The Rise of RegTech: Transforming Regulatory Compliance in the Financial Sector

Regulatory Technology, or RegTech, is rapidly reshaping the financial landscape by streamlining compliance processes through advanced technological solutions. As regulatory requirements grow more complex and numerous, financial institutions are turning to RegTech to manage their obligations efficiently and effectively. This article explores the evolution of RegTech, its key features, and how it is revolutionizing compliance in the financial sector.

Understanding RegTech

RegTech refers to the use of technology to help businesses comply with regulatory requirements. It encompasses a range of tools and services designed to automate and enhance regulatory processes, including monitoring, reporting, and compliance management. The primary goal of RegTech is to reduce the costs and complexities associated with regulatory compliance while ensuring that organizations adhere to legal standards.

The rise of RegTech can be traced back to the aftermath of the 2008 global financial crisis, which led to a significant increase in regulatory requirements. Financial institutions faced a daunting challenge in keeping up with the ever-changing regulatory landscape. In response, RegTech emerged as a solution to help these institutions navigate the complexities of compliance more efficiently.

Key Drivers of RegTech Growth

Several factors are driving the growth of the RegTech market. One of the main drivers is the increasing cost of compliance. As regulations become more stringent, the expenses associated with maintaining compliance have risen significantly. RegTech offers a cost-effective alternative by automating many of the manual processes involved in compliance, thereby reducing the need for extensive human resources.

Another key driver is the emergence of SaaS-based offerings, which have lowered the barriers to entry for smaller firms. These cloud-based solutions allow businesses to access compliance tools without the need for significant upfront investments. Additionally, the demand for faster transactions has pushed financial institutions to adopt technologies that can process data more efficiently.

The regulatory sandbox approach, which allows companies to test innovative solutions in a controlled environment, has also contributed to the growth of RegTech. This framework encourages experimentation and innovation, enabling RegTech providers to develop and refine their solutions before full-scale implementation.

The Role of Advanced Technologies

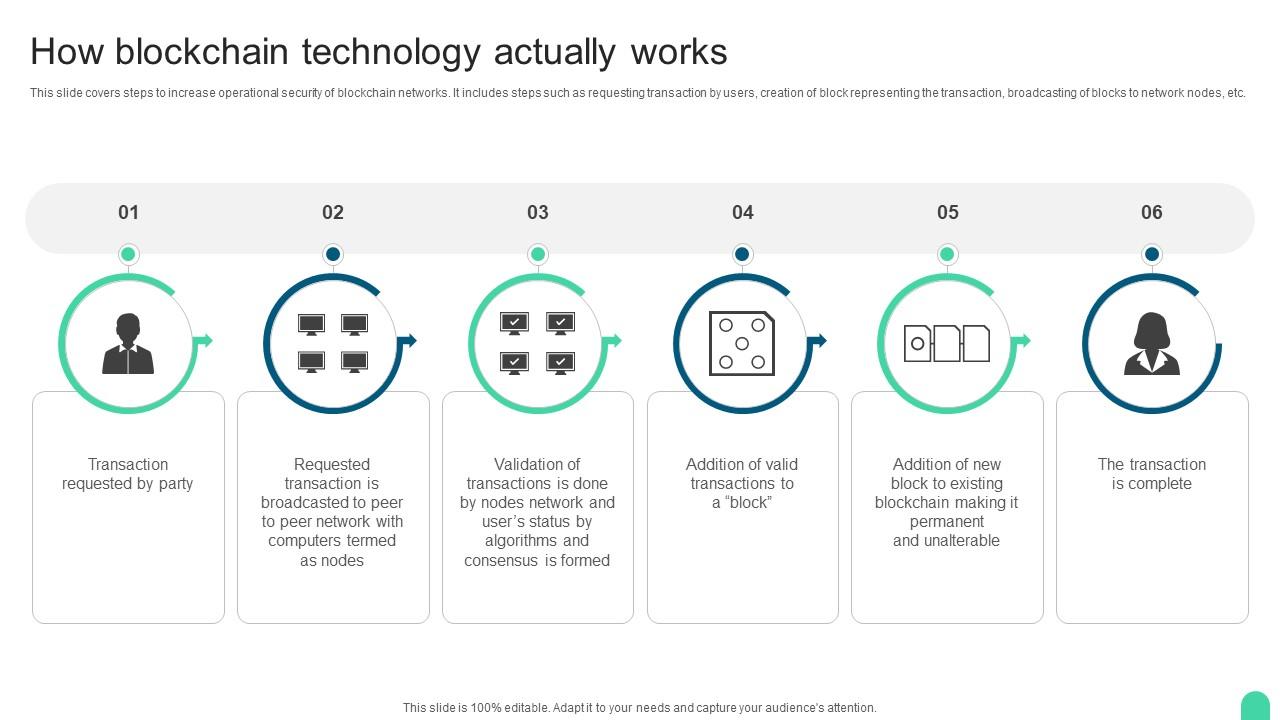

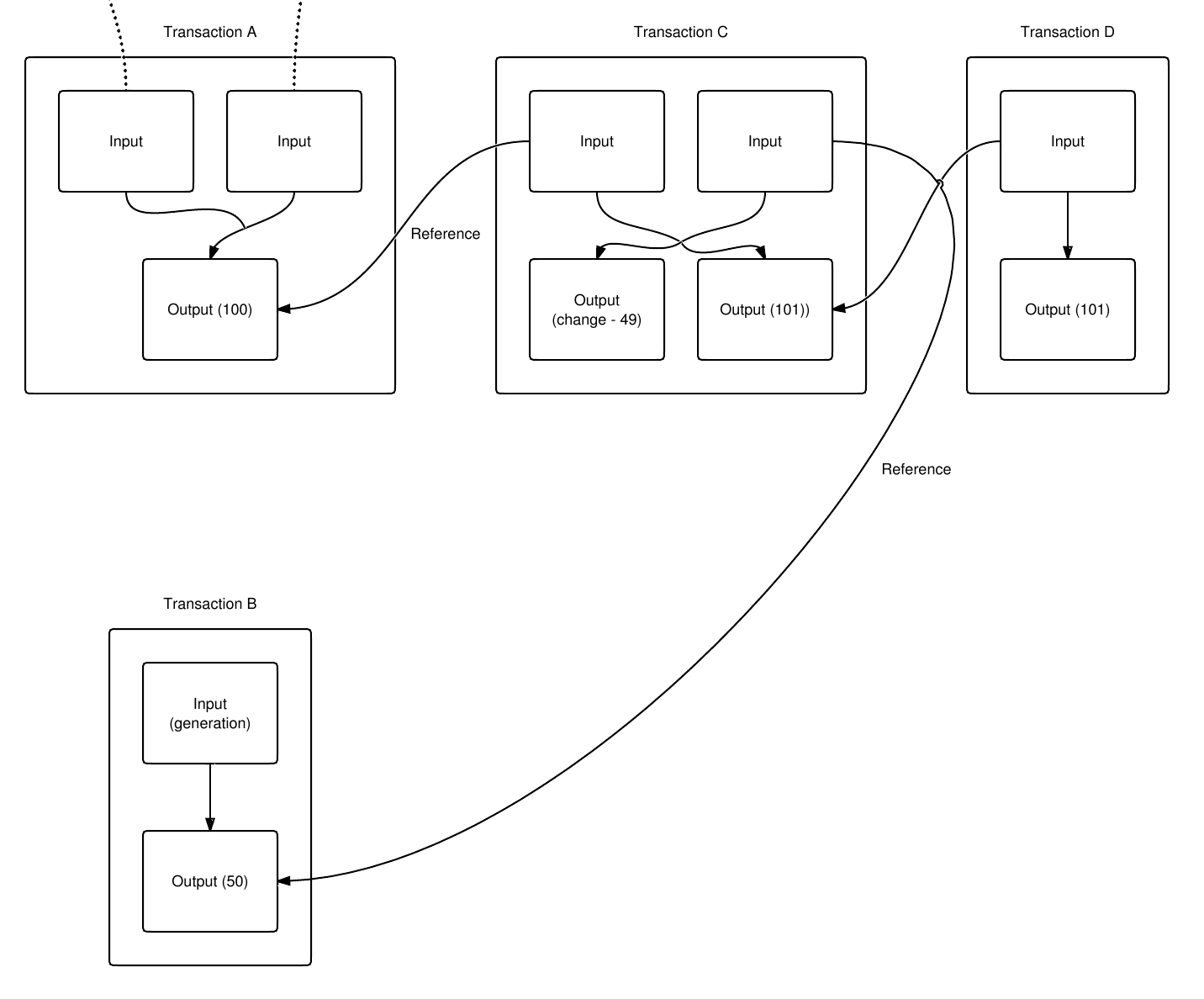

Artificial Intelligence (AI), Machine Learning (ML), and blockchain are playing a crucial role in the development of RegTech solutions. These technologies enable real-time monitoring and analysis of vast amounts of data, allowing financial institutions to detect potential compliance issues quickly. AI algorithms can identify patterns and anomalies that may indicate non-compliance, while blockchain provides a secure and transparent way to record and verify transactions.

For instance, AI-powered tools can analyze transaction data to detect suspicious activities, such as money laundering or fraud. Blockchain technology, on the other hand, offers an immutable ledger that ensures transparency and traceability in financial transactions. These advancements are not only enhancing the efficiency of compliance processes but also improving the accuracy and reliability of regulatory reporting.

The Impact of RegTech on Financial Institutions

RegTech is having a profound impact on financial institutions by transforming the way they manage compliance. By automating routine tasks, RegTech allows compliance teams to focus on more strategic activities, such as risk assessment and regulatory strategy. This shift enables financial institutions to allocate resources more effectively and respond to regulatory changes with greater agility.

Moreover, RegTech solutions are helping financial institutions reduce the risk of non-compliance, which can result in hefty fines and reputational damage. By leveraging advanced analytics and real-time monitoring, these solutions provide a proactive approach to compliance, enabling institutions to identify and address potential issues before they escalate.

Challenges and Considerations

Despite its many benefits, the adoption of RegTech is not without challenges. One of the primary concerns is the initial cost of implementation. While RegTech can lead to long-term savings, the upfront investment required to integrate these technologies into existing systems can be substantial. Financial institutions must carefully evaluate the return on investment (ROI) and ensure that the chosen solutions align with their specific needs and objectives.

Another challenge is the integration of RegTech solutions with legacy systems. Many financial institutions operate with outdated IT infrastructures that may not be compatible with modern RegTech tools. This can lead to additional costs and complexities during the implementation phase. Furthermore, data security and privacy remain critical considerations, as RegTech solutions handle sensitive information that must be protected from cyber threats.

The Future of RegTech

Looking ahead, the future of RegTech appears promising. As regulatory requirements continue to evolve, the demand for innovative compliance solutions will only grow. The integration of emerging technologies such as AI, blockchain, and cloud computing will further enhance the capabilities of RegTech, making it even more essential for financial institutions.

Additionally, the trend towards cloud-based solutions is expected to gain momentum, offering greater scalability and flexibility. The RegTech-as-a-Service (RaaS) model is also gaining traction, allowing businesses to access compliance tools on a subscription basis. This model reduces the financial burden on smaller firms and enables them to benefit from advanced compliance solutions without the need for significant capital investment.

Conclusion

RegTech is revolutionizing the way financial institutions manage regulatory compliance. By leveraging advanced technologies and innovative solutions, RegTech is helping organizations navigate the complexities of the regulatory landscape more efficiently. As the financial sector continues to evolve, the importance of RegTech will only increase, making it a vital tool for ensuring compliance and mitigating risks in an increasingly regulated environment.