Blockchain in Finance: Revolutionizing the Financial Sector

Blockchain technology is reshaping the financial landscape by introducing innovative solutions that enhance security, transparency, and efficiency. As a decentralized ledger system, blockchain enables secure and tamper-proof transactions without the need for intermediaries. This article explores the transformative impact of blockchain in finance, its key benefits, real-world applications, challenges, and future prospects.

Understanding Blockchain in Finance

Blockchain technology in fintech is a public ledger that tracks the origin, movement, and transfer of anything valuable. Unlike traditional banking systems, which rely on central authorities like banks, blockchain uses agreements from multiple network nodes to approve transactions. This decentralized approach ensures that every transaction is recorded and verified across a network of computers, making it nearly impossible to alter or manipulate data.

Key Applications of Blockchain in Finance

- Smart Contracts: These are self-executing contracts with the terms of the agreement directly written into code. They automatically carry out actions when certain conditions are met, reducing the need for manual handling and minimizing delays and errors.

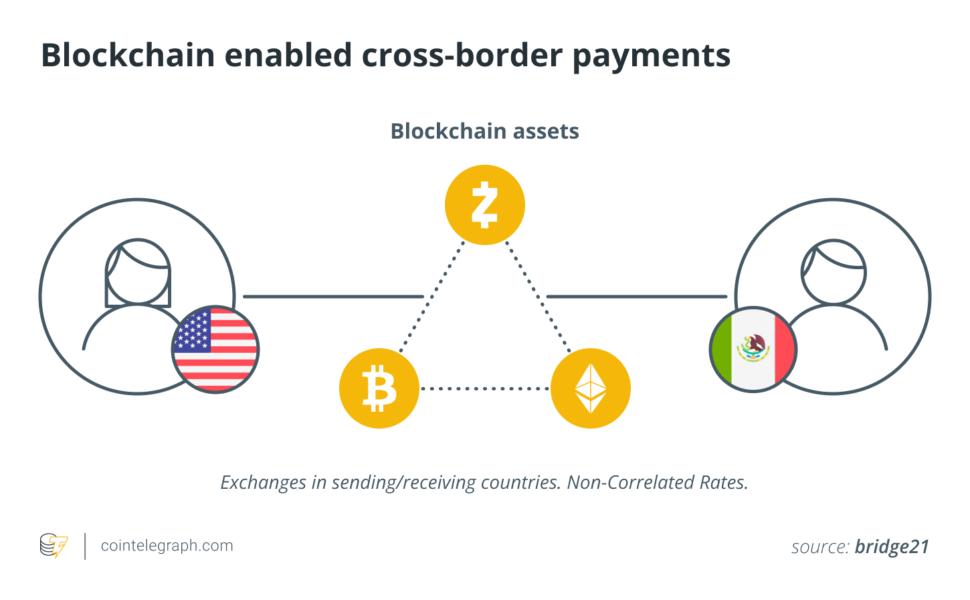

- Cross-Border Payments: Blockchain simplifies international money transfers by enabling direct, peer-to-peer transactions without the need for banks as intermediaries. This reduces fees and speeds up the process, making it more efficient and cost-effective.

- Fraud Prevention: The immutable nature of blockchain makes it an effective tool for tracking transactions, helping financial institutions enhance real-time risk monitoring and improve fraud detection systems.

- Digital Identity Verification: Blockchain-based identity solutions offer secure identity management, lowering dependence on centralized databases. These applications enhance privacy and security, supporting Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance.

Benefits of Blockchain in Finance

Enhanced Security

Blockchain uses advanced cryptographic methods to protect every transaction. This makes unauthorized access, data manipulation, or fraud extremely difficult. Financial institutions can operate with a much higher level of security and confidence. Additionally, 47% of companies report reducing the number of international payments they send due to issues with cross-border transactions, with 41% marking fraud as a top risk.

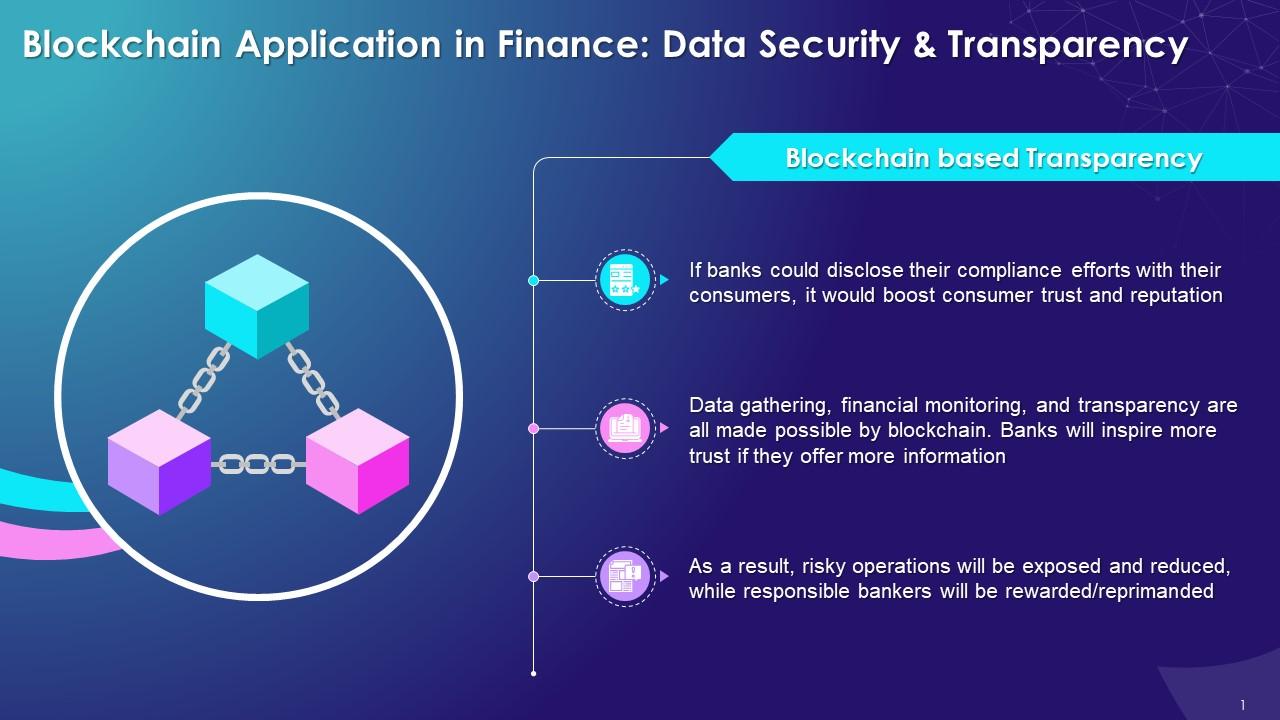

Increased Transparency

Blockchain ensures that every transaction is recorded in a way that can be viewed by all participants in the network. Once added, these records cannot be changed, which helps prevent disputes and builds trust. This level of openness makes it easier to track activity and confirm that financial data is accurate and complete, especially in accounting operations.

Faster Transactions & Reduced Settlement Time

Traditional banking systems often involve multiple checks and third parties, causing delays in processing payments, notably across borders. The adoption of blockchain in finance industry operations removes many of these steps, allowing transactions to be settled much faster. What once took days can now be completed in minutes or even seconds.

Lower Operational Costs & Fewer Fees

By cutting out intermediaries and automating processes with AI, blockchain for finance significantly reduces the costs of running operations. There are fewer processing fees and less administrative overhead, which can lead to more affordable services for both businesses and end users.

Use Cases of Blockchain in Finance

Decentralized Finance (DeFi) Solutions

DeFi platforms run entirely on blockchain, allowing users to borrow, lend, or trade without banks. This blockchain financial technology opens up access to financial services like lending, borrowing, and trading without regular intermediaries. Platforms such as Compound and Uniswap have gained prominence by allowing users to earn interest, access loans, and trade assets directly.

Tokenization of Assets

Blockchain makes it possible to turn physical assets into digital tokens that users can trade effortlessly. Such fintech blockchain use cases allow for fractional ownership and unleash investment opportunities to a greater audience. In 2024, State Street partnered with a Swiss crypto firm Taurus to offer tokenized versions of traditional assets. These include bonds and real estate, catering to institutional investors seeking diversified portfolios.

Cryptocurrency

Stablecoins like Bitcoin and Ethereum provide faster and less costly alternatives to standard currencies for payments, savings, and investment. For example, Coinbase has waived transaction fees for PayPal’s stablecoin PYUSD. This way, they promote its adoption for everyday transactions as a faster and more cost-effective alternative.

Implementing Blockchain in Finance: Challenges & Tips

While the benefits of blockchain in finance are significant, its implementation comes with several hurdles. These include regulatory uncertainty, technical complexity, integration with legacy systems, and concerns around scalability.

Regulatory Uncertainty Across Regions

The lack of consistent regulatory frameworks creates hesitation among fintechs, especially those operating across multiple jurisdictions. Varying legal interpretations and compliance requirements can slow adoption. Fintech companies must adhere to regulatory sanctions, including those from the US and EU, to avoid facilitating illicit activities.

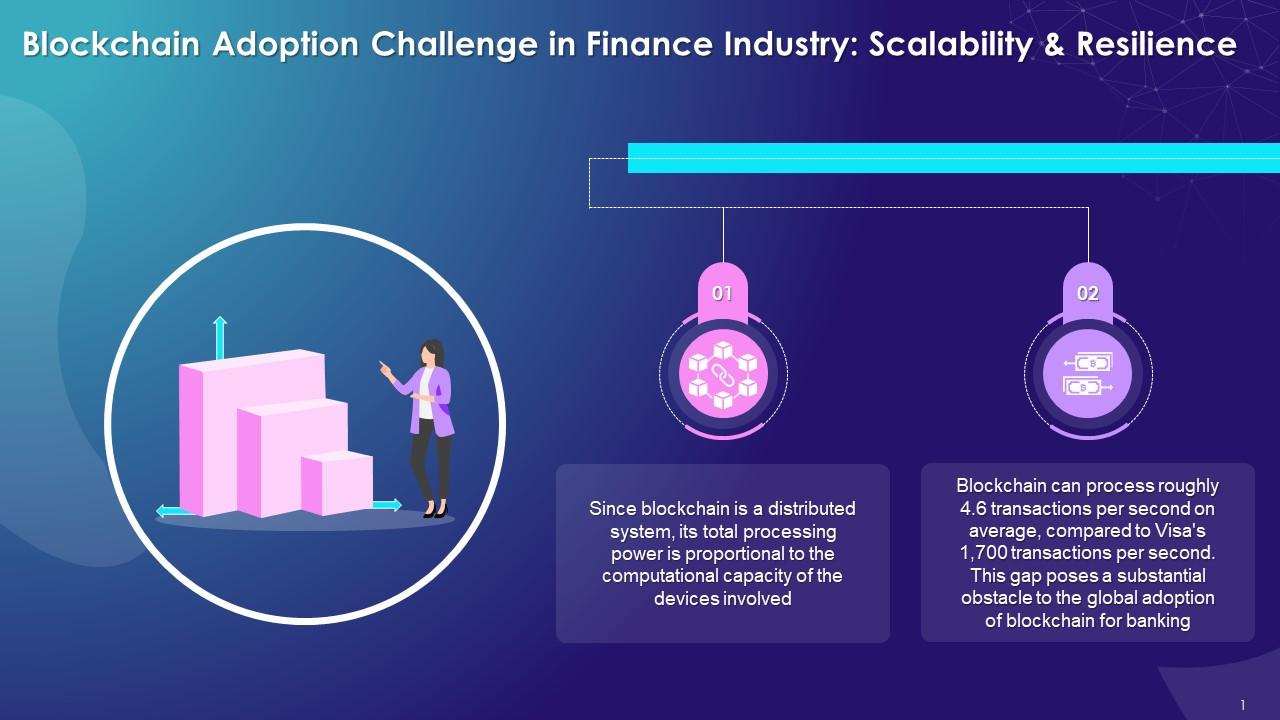

Scalability and Performance Issues

Early blockchain and financial services networks often struggle with transaction speed and throughput, making them difficult to scale for high-volume or time-sensitive financial operations. Transitioning to a more efficient tech stack and consensus mechanisms like proof of stake can significantly improve scalability and reduce latency.

Integration with Legacy Systems

Existing financial infrastructures are often incompatible with decentralized technologies, making integration complex and costly. Middleware and tailored APIs can bridge blockchain with traditional systems, allowing for phased implementation without disrupting operations.

Data Privacy Concerns

Blockchain’s transparency can conflict with privacy requirements in finance, particularly regarding customer data and regulatory adherence. Privacy-enhancing tools such as zero-knowledge proofs or private ledgers can strike the right balance between transparency and confidentiality.

Why Choose Acropolium?

Acropolium is recognized as a leading blockchain developer, bringing over 20 years of experience in custom software development, specializing in fintech solutions. With ISO-certified processes and a focus on compliance, we ensure secure, scalable, and legally sound blockchain applications.

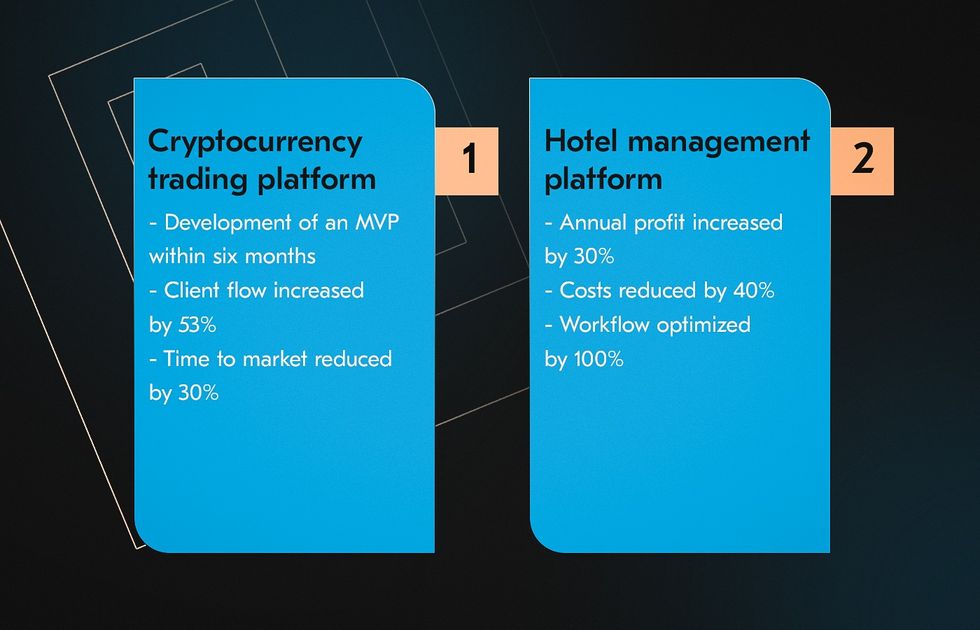

Acropolium’s deep expertise in navigating complex regulatory landscapes allows us to craft solutions that meet global standards. We combine the power of blockchain and finance, helping businesses innovate and grow with confidence. Our dedicated teams deliver measurable results in each project, and here’s one of the most prominent outcomes.

SaaS-Based Crypto Asset Management Platform

Our client, a leading cryptocurrency portfolio management firm, aimed to develop a platform that would simplify asset management and improve user experience. The goal was to implement blockchain in finance for streamlined asset monitoring, transaction tracking, and trading.

Solution

We focused on enhancing user interaction by designing an intuitive interface tailored to traders and investors. The platform features customizable dashboards, real-time data analytics, and easy-to-navigate tools for a seamless user experience:

- A centralized hub for managing diverse digital portfolios

- Customizable dashboards for a personalized experience

- Live analytics to aid decision-making

- Encryption and multi-factor authentication for robust security

- Scalable architecture to handle increasing trading volumes

Results

- 22% increase in clients within six months

- 15% rise in revenue during the same period

- Improved client retention and a growing customer base

- Significant cost savings on infrastructure maintenance

Final Thoughts

Blockchain is a working technology with clear, practical use in fintech. It reduces transaction costs, strengthens data security, and enables instant cross-border transfers—benefits already leveraged by financial institutions aiming for efficiency and resilience.

Realizing these gains, however, requires more than technical implementation. It demands a precise understanding of compliance requirements, security protocols, and financial user behavior.

Acropolium brings a two-decade expertise to employ blockchain in finance in a way that addresses unique needs. Our subscription-based cooperation model ensures predictable costs, technical continuity, and operational flexibility— all while we manage the infrastructure.