How to Choose the Best Credit Card: A Comprehensive Comparison Guide

When it comes to choosing a credit card, the options can be overwhelming. With so many different types of cards available, each offering unique benefits and features, it’s essential to understand what you’re looking for before making a decision. Whether you’re a frequent traveler, a cashback enthusiast, or someone who wants to build their credit score, there’s a credit card that fits your needs. In this guide, we’ll walk you through the key factors to consider when comparing credit cards and help you find the best one for your lifestyle.

Understanding the Different Types of Credit Cards

Before diving into the comparison process, it’s important to familiarize yourself with the various types of credit cards available. Here are some of the most common categories:

1. Travel Rewards Credit Cards

If you love to travel, a travel rewards credit card might be the perfect choice for you. These cards allow you to earn points on your purchases, which can be redeemed for flights, hotel stays, and other travel-related expenses. Some cards also offer additional perks like airport lounge access, travel insurance, and no foreign transaction fees.

2. Cash Back Credit Cards

Cash back credit cards are ideal for everyday spending. They offer a percentage of your purchases back as cash, which can be deposited into your account or used as a statement credit. Many cards also offer bonus categories where you can earn extra cash back on specific types of purchases, such as groceries, gas, or dining out.

3. No Annual Fee Credit Cards

If you’re looking to avoid annual fees, no annual fee credit cards are a great option. These cards typically offer basic rewards and benefits without the added cost of an annual fee. While they may not have the same level of perks as premium cards, they can still provide value if you use them responsibly.

4. Balance Transfer Credit Cards

For those looking to pay off existing debt, balance transfer credit cards can be a smart choice. These cards allow you to transfer your outstanding balances from other credit cards to a new card with a lower interest rate, often with an introductory 0% APR period. This can help you save money on interest and pay off your debt faster.

5. Low Interest Rate Credit Cards

If you plan to carry a balance from month to month, a low interest rate credit card is essential. These cards offer competitive APRs, helping you minimize the amount of interest you pay over time. However, they may not offer as many rewards or benefits as other types of cards.

Key Factors to Consider When Comparing Credit Cards

Once you have a good understanding of the different types of credit cards available, it’s time to evaluate the key factors that will impact your decision. Here are some of the most important considerations:

1. Interest Rates

The interest rate, or APR (Annual Percentage Rate), is one of the most critical factors to consider. If you plan to carry a balance, a lower APR can save you money on interest charges. However, if you pay your balance in full each month, the interest rate may be less of a concern.

2. Annual Fees

Some credit cards charge an annual fee, while others do not. It’s important to weigh the benefits of the card against the cost of the fee. For example, a card with a high annual fee may offer valuable rewards or perks that justify the cost, while a card with no fee may be more suitable for those who don’t need extra benefits.

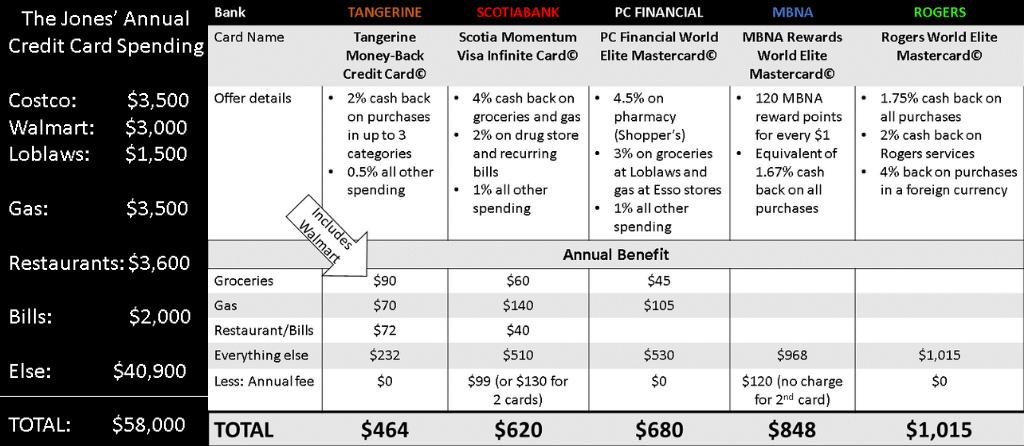

3. Rewards and Benefits

Rewards and benefits vary widely between credit cards. Some cards offer cash back, while others provide travel points, airline miles, or other exclusive perks. Consider what type of rewards align with your spending habits and financial goals.

4. Introductory Offers

Many credit cards come with introductory offers, such as 0% APR on purchases or balance transfers for a limited time. These offers can be highly beneficial if you plan to make a large purchase or transfer existing debt. Be sure to read the terms and conditions carefully to understand how long the offer lasts and what happens after the introductory period ends.

5. Credit Limit

Your credit limit affects your purchasing power and credit utilization ratio. Ensure the card offers a limit that meets your needs without encouraging overspending. A higher limit can be useful for larger purchases, but it’s important to use it responsibly.

6. Customer Service

Good customer service can make a big difference in your overall experience with a credit card. Look for cards from issuers known for their responsive and helpful customer service teams. This can be especially important if you encounter any issues or need assistance with your account.

7. Foreign Transaction Fees

If you travel internationally, a card with no foreign transaction fees can save you money on purchases abroad. Many travel rewards cards offer this feature, but it’s worth checking whether the card you’re considering has this benefit.

8. Credit Score Requirements

Different credit cards have different credit score requirements. Make sure you apply for cards that match your credit profile to increase your chances of approval. If you have a lower credit score, you may need to look for cards designed for individuals with less-than-perfect credit.

Tips for Comparing Credit Cards Effectively

Now that you know what to look for, here are some practical tips to help you compare credit cards effectively:

1. Use a Credit Card Comparison Tool

Credit card comparison tools can simplify the process by allowing you to compare multiple cards side by side. These tools highlight key features like interest rates, rewards, and fees, making it easier to find the best card for your needs.

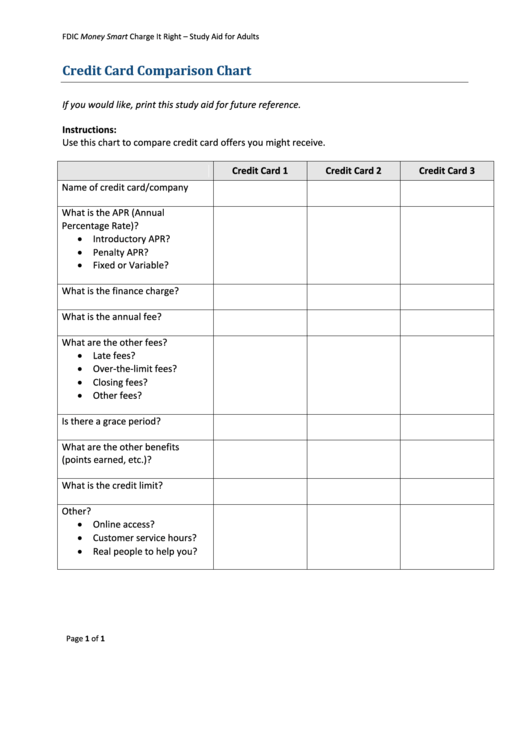

2. Create Your Own Credit Card Comparison Chart

For a more hands-on approach, create your own credit card comparison chart in Excel or another spreadsheet program. List each card’s key features and benefits, such as APR, annual fees, rewards, and additional perks. This visual aid can help you see the differences at a glance and make a more informed choice.

3. Look at Reviews and Ratings from Other Cardholders

Real-life experiences from other cardholders can provide valuable insights. Read reviews and ratings online to see how other users feel about their cards. Look for comments on customer service, ease of use, and hidden fees or issues. Reddit has plenty of threads and communities with firsthand accounts and recommendations.

4. Consider Your Spending Habits and Financial Goals

Think about how you plan to use your credit card. Are you a frequent traveler? Do you spend a lot on groceries and dining? Your spending habits and financial goals will determine which card is best for you. For instance, a card with no foreign transaction fees and excellent travel rewards would be ideal if you travel often.

5. Take Note of Any Perks or Fees Associated with Each Card

Each card comes with its own set of perks and fees. Some offer generous rewards, while others might charge high annual fees. Pay close attention to these details to ensure you get the best value for your money.

Conclusion

Choosing the right credit card requires careful consideration of your financial needs, spending habits, and long-term goals. By understanding the different types of credit cards available and evaluating key factors like interest rates, rewards, and fees, you can make an informed decision that suits your lifestyle. Remember to use credit card comparison tools, read reviews, and consider your personal preferences to find the best card for you. With the right credit card, you can enjoy the benefits of responsible credit use while avoiding unnecessary costs and debt.