Top Health Insurance Companies in the United Kingdom: A Comprehensive Guide

The United Kingdom’s healthcare system is a cornerstone of public welfare, offering a mix of state-funded services and private health insurance options. As the demand for personalized healthcare solutions grows, selecting the right health insurance provider has become increasingly complex. This article explores the landscape of top health insurance companies in the UK, highlighting their unique features, financial performance, and how they cater to diverse consumer needs.

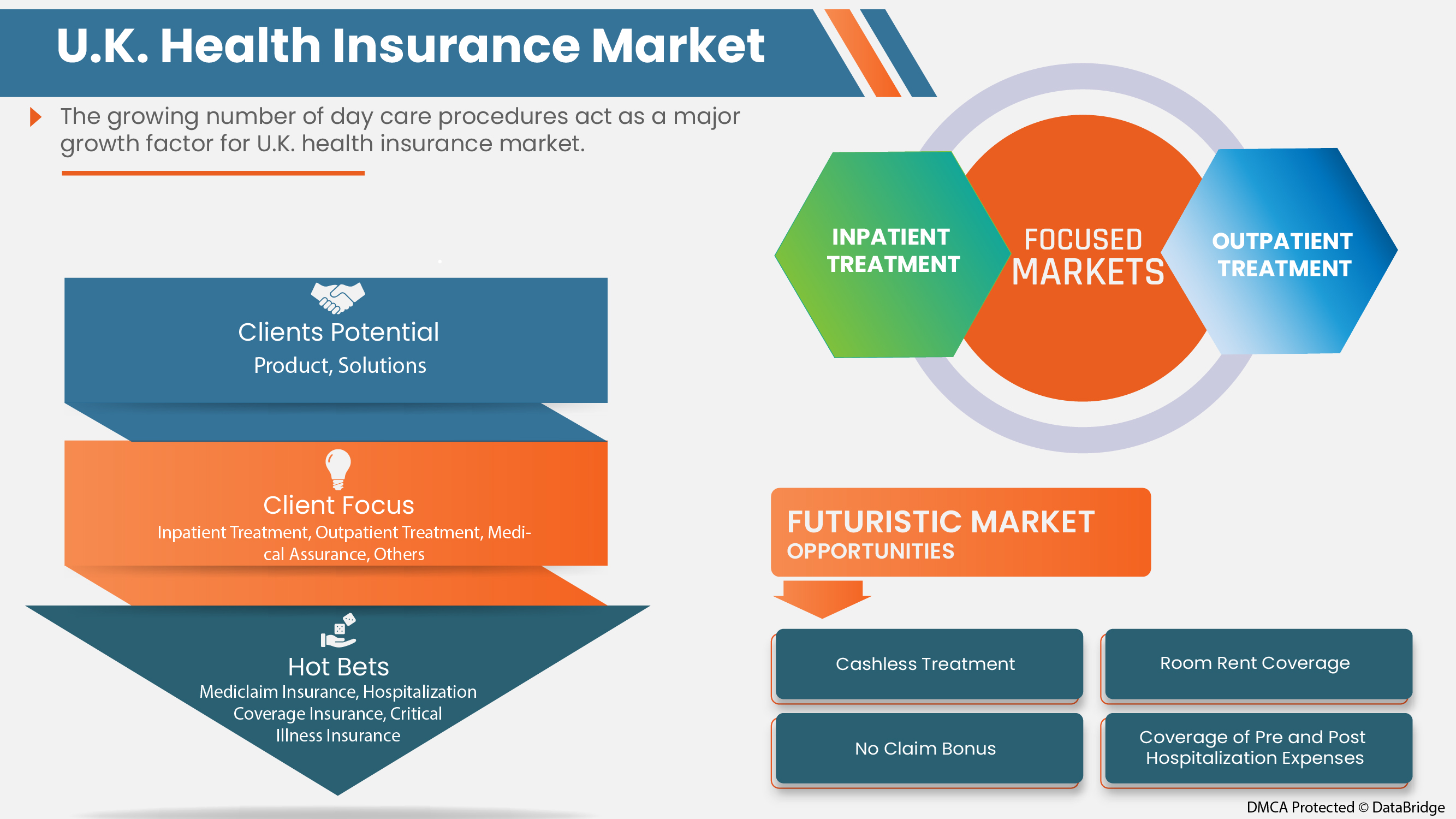

Understanding the UK Health Insurance Market

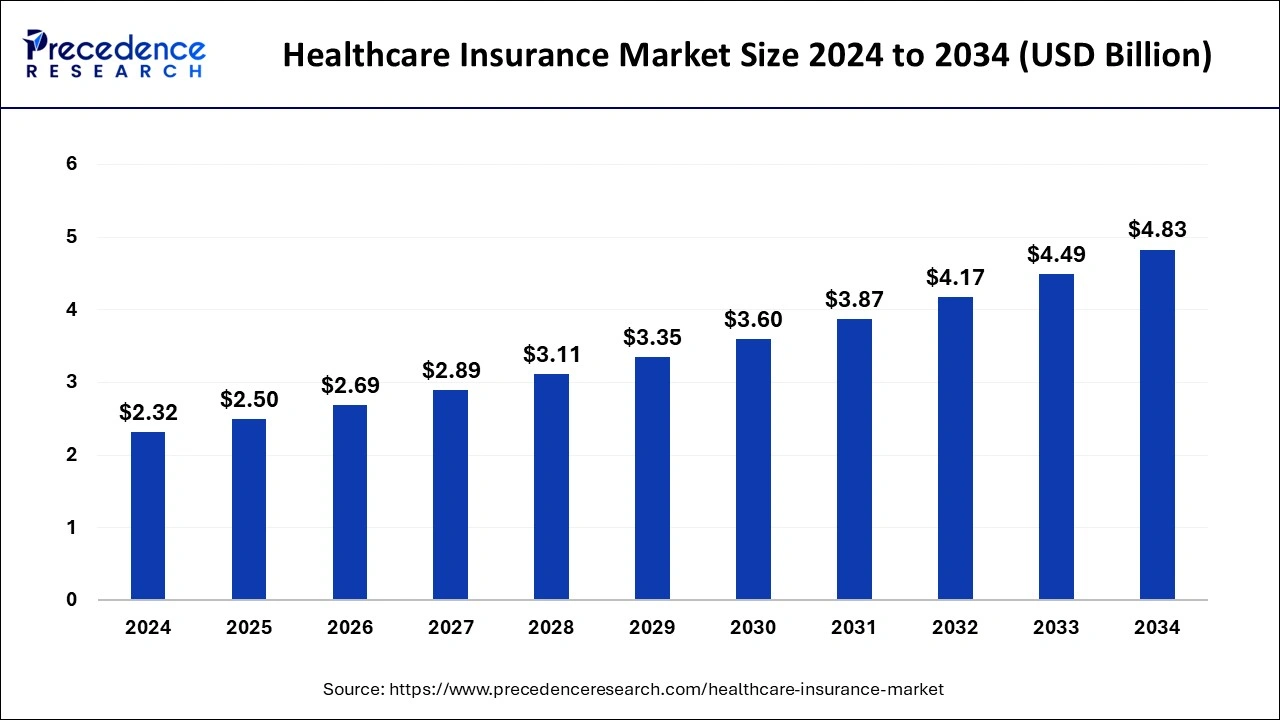

Health insurance in the UK serves as a crucial supplement to the National Health Service (NHS), providing faster access to treatments, specialist care, and additional services not always covered by the public system. The market includes both national and regional insurers, each with distinct strengths and specializations. According to recent data, the industry is projected to see significant growth, driven by rising healthcare costs, an aging population, and increased awareness of the benefits of private coverage.

Key Players in the UK Health Insurance Sector

Several leading health insurance providers dominate the UK market, offering a range of plans tailored to different demographics and lifestyles. These companies include:

- Bupa: Known for its comprehensive coverage and strong customer service.

- Aviva: Offers a variety of plans, including critical illness and life insurance.

- Prudential: Focuses on long-term health and savings products.

- Legal & General: Provides flexible plans with a focus on affordability.

- Axa: Emphasizes digital innovation and customer convenience.

Each of these companies has a unique approach to healthcare, with varying levels of network coverage, premium structures, and additional services such as dental and optical care.

Financial Performance and Market Position

The financial health of a health insurance company is a key indicator of its reliability and ability to meet policyholders’ needs. Leading UK insurers consistently report strong revenue figures, reflecting their market dominance and operational efficiency. For example, Bupa reported a revenue of £4.1 billion in 2023, while Aviva saw a slight increase in premiums due to rising healthcare costs.

These financial metrics are crucial for consumers, as they indicate the insurer’s capacity to manage claims and invest in quality healthcare services. Additionally, companies with high medical loss ratios (MLRs) demonstrate that a larger portion of premiums is directed toward actual healthcare expenses rather than administrative costs.

Types of Health Insurance Plans Available

Understanding the different types of health insurance plans is essential for making an informed decision. Common plan designs in the UK include:

- Private Health Insurance: Covers hospital treatment, specialist consultations, and elective procedures.

- Critical Illness Cover: Provides a lump sum payment upon diagnosis of specific conditions.

- Life Insurance: Offers financial support to beneficiaries in the event of the policyholder’s death.

- Dental and Optical Coverage: Additional services that enhance overall healthcare benefits.

Each plan type caters to different needs, and choosing the right one depends on individual health requirements, budget, and lifestyle.

Factors to Consider When Choosing a Provider

Selecting the best health insurance provider involves evaluating several factors, including:

- Coverage Needs: Assess your current health status, anticipated medical requirements, and any pre-existing conditions.

- Network Adequacy: Ensure that the insurer’s network includes preferred healthcare providers and facilities.

- Customer Service Quality: Look for companies with a reputation for excellent customer support and clear communication.

- Premium Affordability: Compare monthly premiums and consider any available discounts or cost-saving measures.

- Additional Services: Evaluate the availability of extra benefits such as wellness programs, telemedicine, and mental health support.

By considering these factors, consumers can identify an insurer that aligns with their specific needs and preferences.

Regional Market Leaders and Niche Providers

While national insurers like Bupa and Aviva have a broad reach, regional market leaders often provide specialized local coverage. These providers may offer more tailored services and better understanding of area-specific healthcare needs. Examples include:

- WPA Health: A well-known provider with a strong presence in the South East of England.

- One Medical: Focuses on primary care and digital health services.

- NHS Choices: While part of the public sector, it offers guidance on accessing private healthcare options.

Regional insurers can be particularly beneficial for those seeking localized care or facing challenges with broader national networks.

Conclusion

The UK health insurance market is dynamic and diverse, offering a range of options to suit different needs and budgets. From major national insurers to regional specialists, each provider brings unique advantages to the table. By carefully evaluating factors such as coverage, network adequacy, and financial stability, consumers can make informed decisions that best meet their healthcare requirements. As the industry continues to evolve, staying informed about the latest trends and offerings will remain essential for securing the right health insurance solution.