Understanding Financial Statements: A Complete Guide for Beginners

Financial statements are essential tools that provide a comprehensive overview of a company’s financial health. Whether you’re an investor, a business owner, or simply curious about how companies operate, understanding financial statements can help you make informed decisions. In this guide, we will explore the key components of financial statements, their importance, and how to interpret them effectively.

What Are Financial Statements?

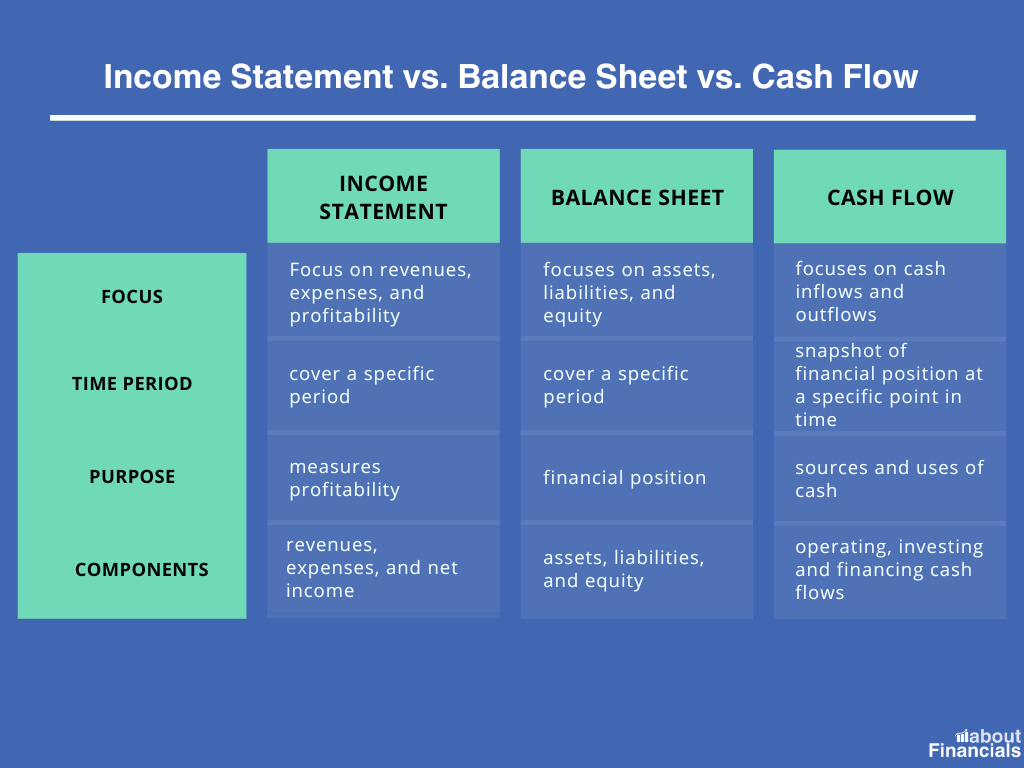

Financial statements are formal records that outline a company’s financial activities and performance. They are used by various stakeholders, including investors, creditors, and management, to assess the financial position of a company. The three primary financial statements are:

1. Balance Sheet

The balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It follows the fundamental accounting equation:

Assets = Liabilities + Shareholders’ Equity

This equation ensures that the balance sheet remains balanced, reflecting the company’s financial position accurately. Assets represent what the company owns, while liabilities show what it owes. Shareholders’ equity is the residual interest in the company after deducting liabilities from assets.

2. Income Statement

The income statement, also known as the profit and loss statement, shows a company’s revenues, expenses, and profits over a specific period. It helps determine the company’s ability to generate profit by analyzing its revenue and costs. Investors use the income statement to assess a company’s profitability and overall financial performance.

3. Cash Flow Statement

The cash flow statement tracks the inflows and outflows of cash within a company. It is divided into three sections:

- Cash Flow from Operating Activities: This section shows the cash generated from the company’s core business operations.

- Cash Flow from Investing Activities: This section includes cash flows related to the purchase or sale of long-term assets.

- Cash Flow from Financing Activities: This section reflects cash flows from financing activities such as issuing shares or repaying loans.

Other Important Financial Statements

In addition to the three main financial statements, there are other documents that provide valuable insights:

4. Statement of Changes in Shareholders’ Equity

This statement outlines the changes in a company’s shareholders’ equity over a specific period. It includes details on share issuances, dividends, and retained earnings. This statement is particularly useful for understanding how a company’s equity has evolved and how it is being managed.

How to Interpret Financial Statements

Understanding financial statements requires a basic knowledge of accounting principles and financial ratios. Here are some key steps to help you interpret these documents effectively:

1. Analyze the Balance Sheet

Start by reviewing the balance sheet to understand the company’s financial position. Look at the current and non-current assets and liabilities to assess liquidity and solvency. Key ratios to consider include the current ratio and quick ratio, which measure a company’s ability to meet short-term obligations.

2. Review the Income Statement

Next, examine the income statement to evaluate the company’s profitability. Focus on revenue, cost of goods sold, operating expenses, and net income. Compare these figures across different periods to identify trends and potential issues.

3. Examine the Cash Flow Statement

The cash flow statement provides insight into a company’s cash generation and usage. Pay attention to operating cash flow, which indicates whether the company is generating enough cash from its operations. Negative cash flow from investing or financing activities may signal significant investments or debt repayments.

4. Use Financial Ratios

Financial ratios are powerful tools that help analyze a company’s performance. Common ratios include:

- Liquidity Ratios: Such as the current ratio and quick ratio.

- Leverage Ratios: Such as debt-to-equity and debt-to-total capital.

- Efficiency Ratios: Such as asset turnover and inventory turnover.

- Profitability Ratios: Such as return on equity (ROE) and return on assets (ROA).

Importance of Financial Statements

Financial statements play a crucial role in decision-making for various stakeholders. For investors, they provide a clear picture of a company’s financial health and potential for growth. For creditors, they help assess a company’s ability to repay loans. For management, they offer insights into operational efficiency and areas for improvement.

Additionally, financial statements are required by regulatory bodies such as the Securities and Exchange Commission (SEC) for public companies. These statements ensure transparency and accountability, allowing investors to make informed decisions.

Conclusion

Understanding financial statements is essential for anyone involved in business or investment. By familiarizing yourself with the balance sheet, income statement, cash flow statement, and other financial documents, you can gain valuable insights into a company’s financial health. Whether you’re an investor, a business owner, or a student, mastering financial statements will empower you to make informed decisions and navigate the world of finance with confidence.