How Insurtech Companies Can Stay Competitive with Strategic Software Development

In the fast-paced world of insurance, staying ahead of the curve is essential. As technology continues to reshape industries, insurtech companies are increasingly turning to innovative software solutions to streamline operations, improve customer experiences, and remain compliant with evolving regulations. The journey from concept to implementation requires a structured approach that ensures efficiency, scalability, and long-term success. This article explores how insurtech firms can leverage strategic software development to navigate challenges and drive growth.

Understanding the Insurtech Landscape

The insurtech sector is at a crossroads. While it offers immense potential for innovation, it also faces significant hurdles. Regulatory complexities, data privacy concerns, and the pressure to maintain technological advancement are just a few of the challenges that companies must address. For many, outsourcing software development has become a strategic move to access specialized expertise, reduce costs, and accelerate time-to-market.

By partnering with experienced developers, insurance carriers and brokers can integrate cutting-edge technologies into their core processes. These solutions enable more efficient policy management, accurate risk assessment, and faster client service. The result is a more agile and responsive business model that meets the expectations of today’s digital-first customers.

The Five-Step Approach to Building Effective Systems

To ensure that software development aligns with business goals, companies often follow a structured approach. This method involves five key steps: Explore, Plan, Develop, Deploy, and Support. Each phase plays a critical role in delivering a system that meets both technical and operational requirements.

Step 1 – Explore

The first step involves understanding the current workflows and identifying pain points. By engaging stakeholders and discussing their needs, developers can uncover opportunities for improvement. This phase is crucial for setting the foundation of the project and ensuring that the final product addresses real-world challenges.

Through open dialogue, teams can identify areas where automation or integration could enhance efficiency. This collaborative approach ensures that the system being developed is tailored to the specific needs of the organization.

Step 2 – Plan

Once the requirements are clear, the next step is to design and plan the system. This includes creating flowcharts, database schemas, and wireframes to visualize the architecture. A detailed proposal is then developed to ensure that the solution aligns with existing workflows, data structures, and budget constraints.

This phase also involves assessing potential risks and determining the best strategies for implementation. A well-thought-out plan sets the stage for a smooth development process and reduces the likelihood of costly revisions later on.

Step 3 – Develop

With a solid plan in place, the development phase begins. Developers follow the outlined specifications while remaining flexible to incorporate improvements as needed. This iterative approach allows for continuous refinement and ensures that the system evolves to meet changing demands.

Testing is an integral part of this phase. Once a working version is ready, it is shared with stakeholders for feedback and validation. This helps identify any issues early on and ensures that the final product meets user expectations.

Step 4 – Deploy

After successful testing, the system is deployed into the organization’s environment. This typically involves integrating the new solution with existing systems and training staff on its use. Deployment may occur gradually, starting with one department before expanding to others.

This phased approach minimizes disruption and allows for a smoother transition. It also provides an opportunity to monitor performance and make adjustments as needed.

Step 5 – Support

Even after deployment, the work isn’t over. Ongoing support is essential to ensure that the system continues to function optimally. This includes monitoring for security threats, performing regular maintenance, and making updates as necessary.

A dedicated support team can help resolve issues quickly and provide guidance on future enhancements. This ensures that the system remains aligned with the company’s long-term goals.

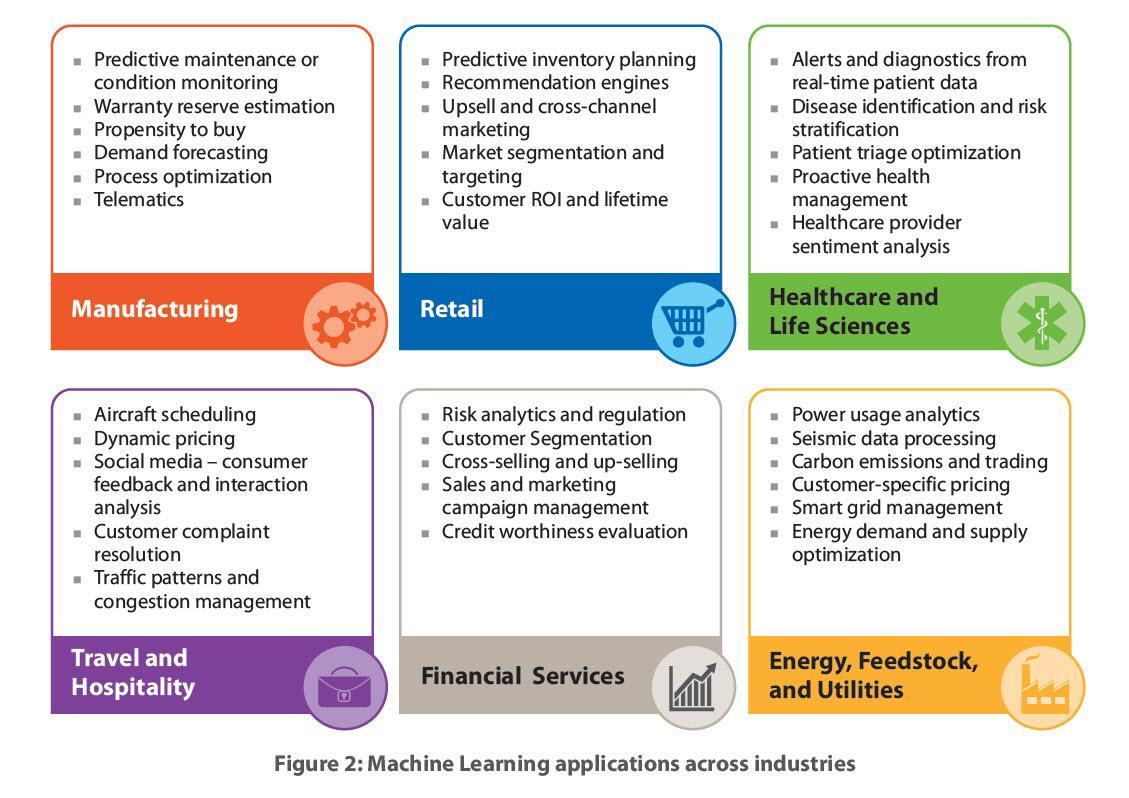

The Role of Advanced Technologies in Insurtech

To stay competitive, insurtech companies must embrace advanced technologies such as artificial intelligence (AI), data analytics, the Internet of Things (IoT), and cybersecurity. These tools enable more accurate risk assessments, personalized customer experiences, and improved operational efficiency.

For example, AI can be used to automate underwriting processes, reducing the time and effort required to evaluate applications. Data analytics helps insurers identify trends and make informed decisions, while IoT devices provide real-time insights into policyholders’ behaviors.

Cybersecurity is another critical area, especially as data privacy regulations become more stringent. Ensuring that systems are secure and compliant is essential for maintaining customer trust and avoiding legal penalties.

The Value of Outsourcing

Outsourcing software development has become a popular choice for many insurtech companies. By partnering with experienced providers, organizations can access a wide range of skills and resources without the need for extensive in-house infrastructure. This approach not only reduces costs but also accelerates project timelines.

Moreover, outsourcing allows companies to focus on their core competencies while leaving the technical details to experts. This is particularly beneficial for smaller firms that may lack the resources to develop complex systems internally.

Conclusion

In an industry defined by rapid change and increasing competition, strategic software development is no longer optional—it’s essential. By following a structured approach and leveraging advanced technologies, insurtech companies can build systems that enhance efficiency, improve customer satisfaction, and drive long-term growth. Whether through in-house efforts or outsourcing, the key is to remain adaptable and focused on delivering value in a digital-first world.