The Rise of Crowdfunding in the United Kingdom: A New Era of Entrepreneurship

Crowdfunding has emerged as a transformative force in the financial landscape, particularly in the United Kingdom. This innovative method of raising capital allows entrepreneurs to connect with a diverse pool of potential investors through social media and dedicated platforms. By leveraging small contributions from many individuals, crowdfunding has become a vital tool for startups and small businesses seeking alternative funding sources. As the global crowdfunding market continues to expand, its significance in the entrepreneurial ecosystem is undeniable.

Understanding the Concept of Crowdfunding

At its core, crowdfunding is a method of raising funds by collecting small amounts of money from a large number of people. This approach differs significantly from traditional fundraising methods such as angel investors or venture capitalists, where a few individuals invest larger sums into a business. In the context of the United Kingdom, crowdfunding has gained traction as a viable option for entrepreneurs who may not have access to conventional financing channels.

The concept of crowdfunding can be traced back to the 2008 financial crisis, when many small businesses found themselves unable to secure loans from banks. This period marked a turning point, as entrepreneurs began exploring alternative funding avenues. According to the Global Equity Crowdfunding Alliance, the global crowdfunding market is projected to grow at an annual rate of 15.82% from 2024 to 2033, highlighting its increasing importance in the entrepreneurial world.

Key Takeaways on Crowdfunding

Several key points underscore the significance of crowdfunding:

- Accessibility: Crowdfunding provides access to a broader audience, enabling entrepreneurs to reach potential investors beyond their immediate network.

- Diversity of Investors: Unlike traditional funding methods, crowdfunding allows for a diverse group of investors, including those who may not have previously considered supporting a business.

- Regulatory Frameworks: In the UK, regulatory frameworks such as the JOBS Act ensure transparency and investor protection, particularly for equity-based models. These regulations are crucial in fostering trust and confidence among investors.

The Process of Crowdfunding

The process of crowdfunding involves several steps that entrepreneurs must navigate carefully. First, they need to create a compelling pitch that outlines their business idea and the value proposition. This pitch is then presented on a crowdfunding platform, where potential investors can review the project and decide whether to contribute.

Once the campaign is launched, the entrepreneur must actively engage with their audience, updating them on the progress of their project and addressing any concerns. It’s essential to maintain transparency and communication throughout the campaign to build trust and encourage support.

Popular Crowdfunding Platforms in the UK

Several platforms have gained popularity in the UK, each catering to different needs and preferences. Kickstarter, Indiegogo, and GoFundMe are among the most well-known platforms, offering a range of services for entrepreneurs and individuals alike.

- Kickstarter: Known for its focus on creative projects, Kickstarter allows entrepreneurs to raise funds for innovative ideas while providing backers with rewards or experiences.

- Indiegogo: This platform offers flexible funding models, allowing campaigners to receive funds as they come in or wait until the target is reached.

- GoFundMe: Ideal for personal causes and emergencies, GoFundMe has become a go-to platform for individuals seeking financial support for medical expenses or other urgent needs.

Rewards and Incentives in Crowdfunding

One of the unique aspects of crowdfunding is the use of rewards and incentives to attract investors. These can range from exclusive merchandise to personalized experiences, creating a sense of connection between the project and its supporters. For example, a filmmaker might offer a behind-the-scenes tour, while a chef could provide a private cooking class. Such incentives not only motivate contributors but also help to build a loyal community around the project.

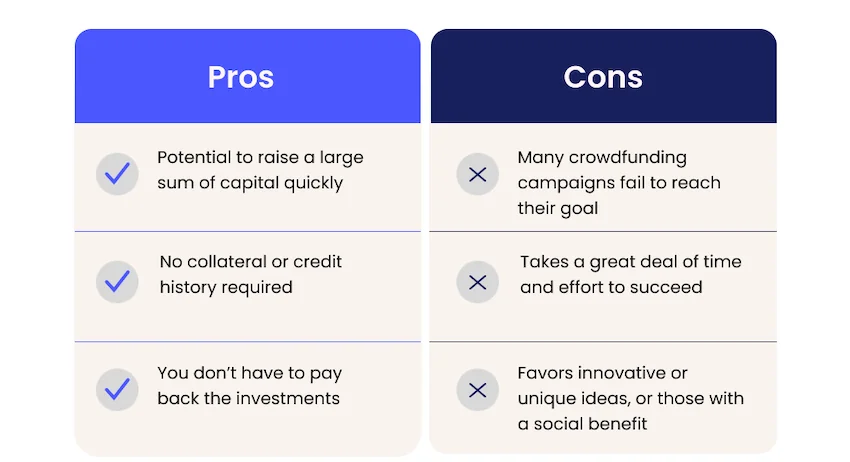

Evaluating the Advantages and Disadvantages

While crowdfunding offers numerous benefits, it also comes with its own set of challenges. On the positive side, it provides access to a larger and more diverse group of investors, which can be invaluable for startups. Additionally, it allows entrepreneurs to gauge public opinion on their products and gain valuable feedback.

However, there are also potential drawbacks to consider. If the funding goal is not met, the pledged funds are returned to investors, leaving the entrepreneur without the necessary capital. Moreover, there is a risk of damaging the company’s reputation if the project fails to deliver on its promises. It’s essential for entrepreneurs to weigh these factors carefully before launching a crowdfunding campaign.

Examples of Successful Crowdfunding Campaigns

Several notable campaigns have demonstrated the power of crowdfunding in the UK. One such example is the Oculus VR project, which was successfully funded through Kickstarter. Founder Palmer Luckey raised $2.4 million, far exceeding his initial goal of $250,000. This campaign ultimately led to Meta acquiring Oculus VR for $2.3 billion in cash and stock.

Another successful example is M3D, a company that manufactured small 3D printers. David Jones and Michael Armani raised $3.4 million for their Micro 3D printer on Kickstarter in 2014, showcasing the potential of crowdfunding to support innovative products.

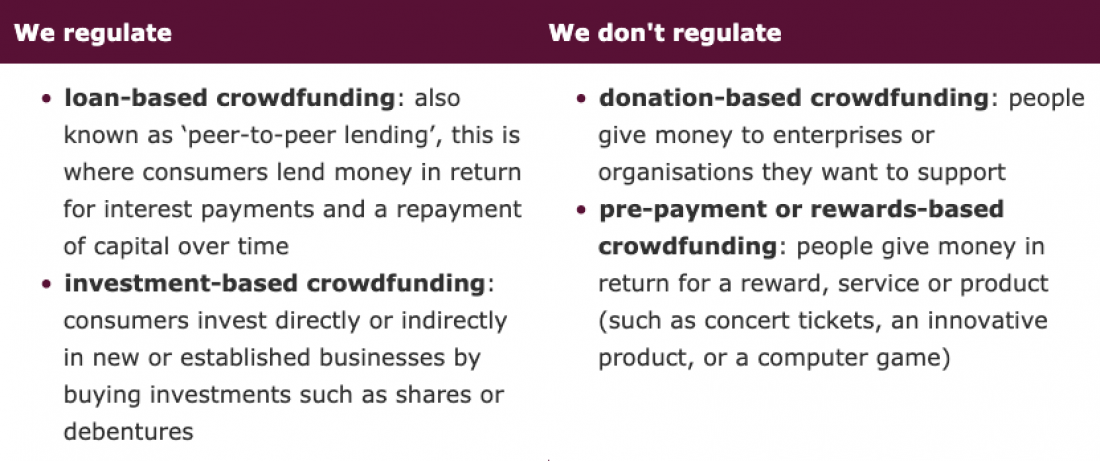

The Role of Regulation in Crowdfunding

As the popularity of crowdfunding grows, so does the need for regulation to protect both investors and entrepreneurs. In the UK, the Securities and Exchange Commission (SEC) oversees these regulations, ensuring that transactions occur through registered intermediaries. These rules aim to maintain transparency and protect investors from potential risks.

The JOBS Act, enacted in 2012, has played a significant role in shaping the crowdfunding landscape in the US. While the UK has its own regulatory framework, the principles outlined in the JOBS Act serve as a useful reference for understanding the importance of investor protection and transparency in crowdfunding.

Future Outlook for Crowdfunding in the UK

Looking ahead, the future of crowdfunding in the UK appears promising. With the continued growth of the global market and the increasing acceptance of alternative funding methods, more entrepreneurs are likely to turn to crowdfunding as a viable option. The integration of technology and social media will further enhance the accessibility and reach of crowdfunding platforms, making it easier for entrepreneurs to connect with potential investors.

Moreover, as more success stories emerge, the perception of crowdfunding will continue to evolve, encouraging greater participation from both entrepreneurs and investors. The UK’s dynamic business environment, combined with a supportive regulatory framework, positions it well to embrace the opportunities that crowdfunding presents.

In conclusion, crowdfunding has become a powerful tool for entrepreneurs in the UK, offering a new avenue for raising capital and connecting with a diverse audience. As the market continues to grow and evolve, it is essential for entrepreneurs to understand the intricacies of crowdfunding and leverage its potential to drive innovation and success.