The Ultimate Guide to Finance Courses: Learn Financial Skills for Success

In today’s rapidly evolving financial landscape, the demand for skilled professionals is at an all-time high. Whether you’re looking to advance your career, transition into finance, or simply gain a better understanding of personal financial management, finance courses offer a valuable pathway to success. With numerous options available—from traditional degrees to specialized certifications—choosing the right program can be overwhelming. This guide will help you navigate the world of finance education and find the best fit for your goals.

Why Take Finance Courses?

Finance courses are more than just academic qualifications; they equip you with practical skills that are in high demand across various industries. From investment banking to corporate finance, these programs provide a foundation in financial analysis, risk management, and strategic decision-making. Here are some key benefits:

- Career Advancement: Many finance roles require specific knowledge or credentials, making courses essential for promotions or new opportunities.

- Personal Financial Literacy: Understanding financial principles can help you make informed decisions about investments, savings, and retirement planning.

- Global Opportunities: Finance is a universal field, and many courses are recognized internationally, opening doors to global careers.

Types of Finance Courses

There are several types of finance courses available, each tailored to different levels of expertise and career goals. Here’s a breakdown of the most popular options:

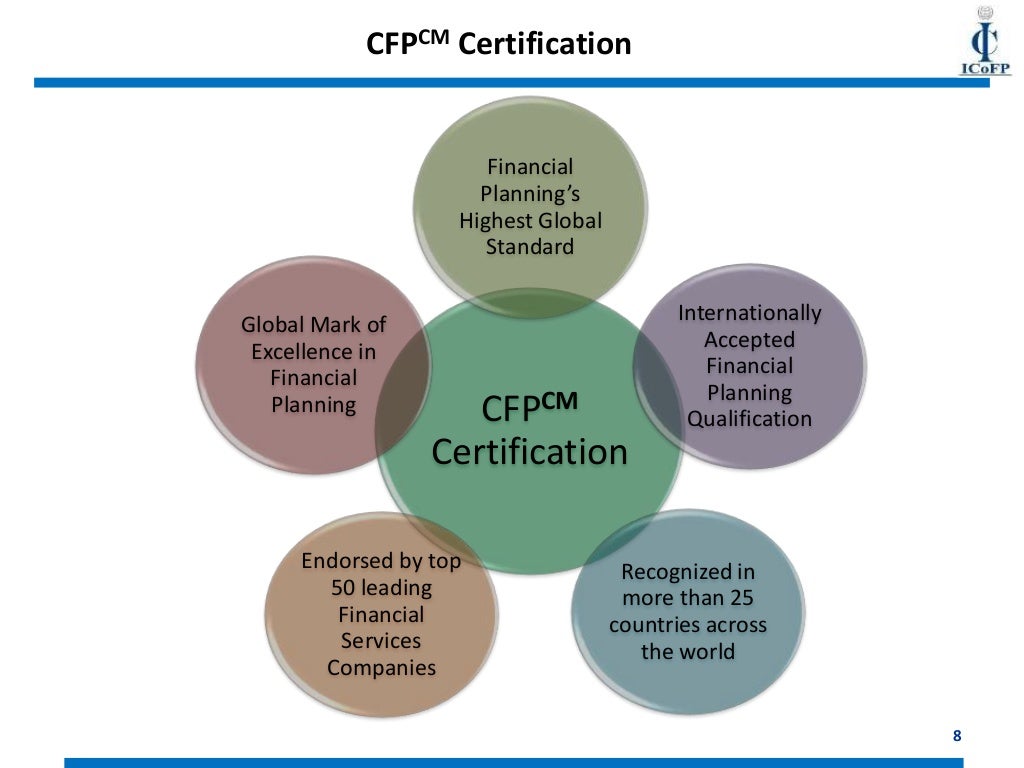

1. Certified Financial Planner (CFP)

The CFP certification is ideal for those interested in financial planning, including tax planning, retirement planning, and estate management. It requires completing coursework, passing an exam, and gaining professional experience.

- Topics Covered: Financial planning process, tax planning, retirement planning, risk management.

- Duration: Typically 6–12 months.

- Cost: $825–$3,025.

- Best For: Individuals aiming to work in retail or wealth management.

2. Chartered Financial Analyst (CFA)

The CFA designation is one of the most respected in the finance industry, particularly for those interested in asset management and securities research. It involves three levels of exams and requires professional experience.

- Topics Covered: Investment management, financial reporting, ethics, and portfolio management.

- Duration: 3–5 years.

- Cost: $2,150–$3,648.

- Best For: Professionals in investment banking, asset management, and research.

3. Financial Risk Manager (FRM)

The FRM certification is designed for professionals who specialize in risk management. It covers topics such as market risk, credit risk, and operational risk.

- Topics Covered: Risk modeling, market risk, credit risk, and integrated risk.

- Duration: 2–3 years.

- Cost: $2,150–$3,648.

- Best For: Risk analysts, compliance officers, and financial managers.

4. Certified Public Accountant (CPA)

The CPA license is essential for those pursuing a career in accounting, auditing, and financial reporting. It requires passing a rigorous exam and meeting state-specific requirements.

- Topics Covered: Financial reporting, auditing, tax law, and accounting standards.

- Duration: 1–2 years.

- Cost: $1,500–$3,500.

- Best For: Accountants, auditors, and financial controllers.

5. Chartered Alternative Investment Analyst (CAIA)

The CAIA certification focuses on alternative investments such as hedge funds, private equity, and real estate. It is ideal for those working in fund management or asset allocation.

- Topics Covered: Alternative assets, portfolio management, and risk management.

- Duration: 1–2 years.

- Cost: $2,440–$4,828.

- Best For: Portfolio managers, consultants, and investment analysts.

Choosing the Right Finance Course

Selecting the right finance course depends on your career goals, current skill level, and long-term aspirations. Here are a few factors to consider:

- Career Path: Determine which area of finance you’re interested in—investment banking, risk management, accounting, or financial planning.

- Time Commitment: Some courses require several years of study, while others can be completed in a few months.

- Cost: Consider the total cost, including exam fees, study materials, and any additional expenses.

- Recognition: Choose a course that is widely recognized in your target industry or region.

Conclusion

Finance courses offer a powerful way to build or enhance your career in the financial sector. Whether you’re aiming for a leadership role, transitioning into finance, or improving your personal financial literacy, there’s a course that fits your needs. By understanding the different options available and aligning them with your goals, you can unlock new opportunities and achieve long-term success.