Understanding Financial Accounting: A Comprehensive Guide for Beginners

Financial accounting is a critical component of the business world, serving as the backbone for transparency, accountability, and informed decision-making. It involves the systematic recording, summarizing, and reporting of financial transactions to provide an accurate picture of a company’s financial health. This guide aims to break down the fundamentals of financial accounting, its key components, and its importance in the broader economic landscape.

What is Financial Accounting?

Financial accounting is the process of recording and aggregating financial transactions into financial statements that are used by external stakeholders such as investors, creditors, and regulators. Unlike managerial accounting, which focuses on internal decision-making, financial accounting provides a historical perspective on a company’s financial activities. The primary goal is to ensure that financial reports are reliable, consistent, and comparable across different entities.

Key Aspects of Financial Accounting

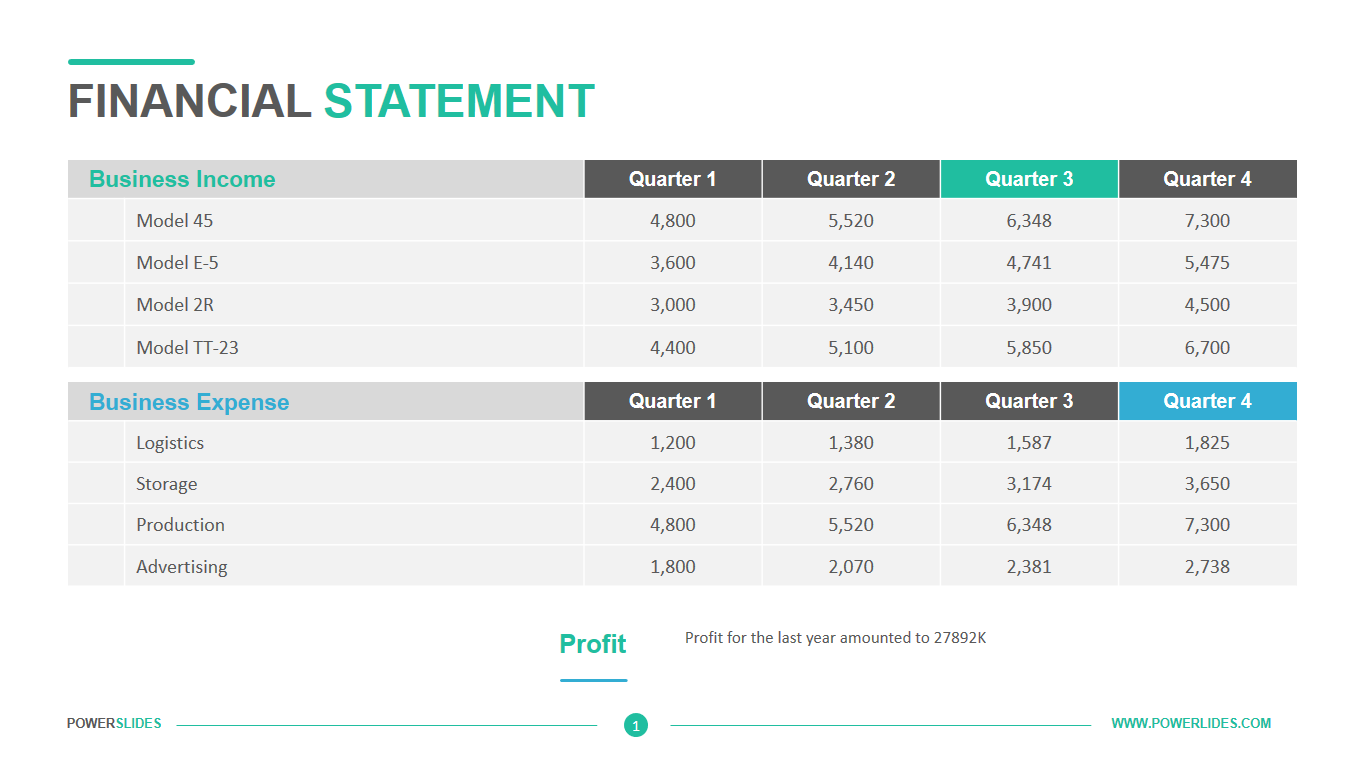

- Financial Statement Preparation

Financial accounting involves creating essential financial statements, including: - Balance Sheet: Shows a company’s assets, liabilities, and equity at a specific point in time.

- Income Statement: Details revenues, expenses, and net income over a period.

- Cash Flow Statement: Tracks cash inflows and outflows from operating, investing, and financing activities.

-

Statement of Shareholders’ Equity: Illustrates changes in equity over a reporting period.

-

Adherence to Standards

Financial accounting follows strict guidelines such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These standards ensure consistency and reliability in financial reporting. -

Historical Focus

Financial accounting primarily records past transactions, providing a historical view of a company’s financial performance. This focus helps stakeholders understand the company’s financial trajectory. -

Objectivity and Accuracy

The emphasis is on objective, verifiable data to ensure accuracy and reduce subjectivity. This is crucial for building trust among external users. -

Legal and Regulatory Compliance

Accurate financial reporting is often legally mandated, especially for publicly traded companies. Compliance with regulations ensures transparency and accountability.

The Application of Accounting Frameworks

Several accounting frameworks provide the rules for constructing financial statements, ensuring comparability across industries. In the United States, these frameworks include:

- Generally Accepted Accounting Principles (GAAP): A set of rules and standards for financial accounting in the U.S.

- International Financial Reporting Standards (IFRS): Widely used globally, IFRS promotes consistency in financial reporting across jurisdictions.

Publicly held companies must also comply with additional rules set by the Securities and Exchange Commission (SEC).

The Structure of Financial Accounting

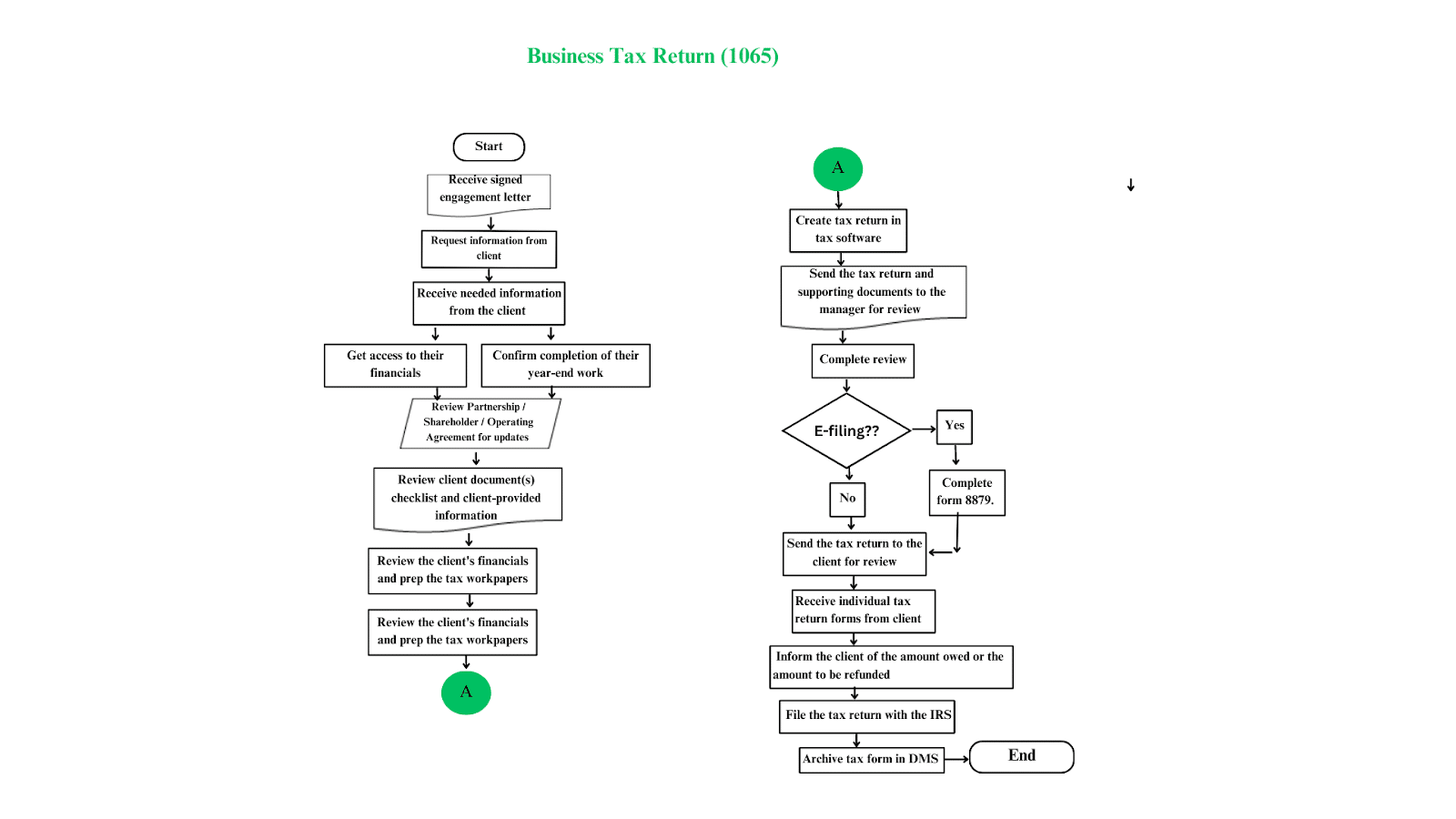

Financial accounting involves several steps to ensure accurate and organized financial reporting:

-

Chart of Accounts

A chart of accounts is created to categorize financial transactions consistently. This system allows for easy tracking and reporting. -

Policies and Procedures

Clear policies and procedures are established to guide how transactions are recorded and reported. These ensure uniformity and compliance. -

Accounting Software

Modern accounting software is used to store and organize financial data efficiently. This technology streamlines the recording and reporting processes. -

Compilation of Financial Statements

Once transactions are recorded, financial statements are compiled and released to stakeholders. These statements provide a comprehensive overview of the company’s financial position.

The Focus of Financial Accounting

The primary focus of financial accounting is on external users. These include:

- Investors: Who rely on financial statements to assess a company’s profitability and growth potential.

- Creditors and Lenders: Who evaluate a company’s ability to repay debts.

- Regulators: Who ensure compliance with financial reporting standards.

Financial accounting is designed to provide a fair and accurate representation of a company’s financial status, reducing the risk of misinformation and legal issues.

How Financial Accounting Works

Financial accounting operates through a structured process that includes:

-

Recording Transactions

Every financial activity, such as sales, purchases, and expenses, is recorded using double-entry accounting. This ensures data consistency and accuracy. -

Classifying and Categorizing

Transactions are organized into categories like revenue, expenses, assets, liabilities, and equity. This classification helps in understanding the financial structure of the business. -

Summarizing

At the end of a financial period, transactions are summarized into quarterly or annual financial statements. These statements provide a snapshot of the company’s financial performance. -

Communicating, Analyzing, and Interpreting

Financial statements are analyzed to make informed decisions. Stakeholders use financial ratios and trends to evaluate a company’s health and potential.

The Power of Financial Statements

Financial statements serve as key tools for assessing a company’s financial health. They include:

-

Balance Sheet

Provides a snapshot of a company’s assets, liabilities, and equity. It reflects the company’s financial stability and capital structure. -

Income Statement

Shows revenues, expenses, and net income over a period. It helps evaluate a company’s profitability. -

Cash Flow Statement

Tracks cash flows from operations, investing, and financing activities. It highlights a company’s ability to generate and manage cash.

Accounting Methods

Two primary accounting methods are used in financial accounting:

-

Accrual Accounting

Recognizes revenue and expenses when they are incurred, not when cash is exchanged. This method provides a more accurate picture of a company’s financial performance. -

Cash Accounting

Records transactions when cash is received or paid. While simpler, it may not reflect the true financial position of a company.

Accounting Principles and Qualities

Financial accounting is guided by principles that ensure relevance and faithful representation:

- Relevance: Information should be useful for decision-making.

- Faithful Representation: Data should accurately reflect the underlying economic events.

- Measurement Basis: Financial statements can use historical cost or current value, depending on the context.

Standard Bodies: The Guardians of Consistency

Standard-setting bodies like the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) play a crucial role in maintaining consistency in financial reporting. These bodies establish guidelines that ensure financial statements are reliable and comparable across different regions and industries.

Unlocking the Power of Financial Accounting

Financial accounting benefits various stakeholders, including:

- Investors: Assess a company’s growth potential and profitability.

- Creditors: Evaluate a company’s creditworthiness and repayment capacity.

- Employees: Ensure job security and opportunities for advancement.

- Regulators: Enforce compliance and transparency.

- Management: Make informed decisions based on financial data.

- Customers: Build trust in a company’s stability and reliability.

Conclusion

Financial accounting is a vital tool for businesses and stakeholders alike. It provides a transparent view of a company’s financial health, enabling informed decision-making and fostering trust. By adhering to established standards and principles, financial accounting ensures consistency, reliability, and comparability in financial reporting. Whether you’re an investor, creditor, or business owner, understanding financial accounting is essential for navigating the complex world of finance.