How to Navigate Your Insurance Renewal: Tips and Tricks for 2024

Insurance renewal is a critical process that ensures your financial protection remains intact as you move through life. Whether you’re an individual or a business owner, understanding how to navigate your insurance renewal can save you time, money, and potential headaches. As we approach 2024, it’s more important than ever to stay informed about the best practices for renewing your policies.

Understanding the Importance of Insurance Renewal

Insurance renewal is the process of extending your existing policy to continue receiving coverage. This is essential because failing to renew your policy can lead to gaps in coverage, which could leave you vulnerable to unexpected financial losses. For individuals, this might mean not being covered in the event of an accident or illness. For businesses, it could result in significant financial risks if operations are disrupted due to unforeseen events.

Key Dates and Deadlines

One of the first steps in navigating your insurance renewal is to be aware of key dates and deadlines. Most insurance policies have specific expiration dates, and it’s crucial to renew them before these dates to avoid lapses in coverage. Many insurers also send out renewal notices approximately 30 to 45 days before the expiration date, so keeping track of these notifications is vital.

Preparing for Your Insurance Renewal

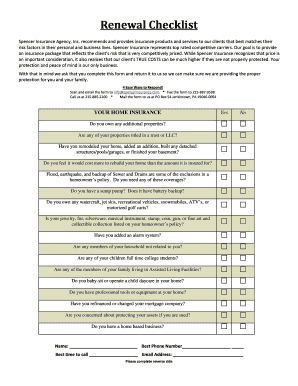

Before you begin the renewal process, take some time to review your current policy. This includes assessing your coverage needs and evaluating any changes in your circumstances since you initially purchased the policy. For example, if you’ve recently made home improvements or purchased a new vehicle, you’ll need to consider whether your current insurance policy adequately covers these investments.

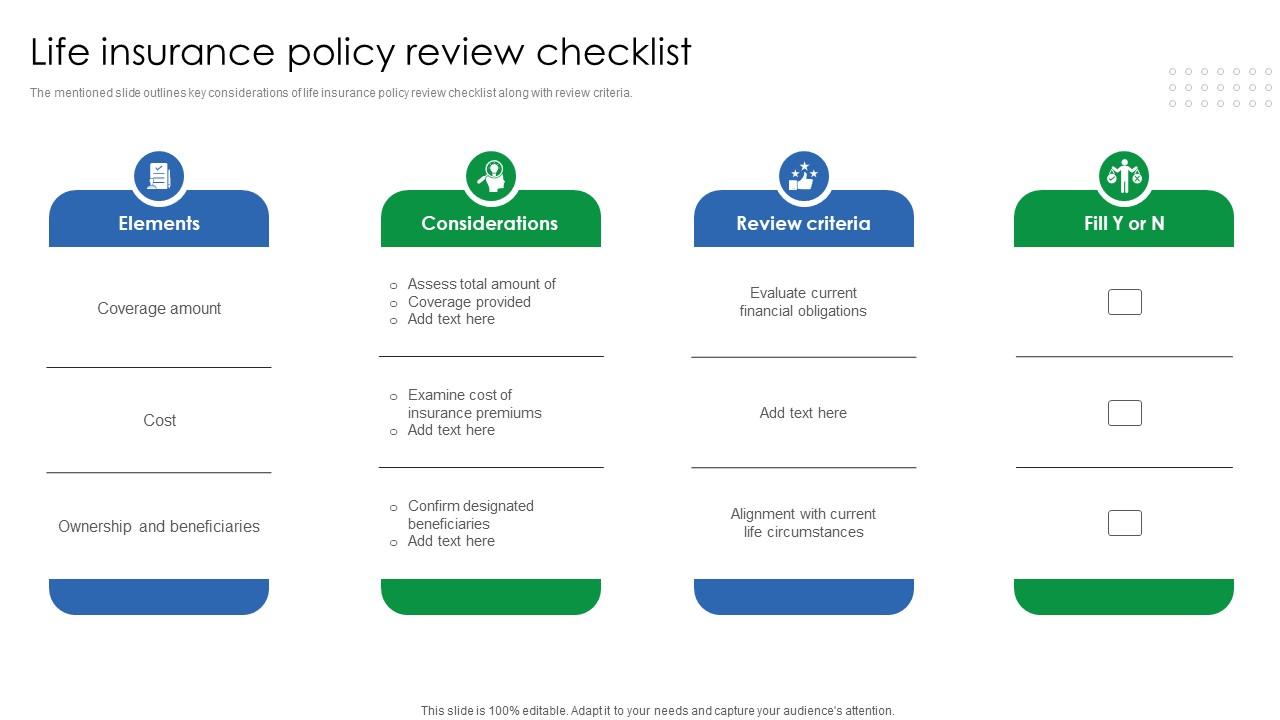

Reviewing Your Coverage Needs

It’s also important to review your current policy’s terms and exclusions. Ensure you understand the limits of your coverage and any specific exclusions that might apply. If any terms or exclusions no longer align with your needs, you should consider making changes during the renewal process.

Researching and Comparing Providers

Once you’ve assessed your current policy, it’s time to research and compare different insurance providers. Start by checking the reputation and financial strength of each provider you’re considering. Look for ratings from organizations like A.M. Best or Standard & Poor’s, as well as customer reviews and testimonials.

Additionally, evaluate each provider’s customer service and policyholder satisfaction. Reach out to friends, family, or colleagues who have experience with the insurer, and consult customer reviews to get a sense of their responsiveness, helpfulness, and overall satisfaction from existing policyholders.

Organizing Necessary Documentation

Gather and organize all necessary documentation for the application process. This will typically include personal information and identifying documents, such as your Social Security number and driver’s license. In addition to your personal information, you’ll need to provide details about the property or vehicle you’re insuring.

Navigating the Renewal Process

The renewal process can vary depending on the type of insurance you have. For auto insurance, most policies last 6 months or 1 year — after that, your policy is up for renewal. That basically means you have the option to continue your coverage. If you don’t renew with your current company, you’ll have to shop around for different car insurance coverage and make sure you have a new auto policy in place for when your current one expires.

Automatic vs. Manual Renewal

Some insurers may offer automatic renewal, which is convenient because it happens automatically — and you may get a customer loyalty discount. However, it’s important to note that your rates could go up without you noticing, if you’re not paying attention.

If your car insurance is set to automatically renew and you feel okay about the new rates, you don’t have to do anything except continue to make payments and swap out your new insurance cards to keep in your wallet and glove box of your vehicle.

Manual Renewal Steps

For those who prefer manual renewal, the process involves actively seeking to renew your insurance policy once it expires. This approach requires more work on the policyholder’s part but may lead to better coverage and rates.

Steps to follow for manual renewal include:

- Reviewing your current coverage and assessing whether any adjustments need to be made.

- Researching available policy options and comparing different insurance providers.

- Requesting renewal quotes from your current provider as well as competitors.

- Evaluating the quotes to find the best coverage and rate for your needs.

- Completing the necessary paperwork and making any required payments to renew the policy.

Avoiding Common Pitfalls

During the renewal process, it’s easy to fall into a few traps. Here are some common pitfalls to avoid:

Don’t Rush the Process

Insurance renewal isn’t done at the last minute. Take some time to review and make any necessary changes.

Don’t Overlook Small Changes

Any tiny change in your business operations can lead to gaps in your coverage. Check your account for any modifications, no matter how minor.

Don’t Focus Only on Price

Yes, the cheapest policy is very tempting, but you don’t want to find out later that you’ve invested in inadequate coverage. Try to find a policy that balances cost with comprehensive protection.

Conclusion

Navigating your insurance renewal in 2024 requires careful planning and attention to detail. By understanding the importance of insurance renewal, preparing for the process, and avoiding common pitfalls, you can ensure that your coverage remains adequate and up-to-date. Whether you’re an individual or a business owner, staying informed about the best practices for renewing your policies can save you time, money, and potential headaches.