Understanding Financial Services: Types, Benefits, and How They Work

Financial services are the backbone of the global economy, influencing everything from personal savings to national policy. Whether it’s securing a mortgage, expanding a small business, or saving for retirement, these services shape our everyday decisions. In the United States, the financial services sector is vast and ever-evolving, encompassing a wide range of institutions and technologies that facilitate economic activity. This article explores the types of financial services, their benefits, and how they function in today’s digital age.

What Are Financial Services?

Financial services refer to the range of services provided by banks, insurance companies, investment firms, and other financial institutions. These services include:

- Banking: Providing checking and savings accounts, loans, and credit.

- Insurance: Offering protection against financial loss through policies like health, life, and property insurance.

- Investment Management: Helping individuals and businesses grow wealth through stocks, bonds, and other investment vehicles.

- Payment Processing: Facilitating transactions through credit cards, mobile payments, and digital wallets.

- Risk Management: Assessing and mitigating financial risks for individuals and organizations.

These services are essential for maintaining economic stability and enabling individuals and businesses to make informed financial decisions.

The Evolution of Financial Services

The financial services industry has undergone significant transformation over the years, driven by technological advancements and changing consumer expectations. Here are some key developments:

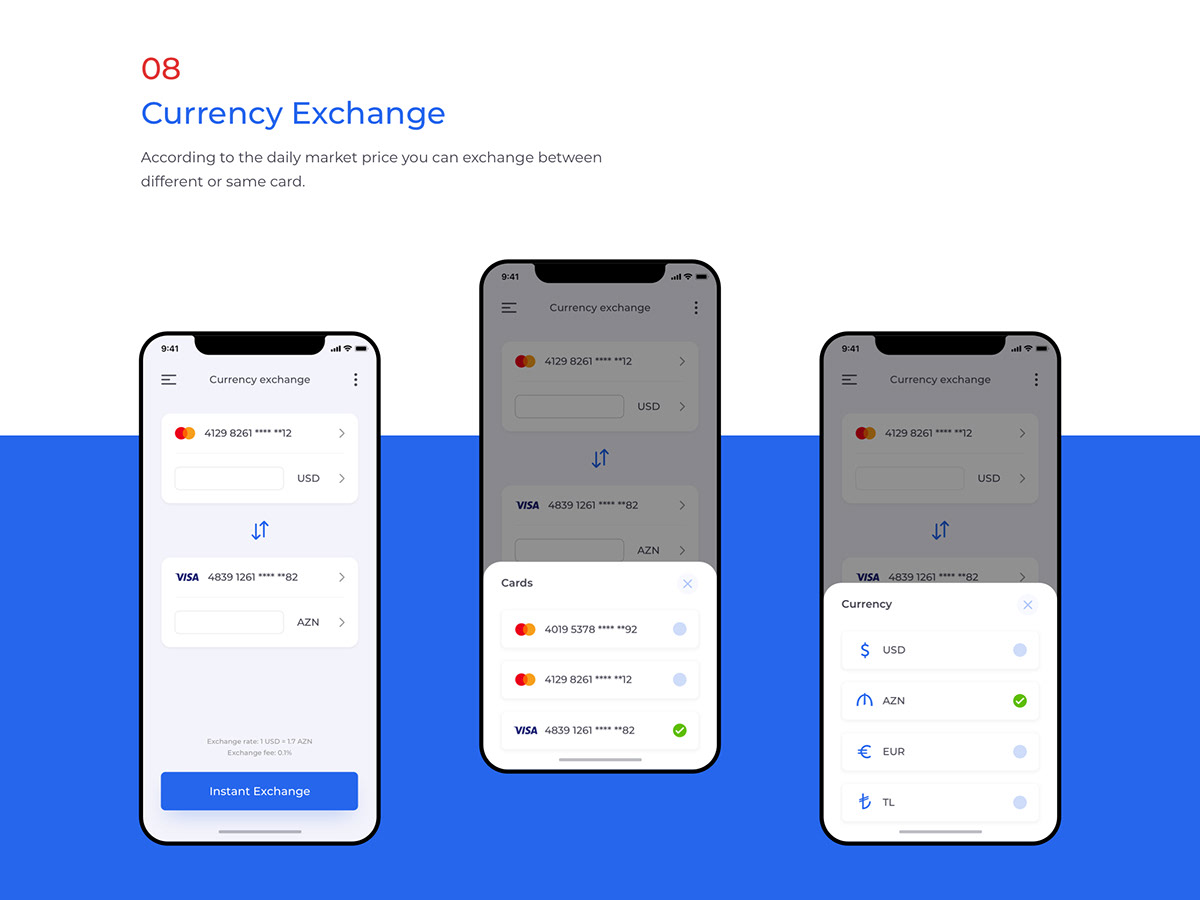

1. Digital Banking

Digital banking has revolutionized the way people interact with financial institutions. Online and mobile banking platforms allow users to manage their accounts, transfer funds, and apply for loans without visiting a physical branch. Neobanks, such as Chime and Revolut, have emerged as fully digital alternatives to traditional banks, offering lower fees and innovative features.

2. Fintech Innovations

Fintech companies are reshaping the financial landscape by introducing new technologies and services. From payment processing to investment platforms, fintech solutions are making financial services more accessible, efficient, and user-friendly. Examples include PayPal, Robinhood, and Coinbase, which offer secure and convenient ways to send money, invest, and trade cryptocurrencies.

3. Cloud Computing

Cloud computing has enabled financial institutions to streamline operations, reduce costs, and improve security. By moving data and applications to the cloud, banks can access real-time information, automate processes, and enhance customer experiences. Cloud-based solutions also provide greater flexibility and scalability, allowing institutions to adapt to changing market conditions.

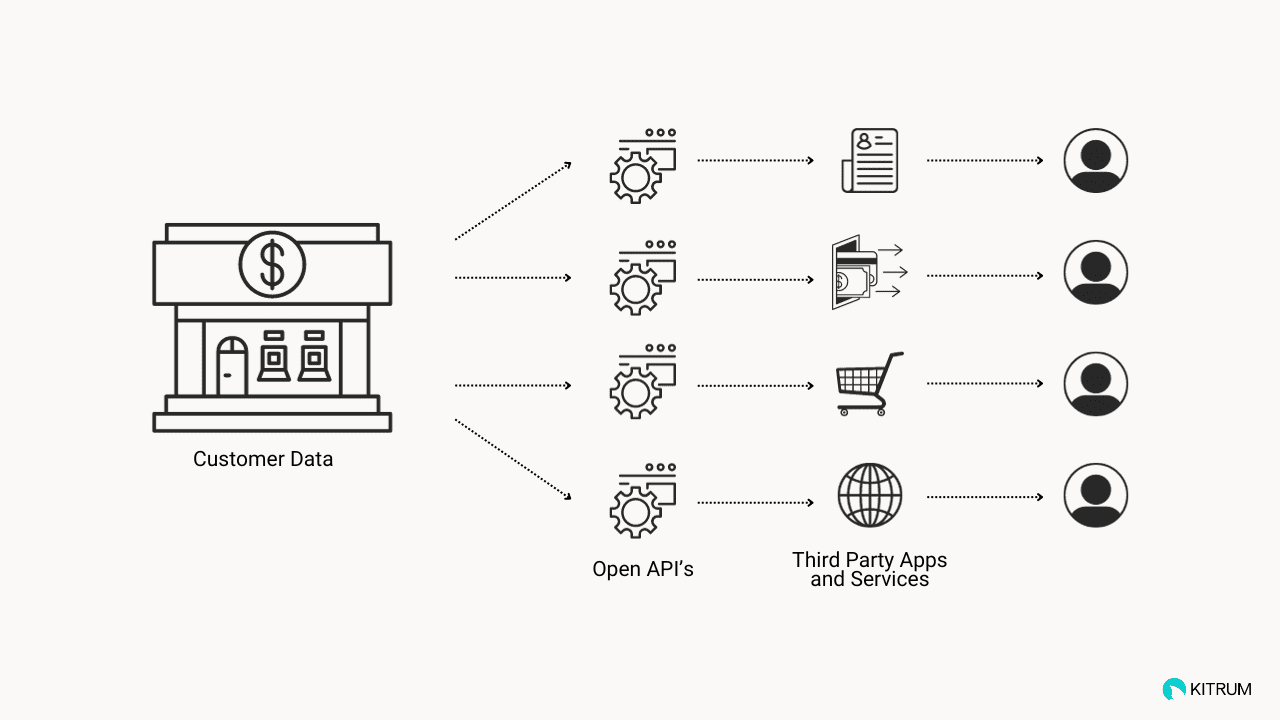

4. Open Banking

Open banking allows third-party providers to access financial data through APIs, enabling the creation of personalized financial products and services. This trend promotes competition and innovation, giving consumers more choices and better control over their financial lives. For example, open banking has led to the development of budgeting apps and financial management tools that integrate with bank accounts.

Key Benefits of Financial Services

Financial services offer numerous advantages that contribute to economic growth and individual well-being. Some of the key benefits include:

1. Access to Credit

Financial services provide individuals and businesses with access to credit, enabling them to invest in education, start a business, or purchase a home. Loans and credit facilities help bridge the gap between immediate needs and long-term goals.

2. Risk Mitigation

Insurance and risk management services protect individuals and organizations from financial losses due to unexpected events. By transferring risk to insurers, individuals can safeguard their assets and ensure financial stability.

3. Wealth Growth

Investment services allow individuals to grow their wealth over time. Through diversified portfolios and professional management, investors can achieve long-term financial goals while managing risk effectively.

4. Convenience and Efficiency

Digital financial services offer convenience and efficiency, enabling users to manage their finances from anywhere at any time. Mobile banking, online payments, and automated investment platforms save time and reduce administrative burdens.

5. Economic Stability

Financial services play a crucial role in maintaining economic stability by facilitating trade, investment, and capital flows. Central banks, such as the Federal Reserve, regulate monetary policy to control inflation, manage interest rates, and support economic growth.

How Financial Services Work

Financial services operate through a complex network of institutions, technologies, and regulations. Here’s a brief overview of how different financial services function:

1. Banking Institutions

Banks act as intermediaries between savers and borrowers. They collect deposits from customers and lend money to individuals and businesses. Banks also offer various financial products, such as credit cards, mortgages, and investment accounts.

2. Insurance Companies

Insurance companies assess risks and provide coverage against potential losses. Policyholders pay premiums in exchange for financial protection, which can include health, life, auto, and property insurance.

3. Investment Firms

Investment firms help clients grow their wealth by managing portfolios and offering advisory services. They may specialize in stock trading, mutual funds, or alternative investments, depending on client preferences and risk tolerance.

4. Payment Processors

Payment processors facilitate transactions between buyers and sellers. They handle credit card payments, digital wallet transactions, and cross-border transfers, ensuring secure and efficient fund movement.

5. Regulatory Bodies

Regulatory bodies, such as the Securities and Exchange Commission (SEC) and the Consumer Financial Protection Bureau (CFPB), oversee financial institutions to ensure compliance with laws and protect consumers from fraud and unfair practices.

Conclusion

Financial services are integral to the functioning of the modern economy, providing essential tools and resources for individuals and businesses. As technology continues to evolve, the financial services sector will remain dynamic, offering innovative solutions that enhance accessibility, efficiency, and security. Whether through digital banking, fintech innovations, or regulatory oversight, financial services play a vital role in shaping the future of finance in the United States and beyond.