The Ultimate Guide to Business Credit Cards: Benefits, Applications, and Tips

For any entrepreneur or small business owner, managing finances can be a complex task. One of the most effective tools for streamlining business expenses and improving financial flexibility is a business credit card. These cards are specifically designed to meet the unique needs of companies, offering features that go beyond what personal credit cards can provide. Whether you’re looking to boost your cash flow, manage employee spending, or take advantage of rewards, understanding how business credit cards work is essential.

Why Use a Business Credit Card?

There are several compelling reasons to consider applying for a business credit card. Here are some key benefits:

1. Access to Cash Flow and Financial Flexibility

Business credit cards can serve as a valuable source of working capital. Unlike traditional loans, they often have quicker approval processes, allowing you to access funds when you need them most. This is especially useful for covering unexpected expenses, purchasing inventory, or investing in equipment without depleting your company’s cash reserves.

2. Separation of Personal and Business Expenses

Keeping personal and business finances separate is crucial for tax purposes and financial clarity. A business credit card helps you track and categorize company expenses, making it easier to prepare for tax season and maintain accurate financial records. Many cards also offer digital tools to streamline expense tracking and integrate with accounting software like QuickBooks.

3. Rewards and Perks

Many business credit cards come with generous reward programs, including cash back, travel points, and other perks. For instance, the Ink Business Preferred® Credit Card offers 3x points on advertising purchases, while the Chase Sapphire Reserve for Business provides premium travel benefits. These rewards can help reduce your business expenses and even generate additional revenue.

4. Higher Spending Limits

Compared to personal credit cards, business credit cards typically offer higher spending limits. This allows you to make larger purchases, such as office equipment or bulk inventory, without worrying about hitting your credit limit. Some high-limit cards even offer lines of up to $50,000 or more, depending on your company’s financial standing.

5. Building Business Credit

Using a business credit card responsibly can help establish and build your company’s credit history. This is particularly beneficial if you plan to apply for business loans or lines of credit in the future. By maintaining a good payment history, you can improve your business credit score, which may lead to better loan terms and interest rates.

How to Apply for a Business Credit Card

Applying for a business credit card is generally straightforward, but the requirements can vary by issuer. Here are some steps to follow:

1. Check Your Eligibility

Most issuers will require your business to have an Employer Identification Number (EIN) and a good credit history. Some cards may also ask for proof of business income or bank statements.

2. Choose the Right Card

With so many options available, it’s important to choose a card that aligns with your business needs. Consider factors such as rewards, annual fees, spending limits, and customer support. For example, the Ink Business Cash® Credit Card is ideal for businesses that want to earn cash back on everyday expenses, while the American Express Business Platinum Card is perfect for frequent travelers.

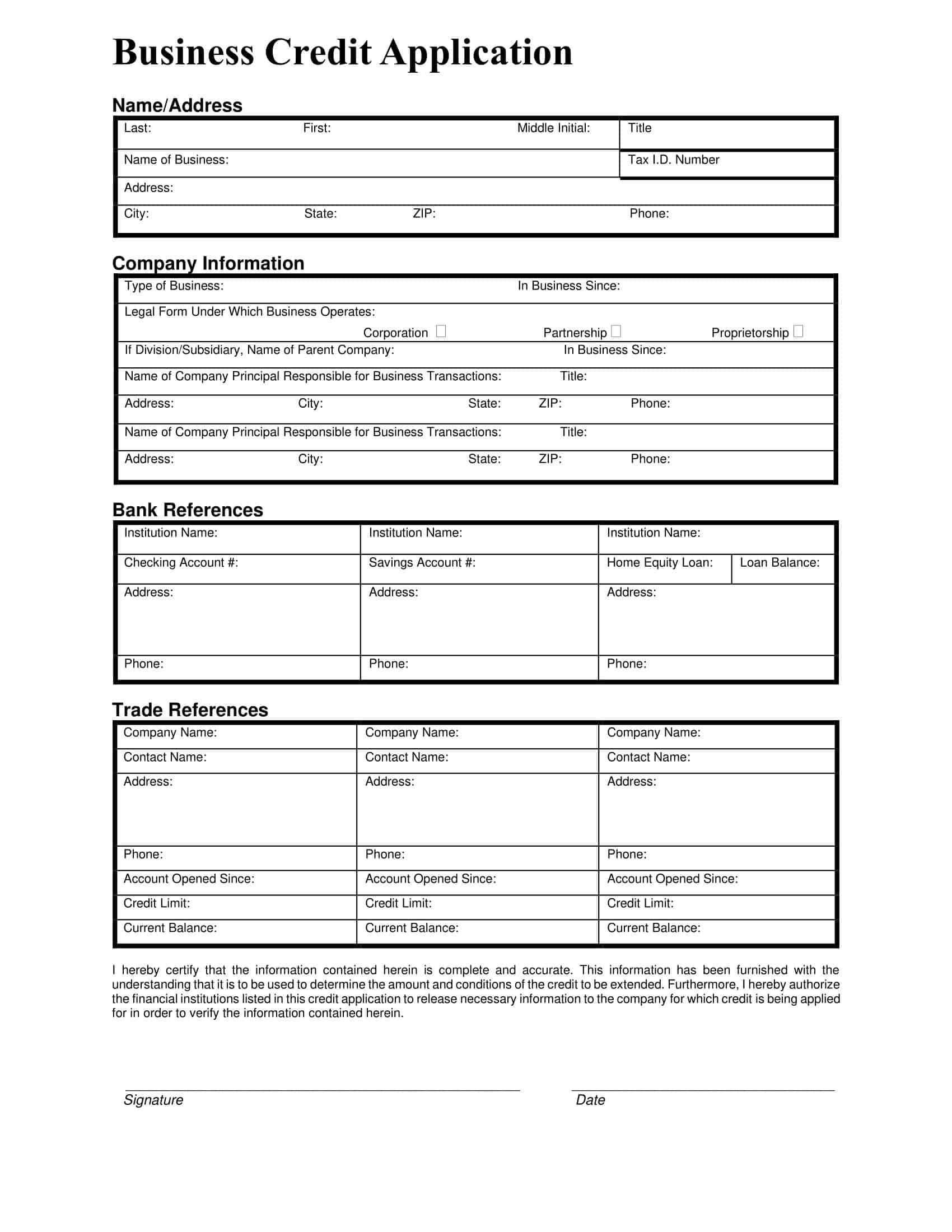

3. Gather Required Documents

You’ll likely need to provide documents such as your EIN, business bank statements, and a personal guarantee. Some cards may also require a personal credit check.

4. Submit Your Application

Once you’ve gathered all necessary information, you can submit your application online or through a financial institution. Approval times can vary, but many applications are processed within a few days.

Tips for Maximizing Your Business Credit Card

To get the most out of your business credit card, consider the following tips:

1. Pay Your Balance in Full Each Month

Paying your balance in full each month helps avoid interest charges and keeps your credit utilization low. This can improve your credit score and reduce the risk of debt accumulation.

2. Monitor Your Spending

Use the tools provided by your card issuer to track your business expenses. This can help you stay within budget and identify areas where you can save money.

3. Take Advantage of Rewards

Make sure to use your card for purchases that earn the most rewards. For example, if your card offers 3x points on travel, try to use it for business trips or hotel bookings.

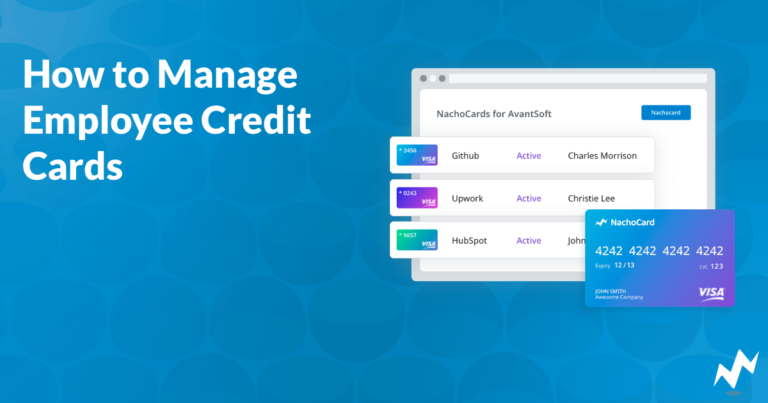

4. Set Spending Limits for Employees

If you have employees who use the card, set spending limits to prevent unauthorized or excessive purchases. Many cards allow you to issue employee cards with individual spending caps.

5. Review Your Card Terms Regularly

Credit card terms and conditions can change over time. Be sure to review your card’s terms and fees regularly to ensure you’re getting the best value.

Conclusion

A business credit card can be a powerful tool for managing your company’s finances and growing your business. From improving cash flow to earning valuable rewards, these cards offer numerous benefits that can help you succeed. By choosing the right card and using it wisely, you can maximize its advantages and build a strong financial foundation for your business.