Understanding International Finance: Key Concepts and Global Impacts

International finance is a complex and dynamic field that plays a critical role in shaping the global economy. It encompasses the flow of money across borders, the management of financial systems, and the mechanisms through which countries interact economically. From the role of international institutions like the International Monetary Fund (IMF) to the impact of currency exchange rates and trade policies, understanding international finance is essential for anyone interested in global economic stability and growth.

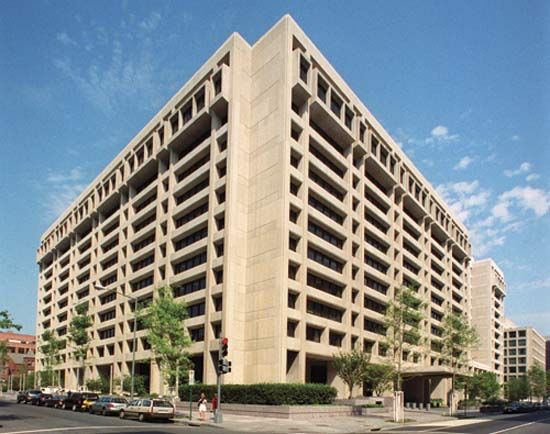

The Role of the International Monetary Fund (IMF)

The IMF is one of the most influential organizations in the realm of international finance. Established in 1944 during the Bretton Woods Conference, the IMF was created to promote global economic growth, high employment, and international monetary cooperation. It serves as a lender of last resort to member countries experiencing balance-of-payments crises and provides policy advice to help nations stabilize their economies.

Key Functions of the IMF

- Surveillance: The IMF monitors the global economy and provides regular assessments of economic conditions through reports such as the World Economic Outlook and the Global Financial Stability Report.

- Capacity Building: The IMF offers technical assistance and training to member countries to improve their economic management and data collection capabilities.

- Lending: The IMF provides loans to countries facing financial distress, often with conditions aimed at promoting fiscal discipline and structural reforms.

How the IMF Operates

Each member country contributes funds to the IMF based on its economic size, with larger economies contributing more. This contribution determines a country’s voting power within the organization. Loans from the IMF are typically conditional, requiring recipient countries to implement specific policy reforms to ensure long-term economic stability.

The Importance of Global Financial Stability

Financial stability is a cornerstone of international finance. When economies are stable, trade flows smoothly, and investment thrives. Conversely, financial instability can lead to crises that ripple across borders, affecting even the most robust economies.

Factors Affecting Financial Stability

- Exchange Rates: Fluctuations in currency values can impact trade balances and investment flows. The IMF has historically played a role in managing exchange rate regimes, transitioning from fixed to floating systems after the collapse of the Bretton Woods system in the 1970s.

- Capital Flows: The movement of capital between countries can be both a boon and a risk. While foreign investment can stimulate growth, sudden capital outflows can destabilize economies, especially in developing nations.

- Debt Management: Countries must manage their debt levels carefully to avoid default and maintain investor confidence. The IMF often intervenes in cases of debt distress, offering support in exchange for policy reforms.

The Impact of International Finance on Developing Economies

International finance has a profound impact on developing economies, influencing everything from access to credit to the ability to attract foreign investment. While international financial institutions like the IMF and the World Bank provide vital support, they also face criticism for the conditions attached to their loans.

Structural Adjustment Programs

Structural adjustment programs (SAPs) are a common conditionality imposed by the IMF. These programs often require countries to implement austerity measures, privatize state-owned enterprises, and reduce trade barriers. While these policies are intended to promote long-term economic growth, critics argue that they can exacerbate poverty and inequality.

Challenges for Developing Nations

- Dependency on External Aid: Many developing countries rely heavily on external financing, making them vulnerable to changes in global economic conditions.

- Policy Constraints: IMF loans often come with strict conditions that limit a country’s ability to pursue independent economic policies.

- Social Impact: Austerity measures can lead to cuts in public services, affecting healthcare, education, and social safety nets.

The Role of Currency Exchange and Trade Policies

Currency exchange rates and trade policies are central to international finance. They determine the cost of imports and exports, influence investment decisions, and affect the overall health of an economy.

Exchange Rate Regimes

- Fixed Exchange Rates: Countries peg their currency to another major currency or a basket of currencies. This provides stability but limits flexibility in responding to economic shocks.

- Floating Exchange Rates: Currencies are determined by market forces. This allows for greater flexibility but can lead to volatility.

Trade Policies

Trade policies, including tariffs, quotas, and trade agreements, shape the global economy. Free trade agreements can boost economic growth, while protectionist policies can hinder it. The IMF and the World Trade Organization (WTO) play key roles in promoting fair and open trade.

The Future of International Finance

As the global economy continues to evolve, so too does the landscape of international finance. Emerging technologies, shifting geopolitical dynamics, and the increasing importance of sustainability are reshaping how countries engage with the global financial system.

Technological Innovations

- Digital Currencies: Central bank digital currencies (CBDCs) and cryptocurrencies are gaining traction, offering new ways to facilitate cross-border transactions and reduce reliance on traditional banking systems.

- Blockchain Technology: Blockchain has the potential to revolutionize financial systems by increasing transparency, reducing fraud, and improving efficiency.

Sustainability and Climate Finance

Climate change is increasingly recognized as a critical issue in international finance. The World Bank and the IMF are working to integrate climate considerations into their lending and policy frameworks, supporting projects that promote sustainable development and resilience to climate shocks.

Geopolitical Shifts

The rise of emerging economies and the shifting balance of power among global players are altering the dynamics of international finance. Countries like China and India are playing a more prominent role in shaping global financial policies, challenging the traditional dominance of Western institutions.

Conclusion

International finance is a multifaceted and ever-evolving field that influences the economic well-being of nations around the world. From the role of institutions like the IMF to the impact of exchange rates and trade policies, understanding international finance is crucial for navigating the complexities of the global economy. As the world faces new challenges, including climate change and technological disruption, the need for innovative and inclusive financial systems has never been greater. By fostering collaboration, promoting transparency, and prioritizing sustainability, the global community can work towards a more stable and equitable financial future.