The Ultimate Guide to Understanding Credit Cards in 2024

Credit cards have become an essential part of modern financial life, offering convenience, flexibility, and the ability to build credit. However, for many, understanding how credit cards work can be confusing. This guide will walk you through everything you need to know about credit cards in 2024, from how they function to the best ways to use them responsibly.

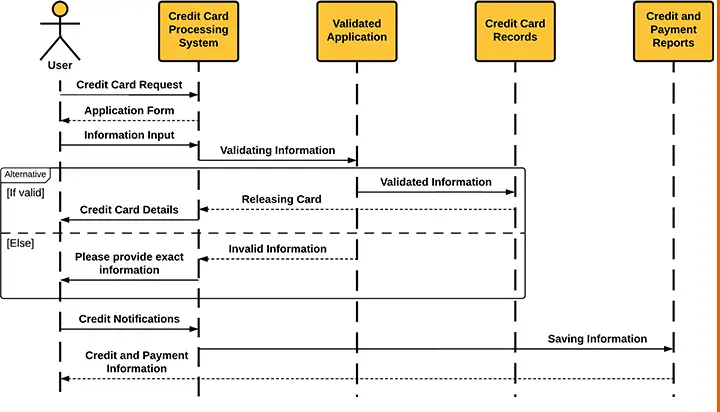

How Credit Cards Work

A credit card is a financial tool that allows you to borrow money from a bank or financial institution to make purchases. Unlike debit cards, which draw funds directly from your checking account, credit cards let you access a line of credit. You are required to pay back the borrowed amount, either in full at the end of the billing cycle or over time with interest.

Key Components of a Credit Card

- Credit Limit: This is the maximum amount you can borrow on your card. It depends on factors like your income, credit history, and other debts.

- Interest Rate (APR): The Annual Percentage Rate represents the cost of borrowing. It varies depending on the type of transaction—purchases, cash advances, or balance transfers.

- Billing Cycle: Typically, this is a month-long period during which you make purchases. At the end of the cycle, you receive a statement detailing your transactions and the minimum payment due.

- Payment Networks: Visa, Mastercard, Discover, and American Express process transactions and ensure secure payments between merchants and cardholders.

Understanding Your Creditworthiness

Your credit score plays a significant role in determining whether you’re approved for a credit card and what terms you’ll receive. A higher credit score generally means better approval chances and more favorable terms, such as lower interest rates and higher credit limits.

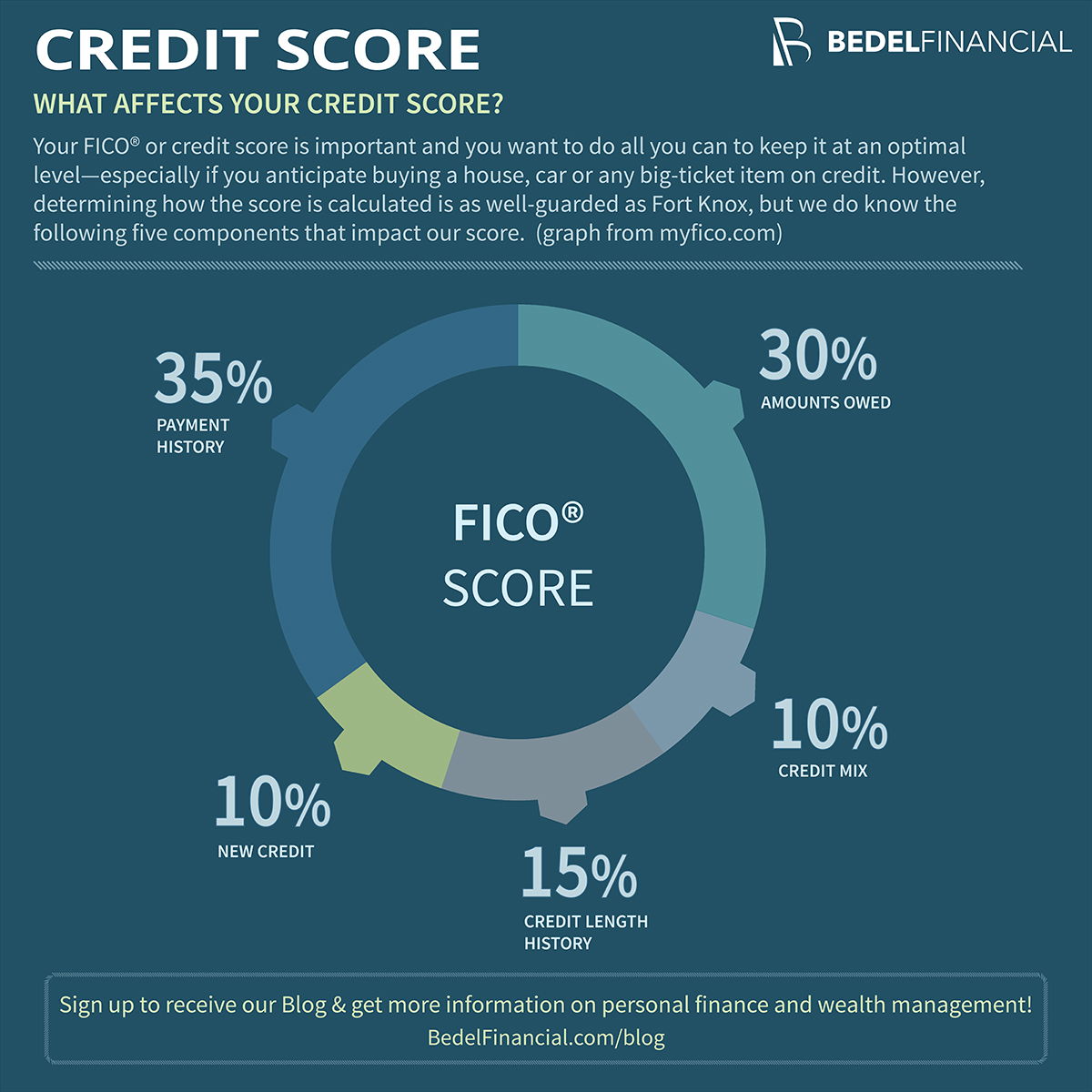

Factors That Influence Your Credit Score

- Payment History (35%): This is the most important factor. Late or missed payments can significantly hurt your score.

- Credit Utilization (30%): This refers to how much of your available credit you’re using. Experts recommend keeping it below 30%.

- Length of Credit History (15%): The longer your credit history, the better.

- Credit Mix (10%): Having a mix of different types of credit (e.g., credit cards, loans) can improve your score.

- New Credit (10%): Opening too many new accounts in a short period can negatively impact your score.

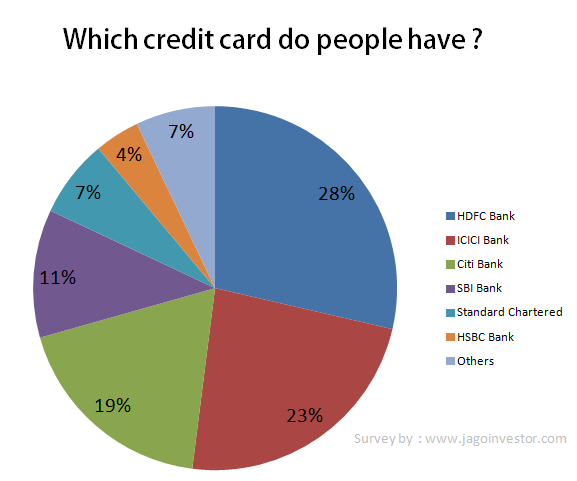

Types of Credit Cards

There are several types of credit cards, each designed to meet different financial needs:

Rewards Credit Cards

These cards offer incentives for spending, such as cash back, travel points, or airline miles. They typically require good credit and are ideal for those who pay their balances in full each month.

Low-Interest Credit Cards

These cards provide lower interest rates, making them suitable for those who may carry a balance. Some cards also offer 0% introductory APR periods for balance transfers or purchases.

Balance Transfer Credit Cards

These allow you to transfer debt from other cards to take advantage of a lower interest rate. They often come with balance transfer fees but can help you save money on interest.

Secured Credit Cards

These require a security deposit, which serves as your credit limit. They are ideal for building or rebuilding credit.

Student Credit Cards

Designed for college students, these cards often have lower credit requirements. However, applicants under 21 must have proof of income or a co-signer.

Benefits of Using a Credit Card

Using a credit card responsibly offers several advantages:

- Build Credit: Regular, on-time payments help establish a positive credit history.

- Rewards and Perks: Many cards offer cash back, travel rewards, and other benefits.

- Convenience and Security: Credit cards offer purchase protections and are easier to replace if lost or stolen.

- Flexibility: They allow you to make purchases now and pay later, which can be useful in emergencies.

Costs Associated with Credit Cards

While credit cards offer many benefits, they also come with potential costs:

- Interest Charges: If you don’t pay your balance in full, you’ll be charged interest.

- Annual Fees: Some cards charge annual fees, which can be worth it if the rewards outweigh the cost.

- Late Payment Fees: These can range from $27 to $38, depending on the issuer.

- Balance Transfer Fees: Typically 3% to 5% of the transferred amount.

- Foreign Transaction Fees: Most cards charge 1% to 3% on international purchases.

Tips for Effective Credit Card Use

To get the most out of your credit card while avoiding common pitfalls, consider the following tips:

- Pay on Time and in Full: This helps avoid interest charges and builds a strong credit history.

- Keep Your Balance Low: Aim to keep your credit utilization below 30%.

- Review Your Statements Regularly: Check for errors or unauthorized transactions.

- Avoid Multiple Applications: Applying for multiple cards in a short period can hurt your credit score.

- Maintain Active Accounts: Keep no-annual-fee cards open to maintain a healthy credit mix.

Conclusion

Credit cards are powerful financial tools when used wisely. Understanding how they work, what affects your credit score, and the different types of cards available can help you make informed decisions. Whether you’re looking to build credit, earn rewards, or manage expenses, a credit card can be a valuable addition to your financial toolkit—if used responsibly.