The Rise and Challenges of Decentralized Finance in the United States

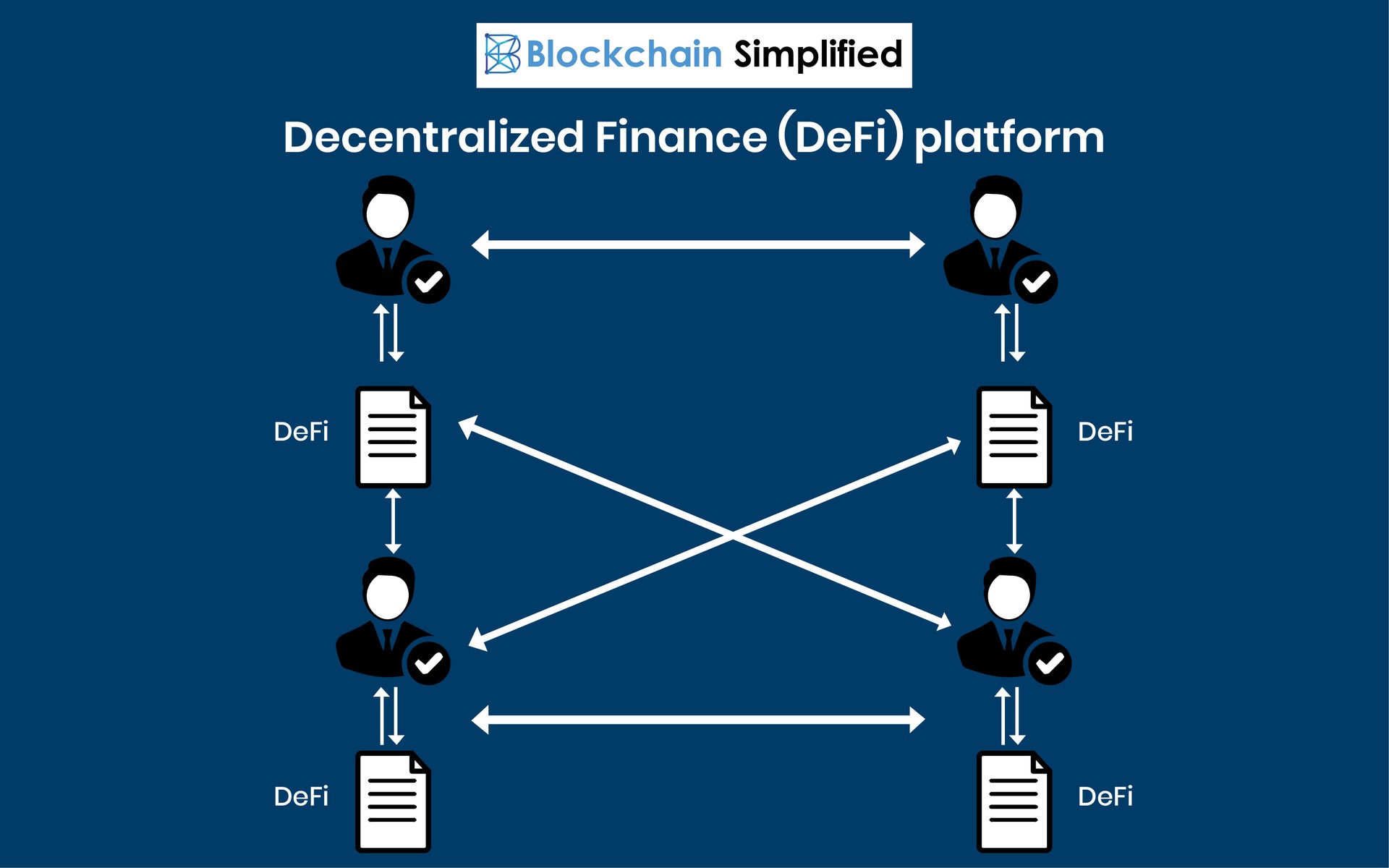

Decentralized finance, or DeFi, is a revolutionary financial system that leverages blockchain technology to eliminate intermediaries like banks and brokerages. By enabling peer-to-peer transactions, DeFi aims to reduce costs and increase efficiency while offering users greater control over their assets. However, this emerging sector is still in its infancy, facing significant challenges such as security vulnerabilities, regulatory uncertainty, and the risk of hacks and scams. As the U.S. financial landscape continues to evolve, understanding the intricacies of DeFi becomes increasingly important for both individuals and institutions.

Understanding the Mechanics of DeFi

At the heart of DeFi lies blockchain technology, a distributed and secured database that records transactions in blocks verified through automated processes. Each block is encrypted and linked to the previous one, forming a chain that ensures data integrity. This decentralized structure allows for secure and transparent transactions without the need for traditional financial intermediaries. Users interact with DeFi through digital wallets, which store private keys that grant access to their cryptocurrency holdings. These keys are essential for transferring ownership of tokens, ensuring that transactions cannot be reversed once executed.

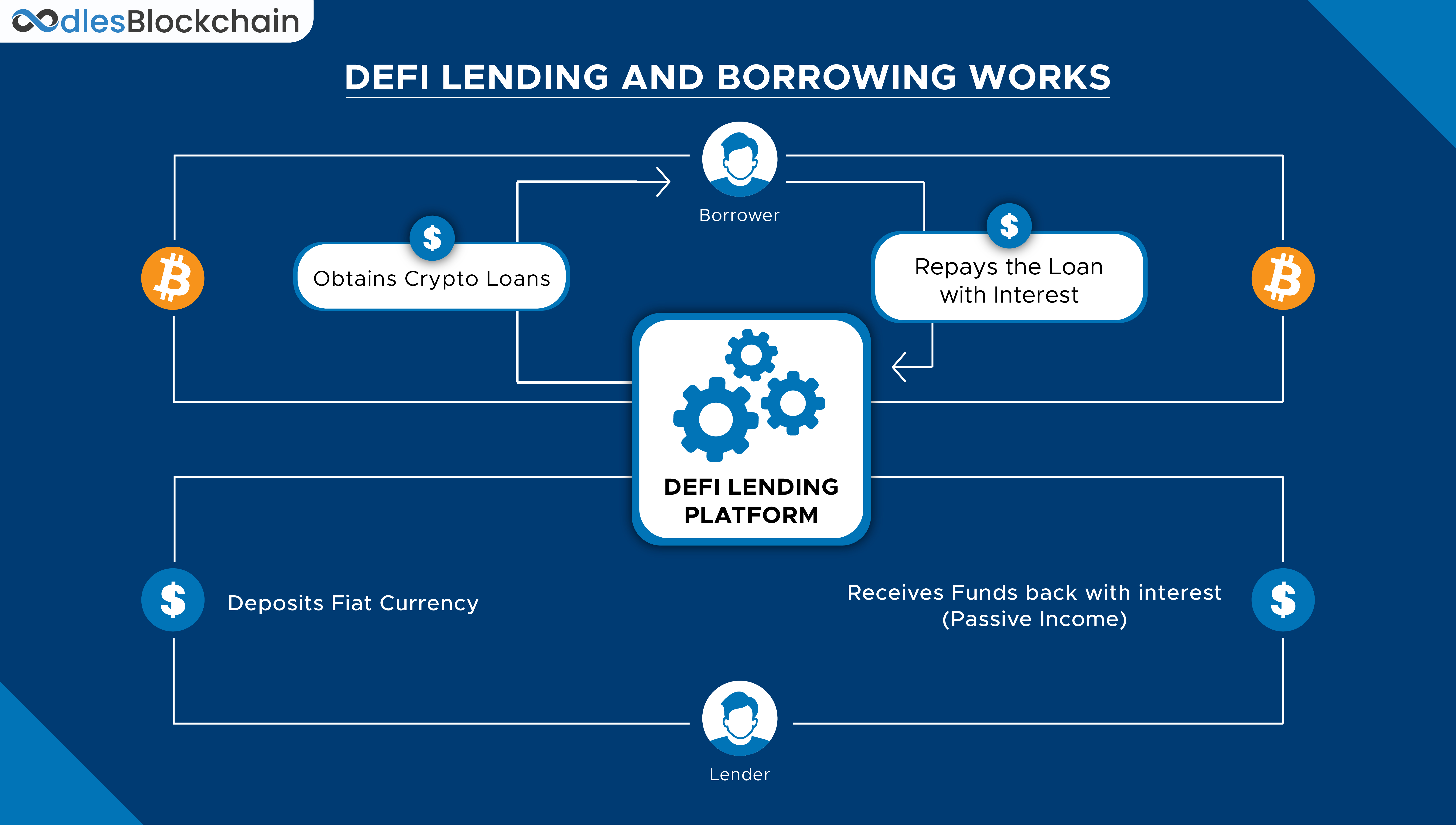

The use of smart contracts further enhances the functionality of DeFi platforms. These self-executing contracts automatically facilitate, verify, and enforce the terms of an agreement, eliminating the need for manual intervention. As a result, DeFi applications can offer a wide range of services, from lending and borrowing to trading and insurance, all while maintaining transparency and reducing transaction costs.

Key Characteristics of DeFi

DeFi is characterized by several key features that distinguish it from traditional financial systems. One of the most notable is its programmability, allowing developers to create new financial instruments and digital assets. This flexibility enables the creation of complex financial products that can adapt to changing market conditions. Additionally, the immutability of blockchain ensures that once a transaction is recorded, it cannot be altered, providing a high level of security and auditability.

Another critical aspect of DeFi is its interoperability. Ethereum’s composable software stack allows different protocols to integrate seamlessly, creating a network effect where developers can build upon existing platforms. This interconnectedness fosters innovation and encourages the development of new applications that enhance the user experience. Furthermore, DeFi promotes transparency by making all transactions publicly visible on the blockchain, allowing users to track their activities and ensure accountability.

Popular Use Cases for DeFi

DeFi has given rise to a variety of innovative applications that cater to different financial needs. One of the most prominent use cases is decentralized exchanges (DEXs), which enable users to trade cryptocurrencies directly without the need for a central authority. Platforms like Uniswap and PancakeSwap have gained popularity due to their ability to provide liquidity and reduce the risks associated with centralized exchanges.

Another significant application is lending and borrowing, where users can earn interest on their cryptocurrency holdings by supplying liquidity to lending pools. Protocols like Aave and Compound allow users to lend their assets and receive interest, while borrowers can access funds by collateralizing their holdings. This system not only facilitates financial inclusion but also provides opportunities for yield farming, where users can maximize their returns by moving their assets across different platforms.

In addition to lending and borrowing, DeFi also supports prediction markets and gaming. Platforms like Augur and PoolTogether allow users to bet on the outcomes of events or participate in no-loss savings games, respectively. These applications demonstrate the versatility of DeFi and its potential to disrupt traditional financial models.

Risks and Challenges in DeFi

Despite its promising potential, DeFi is not without its risks. One of the primary concerns is security vulnerabilities, as coding errors and hacks are common in the DeFi space. The irreversible nature of blockchain transactions means that once a mistake is made, it cannot be undone, leaving users exposed to potential losses. High-profile incidents, such as the hack of the Bancor exchange in 2018, highlight the importance of robust security measures and thorough testing before launching any DeFi application.

Regulatory challenges also pose significant hurdles for DeFi. As the sector grows, governments and regulatory bodies are grappling with how to oversee these decentralized systems. In the U.S., the Securities and Exchange Commission (SEC) has been actively monitoring DeFi platforms to ensure compliance with existing financial regulations. The lack of clear guidelines creates uncertainty for developers and users alike, potentially stifling innovation and growth.

Moreover, the volatility of cryptocurrencies adds another layer of risk to DeFi. Prices can fluctuate dramatically within short periods, leading to potential losses for users who are not adequately prepared. This volatility underscores the importance of conducting thorough research and understanding the risks involved before engaging with DeFi platforms.

The Future of DeFi in the United States

As DeFi continues to gain traction, it is essential for users and investors to approach this space with caution and a clear understanding of the risks involved. While the potential for innovation and financial inclusion is immense, the current state of DeFi is still evolving, and many challenges remain to be addressed.

For those interested in exploring DeFi, it is crucial to conduct thorough research, understand the underlying technology, and assess the risks associated with each platform. Engaging with reputable communities and staying informed about the latest developments can help users navigate the complexities of DeFi more effectively.

In conclusion, DeFi represents a transformative shift in the financial landscape, offering new opportunities for individuals and institutions alike. However, its success will depend on overcoming the challenges of security, regulation, and volatility. As the U.S. financial system continues to adapt, the role of DeFi in shaping the future of finance remains an exciting and dynamic area to watch.