Understanding Blockchain Finance: The Future of Decentralized Financial Systems

Blockchain finance is revolutionizing the way we think about financial systems, offering a decentralized, transparent, and secure alternative to traditional banking. As the technology continues to evolve, it’s becoming increasingly clear that blockchain has the potential to reshape the financial landscape in profound ways. This article explores the core principles of blockchain finance, its applications, and the challenges it faces.

What Is Blockchain Finance?

At its core, blockchain is a distributed ledger technology that records transactions across a network of computers. This ensures that data is immutable, transparent, and resistant to tampering. In the context of finance, blockchain enables the creation of decentralized financial systems where transactions can be executed without the need for intermediaries.

Key Features of Blockchain Finance

- Decentralization: Unlike traditional banking systems, which rely on central authorities, blockchain allows for peer-to-peer transactions.

- Transparency: All transactions are recorded on a public ledger, making it easy to track and verify.

- Security: The use of cryptographic techniques makes blockchain highly secure against fraud and hacking.

- Immutability: Once a transaction is recorded, it cannot be altered, ensuring the integrity of financial records.

How Does Blockchain Finance Work?

Blockchain operates through a network of nodes that validate transactions using consensus algorithms. Each block in the chain contains a list of transactions, and once a block is added, it becomes part of the permanent record. This process ensures that all participants have access to the same information, promoting trust and transparency.

Smart Contracts

One of the most innovative aspects of blockchain is the use of smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. When certain conditions are met, the contract automatically executes the agreed-upon actions. This reduces the need for intermediaries and streamlines processes such as loan approvals and insurance claims.

Applications of Blockchain in Finance

Blockchain technology is being applied across various sectors of the financial industry, including:

1. Cross-Border Payments

Traditional cross-border payments are often slow and costly due to the involvement of multiple intermediaries. Blockchain offers a faster and more efficient alternative by enabling real-time transactions. For example, RippleNet allows banks to send and receive money across borders using cryptocurrency, reducing both time and fees.

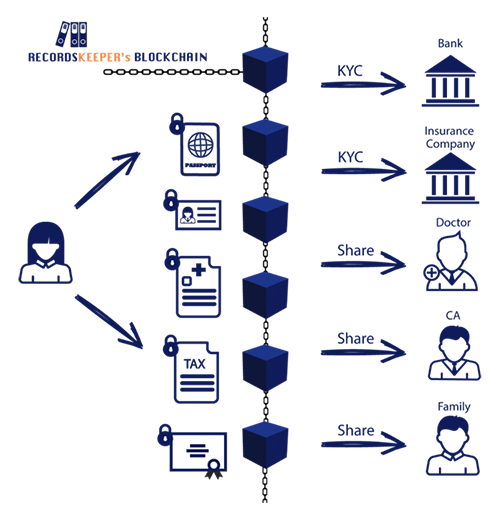

2. Know Your Customer (KYC) and Anti-Money Laundering (AML)

KYC and AML processes are critical for preventing fraud and ensuring compliance. Blockchain can streamline these processes by allowing customers to create a digital identity that can be verified across different institutions. This reduces the need for repeated verification and enhances security.

3. Risk Scoring and Credit Assessment

Financial institutions often struggle with limited data when assessing creditworthiness. Blockchain can provide access to a broader range of data, enabling more accurate risk scoring. By pooling data from multiple sources, banks can make better-informed decisions and reduce the risk of default.

Challenges and Considerations

Despite its potential, blockchain finance faces several challenges that must be addressed for widespread adoption:

1. Regulatory Uncertainty

Regulatory frameworks for blockchain are still evolving. Different countries have varying approaches to regulating cryptocurrencies and blockchain-based financial services. This lack of clarity can hinder innovation and investment.

2. Scalability Issues

While blockchain offers many benefits, it currently faces scalability limitations. The number of transactions that can be processed per second is lower compared to traditional payment systems. This can lead to congestion and higher transaction fees during peak times.

3. Security Concerns

Although blockchain is inherently secure, vulnerabilities can arise from poor implementation or human error. Smart contract bugs and wallet security are areas that require careful attention to prevent breaches.

The Future of Blockchain Finance

The future of blockchain finance looks promising, with ongoing developments aimed at addressing current limitations. As the technology matures, we can expect to see increased adoption across various financial services. Here are some key trends to watch:

1. Interoperability

Efforts are underway to improve interoperability between different blockchain networks. This will enable seamless transactions across platforms, enhancing user experience and expanding the ecosystem.

2. Central Bank Digital Currencies (CBDCs)

Central banks around the world are exploring the possibility of issuing their own digital currencies. CBDCs could provide a bridge between traditional finance and blockchain, offering the benefits of digital currency while maintaining regulatory control.

3. Enhanced User Experience

As blockchain technology becomes more user-friendly, we can expect to see a wider range of applications tailored to everyday users. From mobile banking to microloans, the possibilities are vast.

Conclusion

Blockchain finance represents a paradigm shift in the way we manage and interact with financial systems. Its potential to enhance transparency, security, and efficiency is undeniable. While challenges remain, the continued development and adoption of blockchain technology promise to transform the financial landscape in the years to come. As we move forward, it’s essential to foster collaboration between regulators, developers, and financial institutions to ensure a secure and inclusive future for blockchain finance.