integrated into our daily lives, making transactions faster, easier, and more secure.