The Future of Finance: How AI is Reshaping the Industry

The finance industry is undergoing a profound transformation, driven by the rapid adoption of artificial intelligence (AI). From streamlining operations to enhancing decision-making, AI is redefining how financial institutions function. As the UK’s financial sector continues to evolve, the integration of AI into core processes is no longer a futuristic concept but a present-day necessity. This article explores the key steps for implementing AI in finance, its applications, and the benefits it brings.

5-Step Roadmap for Implementing AI in Finance

Adopting AI in finance requires a structured approach that aligns with business objectives. Here’s a step-by-step guide to help finance leaders navigate the process:

1. Prioritize High-Impact Use Cases

Start by identifying areas within your finance function that could benefit most from AI. Focus on tasks that are repetitive, time-consuming, or prone to errors. Engage with teams such as accounts payable clerks, accountants, and controllers to understand pain points and bottlenecks. Document the time and effort required for each task to determine where AI can make the most significant impact.

2. Establish a Unified Data Platform

A centralized data repository is essential for effective AI implementation. Work with your IT department to consolidate data from various sources such as accounts payable, accounts receivable, and general ledgers. Standardize data formats and implement validation checks to ensure data quality. A basic dashboard tracking key metrics like processing time and exception rates will help monitor performance and support AI training.

3. Deploy AI Models

Choose an AI solution that aligns with your specific goals. This could include AI tools for document analysis or generative AI for creating financial reports. Collaborate with vendors or internal data science teams to train models using historical transaction data. Ensure seamless integration with existing systems so that the AI can pull data and send alerts effectively.

4. Validate Savings

Before full-scale implementation, conduct a pilot test to measure baseline metrics such as processing time and manual reconciliation hours. Run the AI solution in parallel with current workflows to compare results. Use this data to refine model parameters and exception-handling rules before transitioning fully.

5. Scale Continuous Optimization

Establish a regular review process involving stakeholders from finance, IT, and operations to assess AI performance and process metrics. Retrain models with fresh data, adjust automation thresholds, and update validation rules as needed. Apply lessons learned to new finance processes to extend cost savings while maintaining governance and transparency.

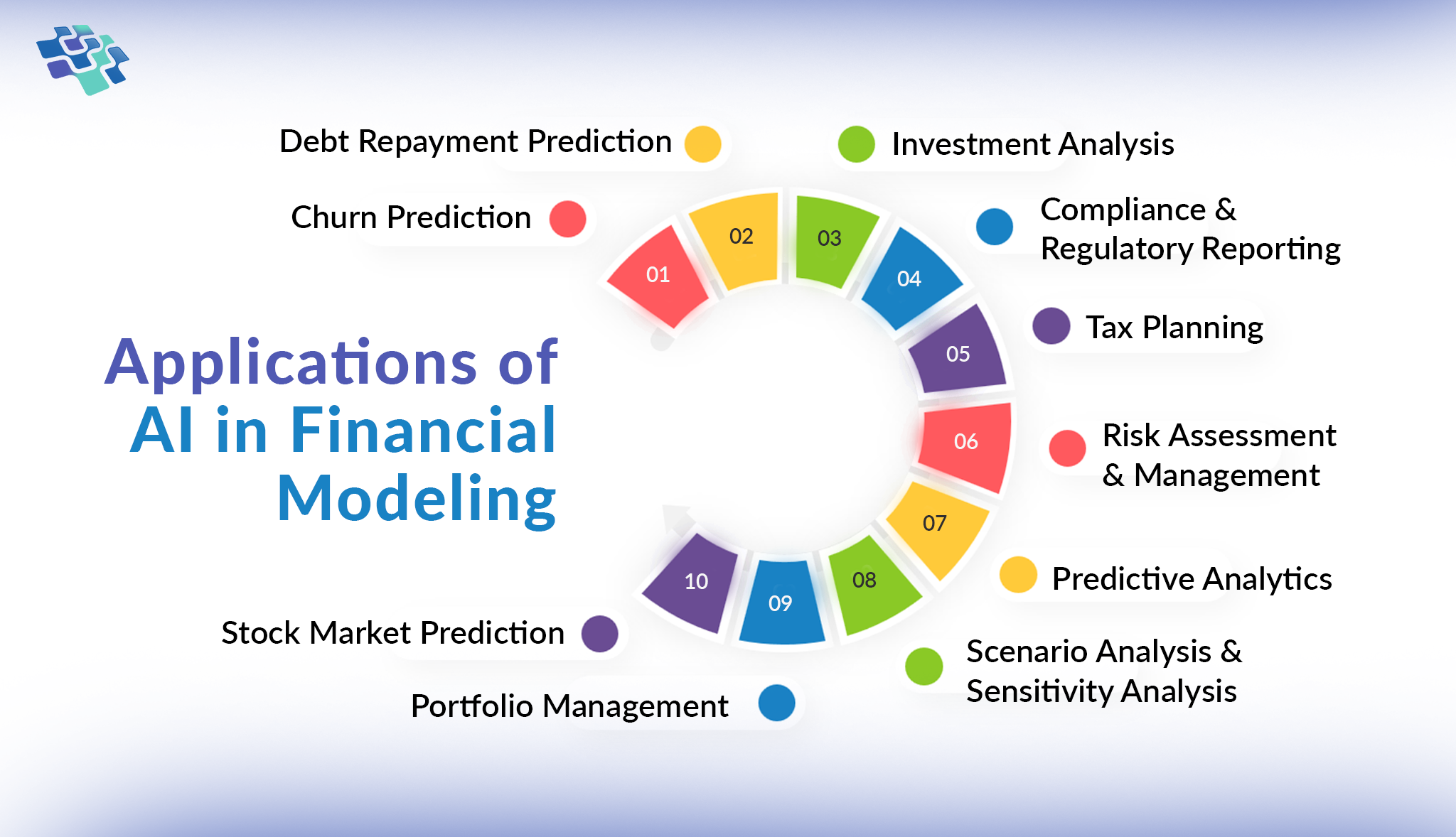

Key Applications of AI in Finance

AI is being used across various areas of finance, delivering tangible benefits:

Operational Efficiency

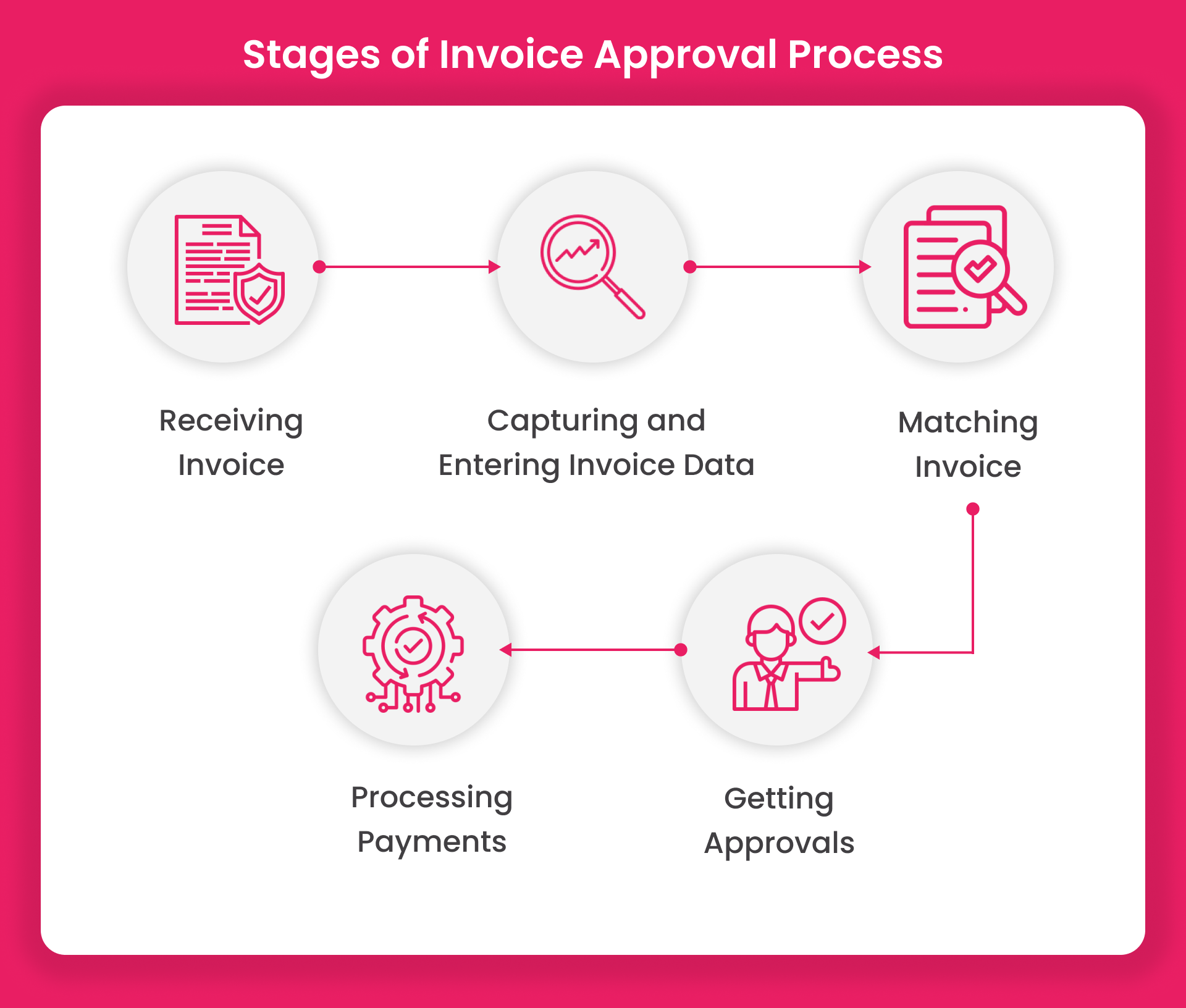

AI-powered automation reduces manual workloads, streamlines processes, and minimizes errors. Tasks such as invoice approvals and account reconciliations can be completed faster and with greater accuracy.

Risk Management

AI models help assess potential risks more accurately and detect fraudulent activities in real time. Machine learning algorithms analyze vast datasets to identify patterns and anomalies that may indicate fraudulent behavior.

Customer Experience

AI enables personalized interactions through chatbots and virtual assistants. These tools provide responsive customer service, offering tailored financial advice and support.

Regulatory Compliance

AI simplifies compliance by automating monitoring and reporting processes. It helps institutions navigate complex regulations by continuously learning from past enforcement actions and regulatory changes.

Competitive Advantage

Institutions that use AI can optimize costs, innovate faster, and offer improved services. This gives them a competitive edge in a rapidly evolving market.

Benefits of AI in Finance

The adoption of AI in finance offers numerous advantages:

Faster Decision-Making With Real-Time Analytics

AI tools process and interpret massive volumes of data in real time, enabling quicker decisions. This speed is crucial in markets where timing is everything.

Reduced Operational Costs Via Automation

Automation cuts overhead, reduces human error, and frees up staff to focus on higher-value work. This leads to leaner operations with greater impact.

Improved Fraud Detection Accuracy

AI improves fraud detection by continuously learning from new patterns and adjusting its models in real time. This reduces false positives and enhances security.

Hyper-Personalized Customer Experiences

By analyzing individual behavior, preferences, and financial goals, AI delivers customized interactions that increase engagement and build loyalty.

Scalability Across Financial Products

AI enables firms to scale services without proportional increases in headcount. It creates flexible systems that grow with the business, supporting expansion while keeping margins strong.

Future of AI in Finance

The future of AI in finance looks promising, with emerging technologies set to further transform the industry. Generative AI for document summarization, explainable AI in compliance, AI in ESG investing, and quantum-integrated AI for financial forecasting are among the trends shaping the next phase of innovation.

As the UK’s financial sector continues to embrace AI, institutions that invest in these technologies will be better positioned to adapt, lead, and grow in a rapidly evolving landscape. The journey to AI in finance begins with targeted projects that demonstrate measurable value, paving the way for broader adoption and long-term success.