The Ultimate Guide to Business Credit Cards: 10 Essential Benefits for UK Entrepreneurs

In the dynamic landscape of UK entrepreneurship, managing finances effectively is crucial. One powerful tool that can significantly enhance financial management for businesses of all sizes is a business credit card. These cards offer a range of benefits that go beyond simple transactional convenience, providing strategic advantages that can support growth, streamline operations, and improve overall financial health.

Why Get a Business Credit Card?

For many small business owners in the UK, the idea of applying for a business credit card might seem daunting. However, the reality is that these cards are often more accessible than traditional loans or lines of credit. Most banks and credit card issuers require minimal documentation, making it possible for even sole traders or micro-businesses to qualify.

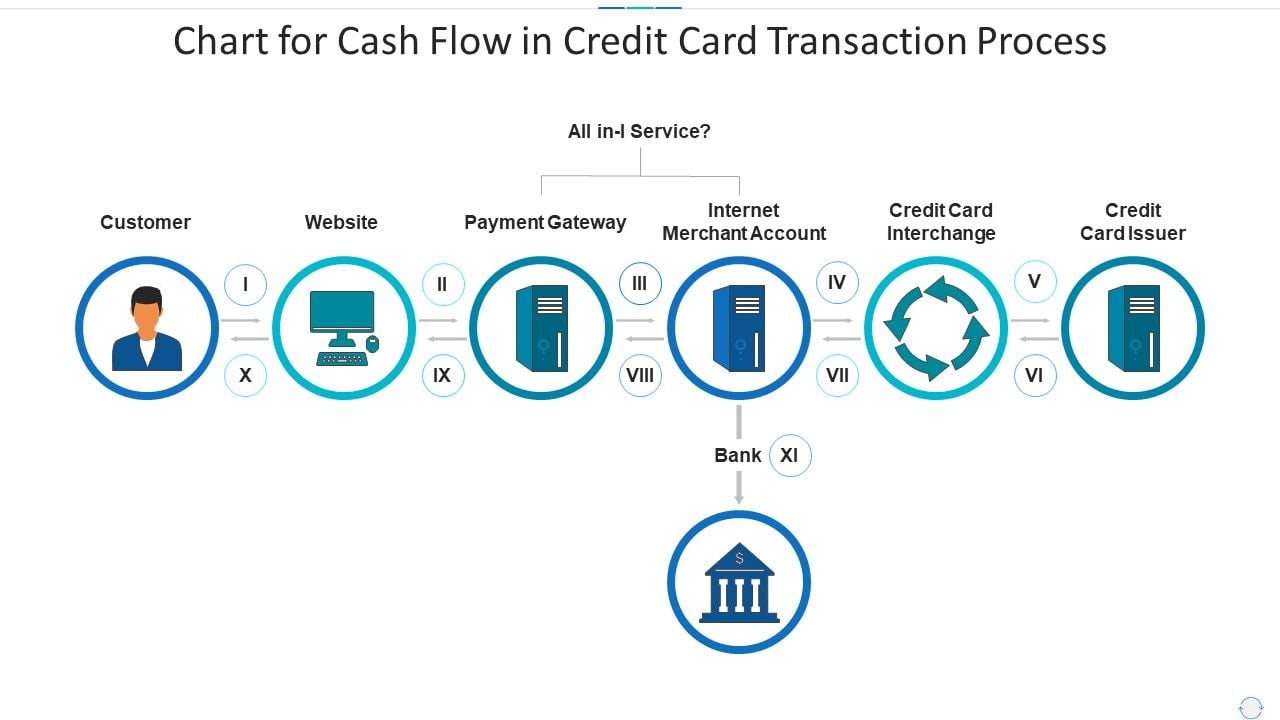

1. Access to Cash Flow and Financial Flexibility

Ample cash flow is a top priority for any business owner. A business credit card can be a lifeline when unexpected expenses arise or when you need to make large purchases without immediate funds. Unlike personal credit cards, which may have lower limits, business cards often come with higher spending limits, allowing you to handle larger transactions with ease.

2. Separation of Personal and Business Expenses

One of the most significant advantages of a business credit card is the ability to separate personal and business expenses. This not only simplifies accounting but also makes tax time much easier. By keeping business spending distinct from personal outlays, you can maintain better financial organization and ensure compliance with tax regulations.

3. Points, Cash-Back, or Other Rewards

Many business credit cards offer rewards programs that can provide substantial savings. Whether it’s cash back on everyday purchases, travel points, or exclusive discounts, these perks can help reduce operational costs and enhance your bottom line.

4. Large Credit or Spending Limit

Business credit cards typically offer higher credit limits compared to personal cards. This can be particularly beneficial for businesses that need to make significant investments or manage large inventory orders. The flexibility provided by these higher limits can help you navigate financial challenges more effectively.

5. Opportunity to Boost Your Credit Rating (While Not Impacting Personal Credit)

Responsible use of a business credit card can help build your business’s credit score. This can open doors to better financing options and improved supplier relationships. Importantly, using a business card doesn’t necessarily impact your personal credit score, as long as the card is not tied to your personal account.

6. Establish a Business Credit Score

A strong business credit score is essential for accessing loans and other financial products. By consistently using a business credit card and making timely payments, you can establish and improve your company’s credit rating. This can lead to more favorable terms when seeking future financing.

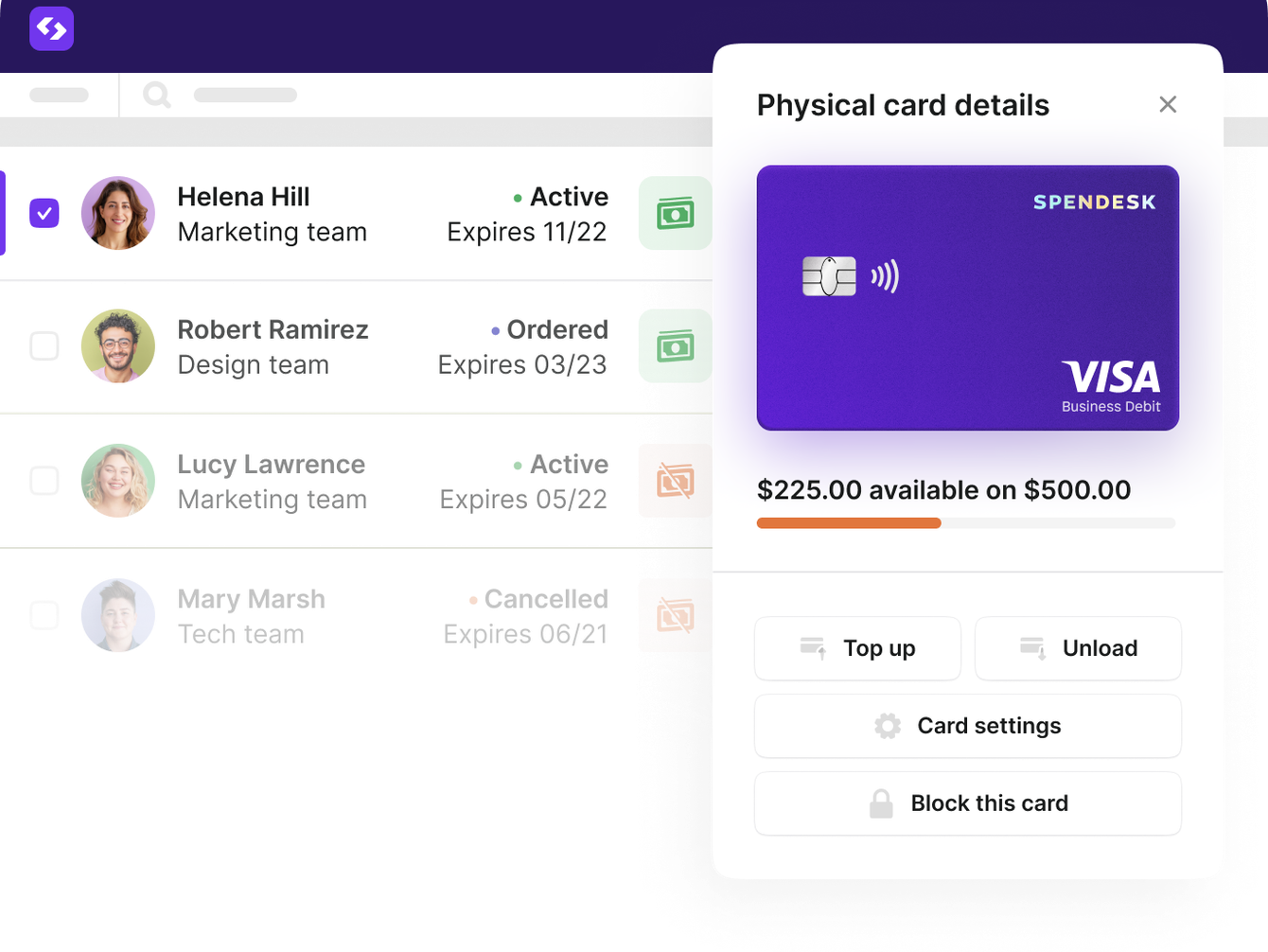

7. Control of Employee Spending

For businesses with employees, a business credit card can help monitor and control spending. You can set spending limits for each employee, ensuring that company funds are used appropriately. Many cards also offer tools for tracking expenses and generating reports, which can save time and reduce administrative burdens.

8. Business Perks

Beyond basic rewards, many business credit cards offer unique perks tailored to specific industries. These can include discounts on business travel, shipping, and advertising. Some cards even offer special deals on software subscriptions or office supplies, helping to reduce overhead costs.

9. Business Cards Not Subject to Personal Card Limits

Unlike personal credit cards, which often have limits on the number of cards you can hold, business credit cards typically allow for more flexibility. This means you can take advantage of multiple cards and their respective offers, maximizing your rewards and benefits.

10. Higher Limit Purchase Protection

Business credit cards often come with enhanced purchase protection, including extended warranties and coverage for damaged or stolen items. This added security can give you peace of mind when making larger purchases, knowing that your business is protected against potential losses.

Choosing the Right Business Credit Card

With so many options available, selecting the right business credit card can be overwhelming. Factors to consider include:

- Rewards Program: Look for cards that offer rewards aligned with your business needs, such as cash back on office supplies or travel points.

- Annual Fee: Some cards charge an annual fee, while others are free. Consider whether the benefits outweigh the cost.

- Credit Limit: Ensure the card offers a limit that suits your business’s financial requirements.

- Interest Rate: Compare APRs to find a card with a competitive interest rate.

- Additional Features: Check for features like expense tracking tools, employee card management, and virtual card options.

Final Thoughts

In conclusion, a business credit card can be a valuable asset for any entrepreneur in the UK. From improving cash flow to offering rewards and enhancing financial organization, these cards provide a range of benefits that can support your business’s growth and success. By carefully selecting the right card and using it responsibly, you can unlock significant financial advantages and position your business for long-term prosperity.