How to Save on Car Insurance in the UK: A Comprehensive Guide

Car insurance is a legal requirement for all drivers in the United Kingdom, but the cost of this essential coverage has been rising due to factors like inflation and increased repair costs. Fortunately, there are numerous ways to reduce your premiums by taking advantage of various car insurance discounts. This article explores the different types of discounts available, how to qualify for them, and strategies to save money on your policy.

Understanding Car Insurance Discounts

Insurance companies offer a wide range of discounts to help drivers lower their premiums. These discounts can be categorized into several main types, including driver-based, driving-based, vehicle-based, and loyalty-based discounts. Each type targets specific characteristics or behaviors that can reduce risk for the insurer.

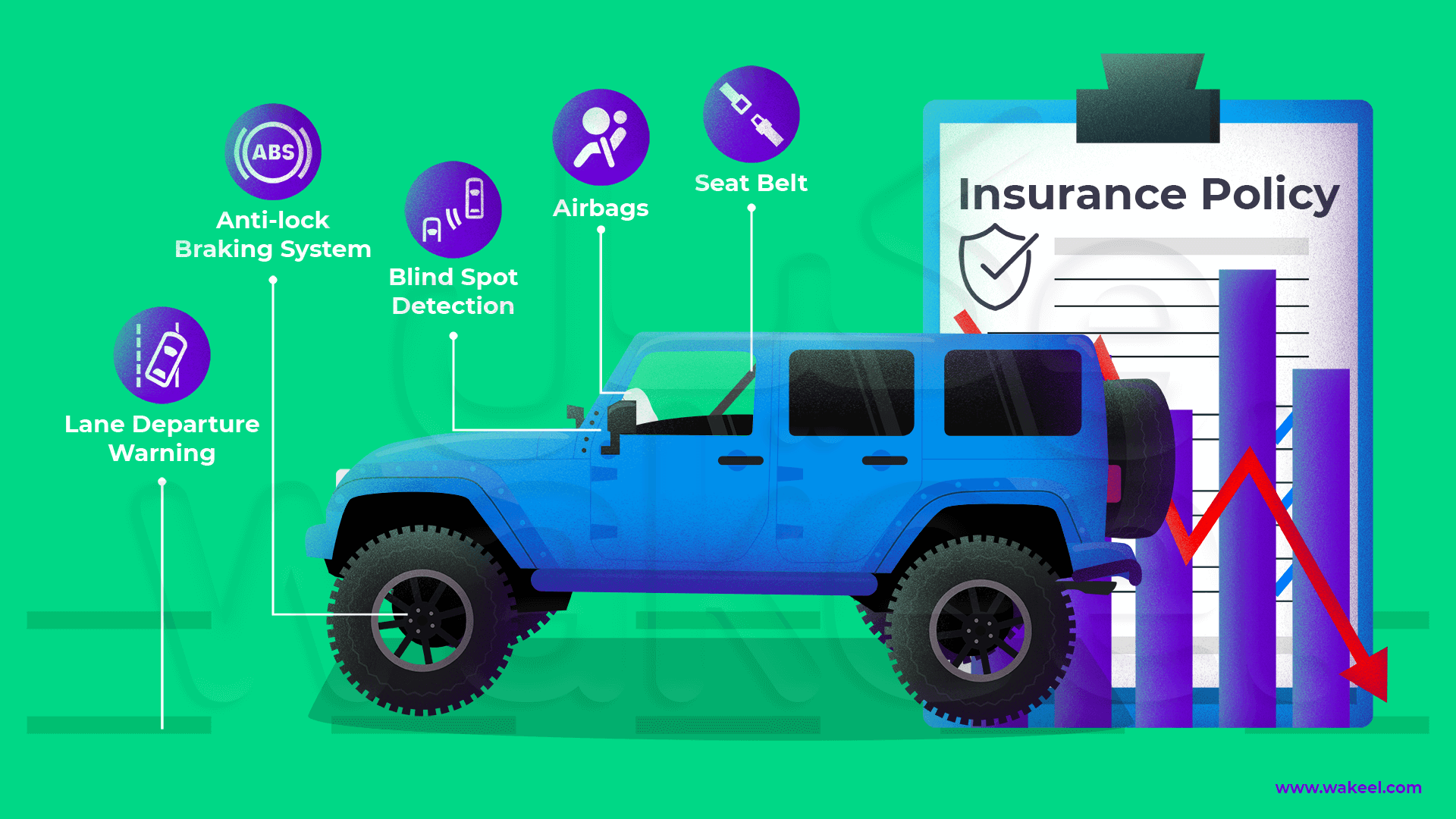

Vehicle Equipment Discounts

One of the most effective ways to save on car insurance is by purchasing a vehicle equipped with safety features. Features such as anti-lock brakes, airbags, and advanced collision avoidance systems not only enhance safety but also reduce the likelihood of accidents, which can lead to lower premiums.

- Restraint Device Discount: Vehicles with airbags, seat belts, and passive restraint systems can save up to 23% on medical payments or personal injury coverage.

- Anti-Lock Braking System (ABS) Discount: Cars with factory-installed ABS may receive a 5% discount on certain coverages.

- Anti-Theft System Discount: Vehicles with built-in anti-theft systems could earn up to 23% off the comprehensive portion of your premium.

- Daytime Running Lights Discount: Cars with standard daytime running lights might get a 3% discount on some coverages.

- New Vehicle Discount: New vehicles three model years old or newer could qualify for up to a 15% discount.

Driving History and Habits

Your driving record plays a significant role in determining your insurance rates. Insurers reward safe drivers with discounts, encouraging responsible behavior on the road.

- Clean Driving Record Discount: A clean record can lead to a 22% discount on most GEICO coverages.

- Drive Easy Discount: By installing a telematics device, you can monitor your driving habits and potentially earn a 5–15% discount based on your score.

- Defensive Driving Discount: Completing a defensive driving course may result in additional savings.

- Good Student Discount: Full-time students with good grades can receive up to a 15% discount.

Driver Affiliation Discounts

Certain professions, memberships, and affiliations can also qualify you for car insurance discounts.

- Military Discount: Active duty, retired military members, and National Guard/Reserve personnel may get up to a 15% discount.

- Federal Employee (Eagle) Discount: Active or retired federal employees could qualify for a 12% discount.

- Membership & Employee Discounts: Belonging to one of 500+ organizations may provide additional savings.

- Deployed Driver Discount: Drivers deployed overseas may receive a discount on their policy.

Policy and Customer Loyalty Discounts

Insurance companies often reward long-term customers with discounts for maintaining policies or bundling multiple policies.

- Multi-Vehicle Discount: Insuring more than one car can lead to a 25% discount.

- Multi-Policy (Multi-line) Discount: Bundling auto insurance with home or renters insurance can provide significant savings.

- Homeownership Discount: Homeowners may be eligible for a discount just for being a homeowner.

- Paperless Discount: Going paperless can also result in a discount on your premiums.

Other Ways to Save on Car Insurance

In addition to discounts, there are other strategies to reduce your car insurance costs:

- Raise Your Deductible: Increasing your deductible can slightly lower your premiums, though it’s important to choose an amount you can afford in case of a claim.

- Practice Safe Driving: Maintaining a clean driving record helps keep your base rate low and qualifies you for more discounts.

- Compare Rates Often: The insurance market is dynamic, so shopping around during renewal periods can uncover better deals.

- Build Your Credit: In many states, credit history affects insurance rates, so improving your credit score can lead to lower premiums.

Frequently Asked Questions

Where do I find all the discounts added to my policy?

All included discounts on your car insurance policy can be found in your policy declarations page. If you’re still in the quoting process, it will be on the quote completed by the company.

Does my mileage affect my car insurance premium?

Most insurers ask for an odometer reading when you start your policy. Low-mileage drivers typically pay less than those who drive frequently.

Why is it important to shop around for car insurance quotes?

Each insurance company uses its own underwriting algorithm to determine rates. Shopping around can help you find the best deal for your unique profile.

How does vehicle type affect car insurance discounts?

The type of vehicle you drive can impact both your rate and the number of discounts you can receive. Vehicles with safety features may qualify for more discounts.

Conclusion

Saving on car insurance in the UK requires a combination of strategic choices, including selecting the right vehicle, maintaining a clean driving record, and taking advantage of available discounts. By understanding the different types of discounts and exploring options from multiple insurers, you can significantly reduce your premiums while ensuring adequate coverage. Always review your policy regularly and consider switching providers if better deals become available. With careful planning and informed decisions, you can enjoy the benefits of affordable car insurance without compromising on safety.