The Ultimate Guide to Business Loans: Types, Applications, and Tips for Approval

Starting or growing a business often requires financial support, and one of the most common ways to obtain this is through business loans. Whether you’re launching a new venture or expanding an existing one, understanding the different types of business loans available, how to apply for them, and what lenders look for can make all the difference in securing the funding you need. This guide will walk you through everything you need to know about business loans.

Understanding Business Loans

A business loan is a financial product designed to help entrepreneurs and small business owners access capital. These loans can be used for various purposes, such as purchasing equipment, covering operational costs, or expanding your business. There are several types of business loans, each with its own set of requirements, benefits, and drawbacks.

Types of Business Loans

- Term Loans

- Best for: Established businesses that need to make a large purchase.

- Not ideal for: Businesses that need ongoing funding.

-

Term loans are one of the most common forms of business financing. Funds are distributed in a lump sum upfront, and then repaid in fixed, regular installments over a set period. They can be unsecured or secured by collateral.

-

SBA Loans

- Best for: Businesses that may not qualify for more traditional forms of funding.

- Not ideal for: Businesses that need fast funding.

-

SBA loans are backed by the U.S. Small Business Administration and offer more flexible qualifying requirements. They come with lower interest rates and longer repayment terms.

-

Business Lines of Credit

- Best for: Businesses that need ongoing access to funding.

- Not ideal for: Businesses looking to make a large, one-time purchase.

-

A business line of credit allows you to borrow money up to a predetermined limit, and only pay interest on the amount you’ve borrowed.

-

Equipment Loans

- Best for: Businesses purchasing equipment.

- Not ideal for: Businesses that want unsecured funding.

-

Equipment loans help business owners purchase the equipment needed to run their companies. The equipment itself often serves as collateral.

-

Commercial Real Estate Loans

- Best for: Businesses purchasing real estate.

- Not ideal for: Businesses that need to make other types of purchases.

-

These loans work like home mortgages, allowing businesses to buy physical locations.

-

Invoice Factoring

- Best for: Businesses with unpaid invoices that are trying to cover cash-flow gaps.

- Not ideal for: Businesses that don’t use an invoicing model.

-

Invoice factoring involves selling unpaid invoices to a factoring company for an advance.

-

Accounts Receivable Financing

- Best for: Businesses that have unpaid invoices and want to retain control of collection.

- Not ideal for: Businesses with customers who take a long time to pay.

-

This type of financing allows businesses to leverage their unpaid invoices as collateral for a loan.

-

Merchant Cash Advances

- Best for: Businesses with consistent credit card sales that need to cover cash flow gaps.

- Not ideal for: Businesses that will struggle with frequent repayments.

-

Merchant cash advances provide a lump sum in exchange for a percentage of future credit card sales.

-

Personal Loans for Business Purposes

- Best for: Business owners with a strong personal credit history who may not qualify for other loans.

- Not ideal for: Business owners who don’t want to be personally on the hook for repayment.

-

Personal loans can be an alternative to traditional business loans, but they come with higher risks.

-

Business Credit Cards

- Best for: Business owners seeking to cover ongoing expenses.

- Not ideal for: Business owners who need longer repayment timeframes.

- Business credit cards offer revolving credit, allowing you to borrow up to a credit limit and repay it as needed.

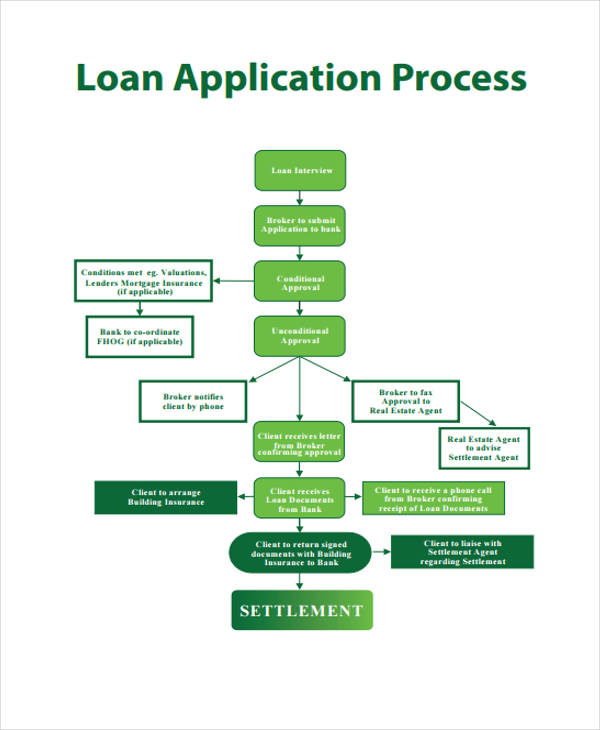

How to Apply for a Business Loan

Applying for a business loan involves several steps, and the process can vary depending on the type of loan you’re seeking. Here’s a general overview of what to expect:

1. Determine Your Funding Needs

Before applying for a loan, calculate how much money you need and what you’ll use it for. Consider factors such as startup costs, equipment purchases, or expansion plans.

2. Check Your Credit Score

Lenders typically review your credit score to assess your financial reliability. A higher credit score can increase your chances of approval and may lead to better interest rates.

3. Prepare Financial Documents

You’ll need to provide financial documents such as tax returns, bank statements, and a business plan. These documents help lenders evaluate your ability to repay the loan.

4. Choose the Right Lender

Research different lenders, including banks, online lenders, and government-backed programs like the SBA. Compare interest rates, repayment terms, and eligibility requirements.

5. Submit Your Application

Once you’ve selected a lender, complete the application process. Be prepared to provide detailed information about your business and financial situation.

6. Wait for Approval

The approval process can take anywhere from a few days to several weeks, depending on the lender and the type of loan.

Tips for Getting Approved for a Business Loan

![]()

Securing a business loan can be challenging, but there are steps you can take to improve your chances of approval:

- Improve Your Credit Score: Pay bills on time, reduce debt, and avoid opening new credit accounts before applying.

- Create a Strong Business Plan: A well-documented business plan shows lenders that you have a clear vision and strategy for your business.

- Build a Solid Financial History: Maintain a good track record of managing finances, including consistent revenue and low debt.

- Consider Collateral: Offering collateral can increase your chances of approval, especially for secured loans.

- Work with a Lender Match Program: Programs like the SBA’s Lender Match tool can connect you with lenders who are more likely to approve your application.

Conclusion

Business loans are a powerful tool for entrepreneurs and small business owners looking to grow their ventures. By understanding the different types of loans available, preparing a strong application, and following best practices for approval, you can secure the funding you need to achieve your business goals. Whether you’re starting a new business or expanding an existing one, the right loan can provide the financial support necessary to succeed.