Understanding Business Financing: A Comprehensive Guide for UK Entrepreneurs

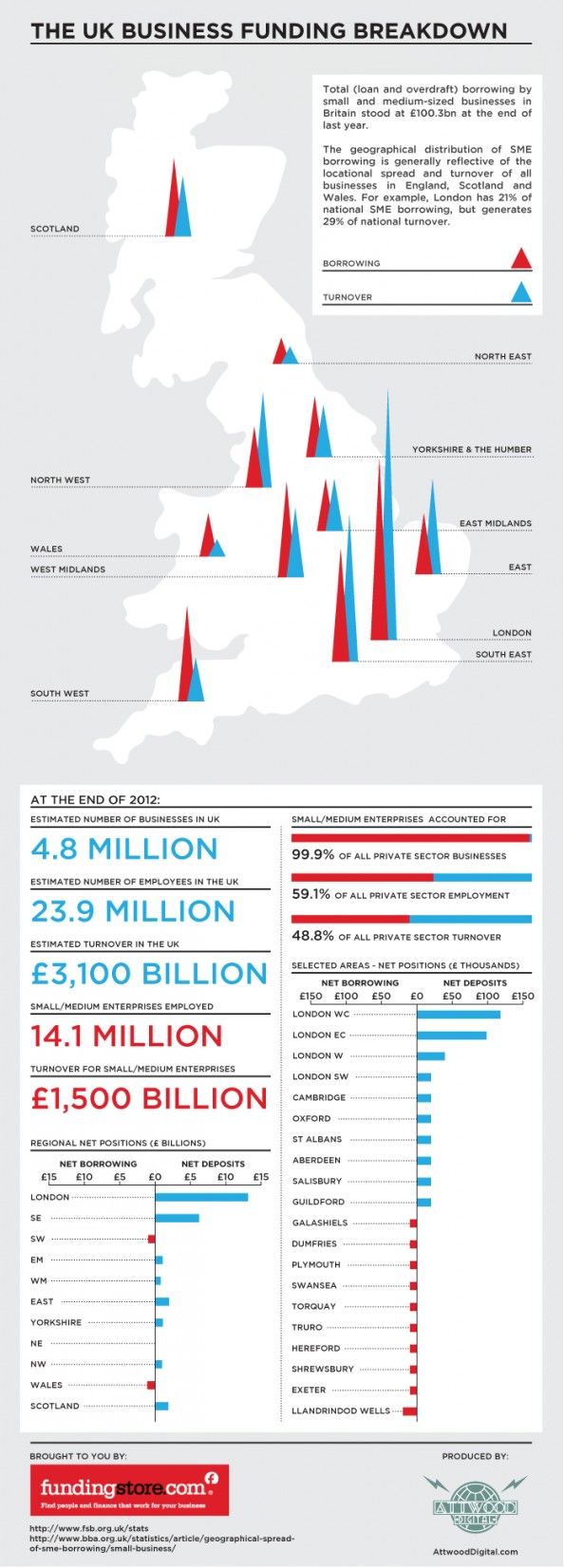

Business financing is a critical aspect of running any enterprise, whether it’s a small local shop or a multinational corporation. For many businesses, accessing capital is not just a necessity but a strategic move that can determine their long-term success. In the United Kingdom, where entrepreneurship thrives and innovation drives economic growth, understanding the various forms of business financing is essential for both new and established businesses.

What Is Business Financing?

Business financing refers to the process of obtaining funds to support a company’s operations, expansion, or development. It encompasses a range of strategies, from traditional loans to more complex investment models. The right choice of financing can significantly impact a business’s ability to grow, manage risks, and achieve its financial goals.

Key Types of Business Financing

There are several key types of business financing, each with its own advantages and disadvantages. These include:

- Debt Financing: This involves borrowing money from lenders such as banks or private investors, which must be repaid with interest.

- Equity Financing: In this model, investors provide capital in exchange for ownership stakes in the business.

- Mezzanine Financing: A hybrid form of financing that combines elements of debt and equity.

- Off-Balance Sheet Financing: A strategy used to keep large expenses off a company’s balance sheet, often through special purpose vehicles (SPVs).

Each of these options has unique implications for a business’s financial structure and decision-making processes.

Debt Financing: Pros and Cons

Debt financing is one of the most common methods of raising capital. It typically involves taking out a loan from a bank or other lending institution. The borrower is required to repay the principal amount along with interest over a set period.

Advantages of Debt Financing

- No Loss of Ownership: Unlike equity financing, debt financing does not require giving up ownership of the business.

- Tax Deductions: The interest paid on debt is often tax-deductible, providing a financial benefit to the business.

- Predictable Payments: Monthly payments are usually structured, making it easier to budget and forecast.

Disadvantages of Debt Financing

- Repayment Obligations: The business must ensure it has sufficient cash flow to meet monthly payments, which can be challenging during economic downturns.

- Credit Requirements: Lenders often scrutinize a business’s credit history and financial stability before approving a loan.

- Risk of Default: Failure to repay the loan can lead to severe consequences, including bankruptcy.

Equity Financing: A Share in the Success

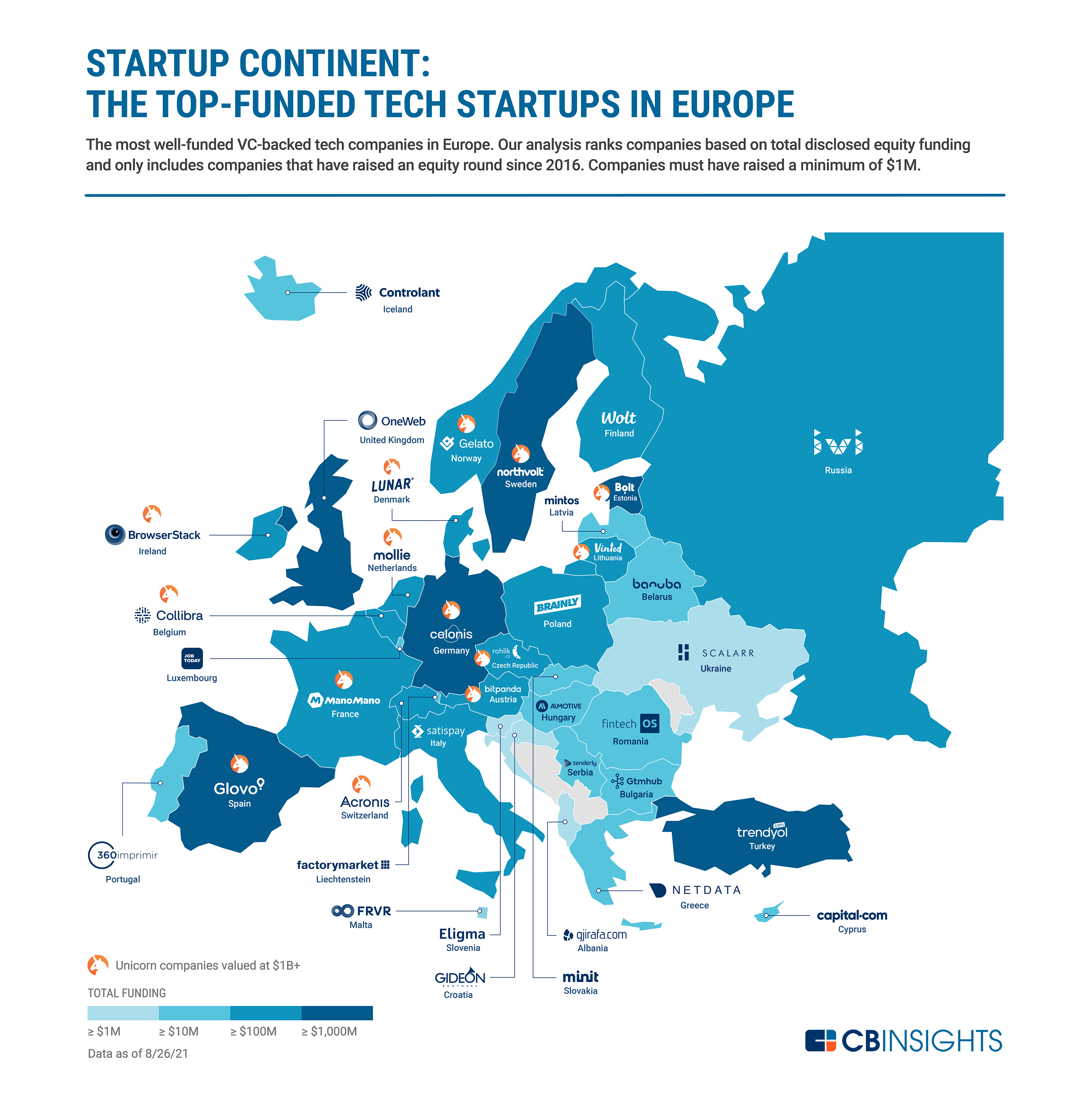

Equity financing involves selling shares of the business to investors in exchange for capital. This method is particularly popular among startups and growing companies that need significant funding without the burden of debt.

Advantages of Equity Financing

- No Repayment Required: Investors do not expect repayment; instead, they seek returns through profits or the sale of the business.

- Access to Expertise: Investors often bring valuable experience and networks that can help the business grow.

- Flexibility: There is no obligation to make regular payments, allowing more cash flow for operational needs.

Disadvantages of Equity Financing

- Loss of Control: Giving up ownership means sharing decision-making power with investors, which can be a challenge for entrepreneurs.

- Profit Sharing: Investors may take a significant share of profits, reducing the business owner’s earnings.

- Dilution of Ownership: As more shares are issued, the original owner’s stake in the business diminishes.

Mezzanine Financing: Bridging the Gap

Mezzanine financing is a less common but effective option that blends aspects of debt and equity financing. It typically involves a loan that can be converted into equity if the business fails to meet repayment terms.

Advantages of Mezzanine Financing

- Flexibility: Offers a middle ground between debt and equity, providing businesses with more options.

- Speed: Often quicker to secure compared to traditional loans.

- Improved Balance Sheet: Treated as equity on the balance sheet, making the business appear more financially stable.

Disadvantages of Mezzanine Financing

- Higher Interest Rates: Due to the increased risk, lenders often charge higher interest rates.

- Potential Loss of Control: If the loan is converted to equity, the lender may gain significant influence over business decisions.

- Complexity: The terms and conditions can be intricate, requiring careful negotiation.

Off-Balance Sheet Financing: Strategic Financial Planning

Off-balance sheet financing (OBSF) is a technique used by businesses to keep certain liabilities off their balance sheets. This can make the company appear more financially stable to investors and creditors.

How It Works

- Special Purpose Vehicles (SPVs): Companies create SPVs to hold assets or debts, keeping them separate from the main business.

- Leasing vs. Buying: Instead of purchasing expensive equipment, businesses may lease it, reducing the immediate financial burden.

Considerations

While OBSF can offer benefits, it is strictly regulated under Generally Accepted Accounting Principles (GAAP). Businesses must ensure transparency and compliance to avoid legal issues.

Other Funding Options

In addition to the primary forms of financing, there are other options that entrepreneurs can explore:

- Family and Friends: Borrowing from personal connections can provide flexible terms and support.

- Retirement Accounts: Using funds from retirement plans, such as a 401(k), can be an option for those starting a business.

- Asset Financing: Using existing assets as collateral to secure loans.

Each of these options comes with its own set of risks and benefits, and businesses should carefully evaluate their suitability based on their specific needs and circumstances.

Conclusion

Understanding the various forms of business financing is crucial for any entrepreneur in the UK. Whether it’s through debt, equity, mezzanine, or off-balance sheet financing, the right choice can significantly impact a business’s growth and sustainability. By carefully considering the pros and cons of each option, businesses can make informed decisions that align with their long-term goals and financial health.