Top Credit Cards in the United Kingdom: A Comprehensive Guide

Choosing the right credit card can be a game-changer for managing your finances, especially if you’re looking to build credit, earn rewards, or enjoy travel perks. With so many options available, it’s essential to understand the features and benefits of each card to make an informed decision. In this article, we’ll explore some of the top credit cards available in the United Kingdom, their unique features, and how they can benefit different types of users.

Understanding How Credit Cards Work

Before diving into specific cards, it’s important to understand how credit cards function. A credit card allows you to borrow money from a financial institution up to a certain limit. You can use this money to make purchases, pay bills, or even withdraw cash. If you pay your balance in full by the due date, you won’t incur any interest charges. However, if you carry a balance, you’ll be charged interest on the outstanding amount.

Credit cards are also a useful tool for building credit history. Responsible usage—such as making timely payments and keeping your balance low—can help improve your credit score over time. This is particularly beneficial for those who are new to credit or looking to rebuild their credit.

Types of Credit Cards in the UK

There are several types of credit cards available in the UK, each tailored to meet specific financial needs. Here are some of the most common categories:

-

Cash Back Credit Cards: These cards offer a percentage of your spending back as cash. For example, some cards give 2% cash back on all purchases, while others offer higher rates on specific categories like groceries or gas.

-

Rewards Credit Cards: These cards reward users with points, miles, or other benefits that can be redeemed for travel, merchandise, or statement credits. They often come with sign-up bonuses and exclusive perks.

-

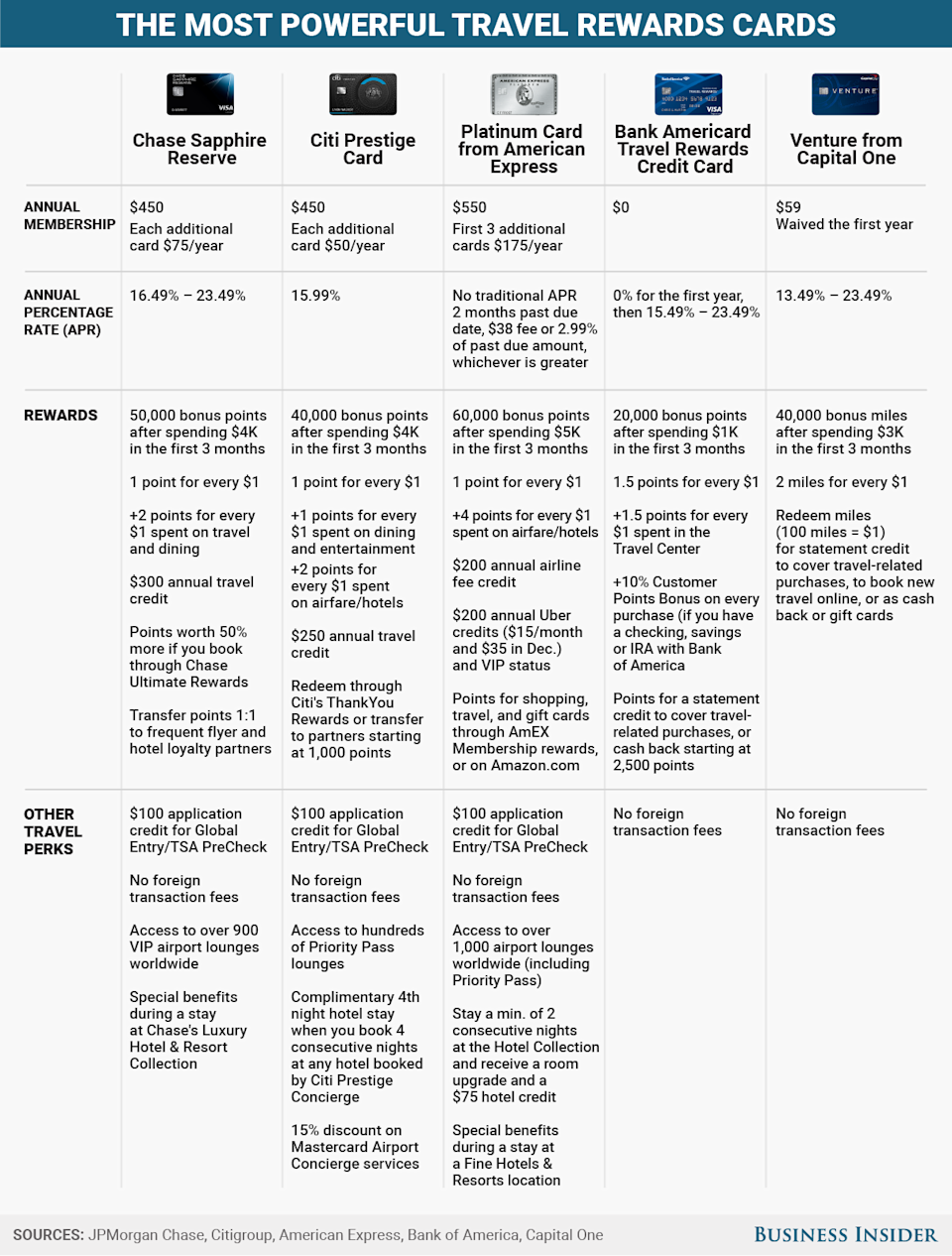

Travel Credit Cards: Designed for frequent travelers, these cards offer points or miles for every purchase, along with travel-related benefits such as airport lounge access, free checked bags, and travel insurance.

-

Balance Transfer Cards: Ideal for those with existing debt, these cards allow you to transfer balances from other credit cards at a lower or 0% APR for a promotional period.

-

Secured Credit Cards: These cards require a security deposit, which typically becomes your credit limit. They are ideal for individuals with poor or no credit history.

-

Student Credit Cards: Tailored for college students, these cards help build credit while offering benefits like cash back and rewards.

Top Credit Cards in the UK

Let’s take a closer look at some of the best credit cards currently available in the UK:

- American Express Gold Card Travel

- Key Features: 4X points on restaurants worldwide (up to $50,000 per year), 3X points on flights booked directly with airlines or via Amex Travel, and various monthly Uber Cash credits.

- Annual Fee: £325

-

Best For: Frequent diners and travelers.

-

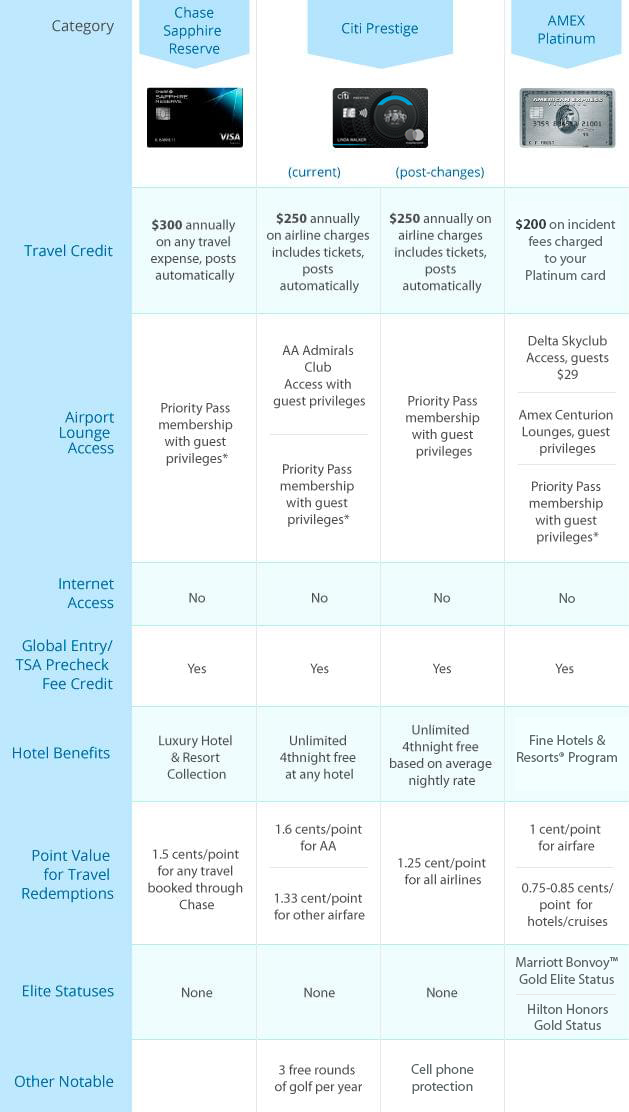

Chase Sapphire Reserve®

- Key Features: 8X points on Chase Travel℠ bookings, 4X points on flights and hotel stays, and $1,700 in recurring travel and dining perks.

- Annual Fee: £795

-

Best For: High spenders who travel frequently.

-

Chase Sapphire Preferred®

- Key Features: 3X points on online grocery purchases, 5X points on Chase Travel℠ and Lyft Rides, and a $50 annual hotel stay credit.

- Annual Fee: £95

-

Best For: Everyday shoppers and travelers.

-

Citi Double Cash®

- Key Features: 2% cash back on all purchases, 5% on hotels, car rentals, and attractions through the Citi Travel portal, and 0% intro APR on balance transfers.

- Annual Fee: £0

-

Best For: Those looking for straightforward cash back rewards.

-

Blue Cash Preferred® from American Express

- Key Features: 6% cash back at U.S. supermarkets, 3% at gas stations, and up to $120 annually in Disney streaming subscription credits.

- Annual Fee: £95

-

Best For: Regular grocery and gas shoppers.

-

Capital One Venture X Rewards

- Key Features: 10X miles on hotel and rental car bookings, 5X miles on flights, and a $300 Capital One Travel credit.

- Annual Fee: £395

-

Best For: Frequent travelers seeking extensive rewards.

-

The Platinum Card® from American Express

- Key Features: 5X points on flights and hotels, access to over 1,550 airport lounges, and numerous statement credits including Uber Cash and hotel discounts.

- Annual Fee: £895

- Best For: Luxury travelers and high spenders.

Choosing the Right Card for Your Needs

Selecting the right credit card depends on your spending habits, financial goals, and lifestyle. For example, if you’re a frequent traveler, a travel rewards card might be the best choice. If you’re looking to build credit, a secured card could be more suitable. It’s also important to consider factors like annual fees, APR, and rewards programs when comparing cards.

Remember, the goal is to find a card that offers the most value for your specific needs. Always read the terms and conditions carefully to understand any fees, restrictions, or requirements associated with the card.

Conclusion

In conclusion, credit cards can be powerful tools for managing your finances, earning rewards, and building credit. Whether you’re a student, a frequent traveler, or someone looking to build credit, there’s a card out there that suits your needs. By understanding the different types of cards available and their unique features, you can make an informed decision that aligns with your financial goals.

Always remember to use your credit card responsibly. Pay your balance in full each month to avoid interest charges and maintain a healthy credit score. With the right card and responsible usage, you can enjoy the many benefits that credit cards have to offer in the UK.