How to Get a Free Credit Report and Why It Matters

Your credit report is one of the most important documents in your financial life. It can determine whether you qualify for loans, credit cards, or even employment opportunities. Understanding how to obtain a free credit report and why it matters is essential for maintaining financial health and protecting yourself from identity theft. In this article, we’ll guide you through the process of getting a free credit report and explain its significance.

What Is a Credit Report?

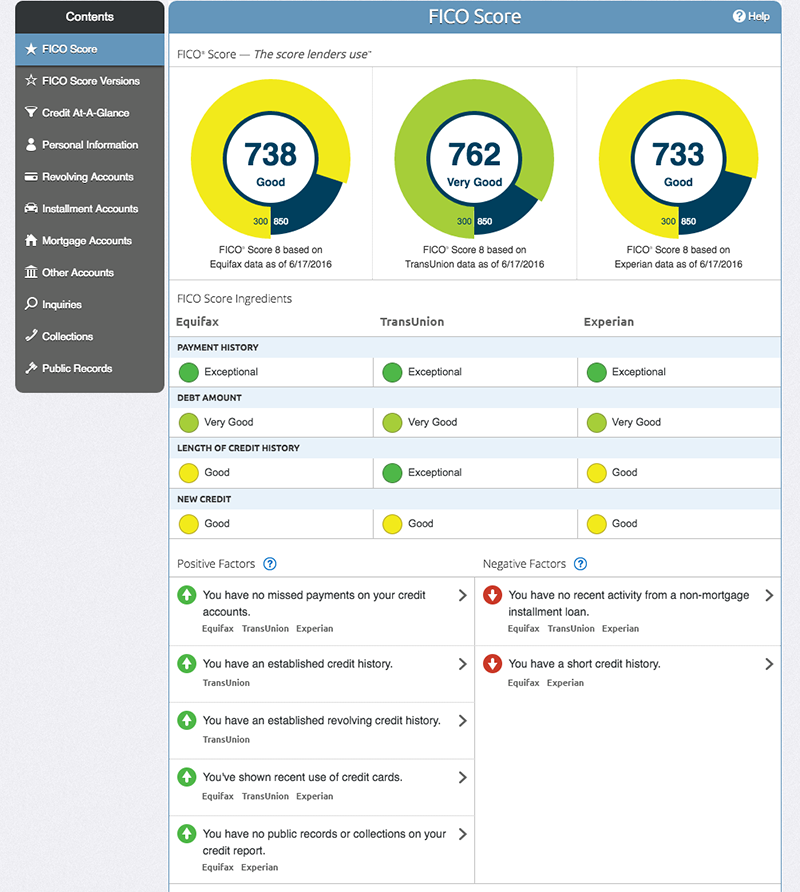

A credit report is a detailed summary of your personal credit history. It includes identifying information such as your name, address, and Social Security number, as well as details about your credit accounts, payment history, and any bankruptcies or collections. The three major credit bureaus—Equifax, Experian, and TransUnion—collect and maintain this information. While not all creditors report to these bureaus, most major lenders and financial institutions do.

The data in your credit report can impact your ability to secure credit, the interest rates you’re offered, and even your chances of being hired for certain jobs. Employers, landlords, and insurance companies often use credit reports to assess your reliability and financial responsibility.

Why You Should Get a Free Credit Report

There are several compelling reasons to regularly check your credit report:

1. Detect Errors and Inaccuracies

Credit reports can contain errors, such as incorrect account balances, outdated information, or fraudulent activity. Reviewing your report allows you to identify and correct these issues before they negatively affect your financial standing.

2. Spot Signs of Identity Theft

If someone has stolen your personal information, they may open accounts in your name, which will appear on your credit report. Regularly checking your report helps you catch these red flags early.

3. Monitor Your Financial Health

By reviewing your credit report, you can track your borrowing habits, see how you’re managing debt, and understand how your actions impact your credit score.

4. Prepare for Major Financial Decisions

Before applying for a loan, mortgage, or credit card, it’s wise to review your credit report to ensure there are no surprises that could affect your approval.

How to Get a Free Credit Report

Under federal law, you are entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. Here’s how you can access them:

1. Visit AnnualCreditReport.com

This is the only authorized website to request your free annual credit reports. Simply visit the site, click “Order Your Free Reports,” and follow the steps to select the credit bureau(s) you want.

2. Call the Toll-Free Number

You can also request your reports by calling 1-877-322-8228. A representative will guide you through the process.

3. Mail a Request Form

Download the Annual Credit Report Request Form from the official site, complete it, and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

4. Check for Additional Free Reports

If you meet certain criteria, you may be eligible for additional free reports. These include:

- Being denied credit or insurance within the past 60 days

- Placing a fraud alert on your credit report

- Being unemployed and planning to apply for a job within 60 days

- Receiving public assistance

- Suspecting fraud or identity theft

How Often Can You Get a Free Report?

Federal law gives you the right to get a free copy of your credit report once every 12 months from each of the three credit bureaus. However, there is an additional benefit: everyone in the U.S. can get six free credit reports per year from Equifax through 2026 by visiting AnnualCreditReport.com. This means you can receive more frequent access to your credit information without paying.

Additionally, the three credit bureaus have a program that allows you to check your credit report from each bureau once a week for free at AnnualCreditReport.com.

What to Expect When You Order Your Credit Report

When you request your credit report, the credit bureaus will verify your identity to protect your information. You’ll need to provide your name, address, Social Security number, and date of birth. If you’ve moved recently, you may also need to provide your previous address.

Depending on how you request the report, you can receive it immediately online, or within 15 days if you request it by phone or mail. If you need your report in Braille, large print, or audio format, it will take approximately three weeks to arrive.

How to Monitor Your Credit Reports

While you’re entitled to one free report per year from each bureau, some experts recommend staggering your requests throughout the year to monitor your credit more closely. For example, you could request one report every four months. This helps you stay on top of changes and detect issues early.

It’s also a good idea to check your credit report before applying for major financial products like a mortgage or car loan. This ensures there are no unexpected errors or inaccuracies that could affect your application.

Avoid Scams and Fraudulent Sites

Be cautious of websites or services that claim to offer free credit reports. Only AnnualCreditReport.com is officially authorized to provide free annual credit reports. Other sites may be scams designed to steal your personal information or sell you unnecessary services.

If you encounter a scam, report it to the Federal Trade Commission (FTC) at ReportFraud.ftc.gov.

Conclusion

Getting a free credit report is a simple yet powerful way to protect your financial health. By understanding how to access your reports and what to look for, you can ensure your credit history is accurate, detect potential fraud early, and make informed financial decisions. Make it a habit to check your credit report annually—and consider using the weekly access option to stay even more proactive about your financial well-being.