What Is an Insurance Broker? A Complete Guide to Understanding Their Role

Insurance is a critical component of financial planning, offering protection against unexpected events. While many people purchase insurance directly from carriers, others turn to professionals who specialize in navigating the complex world of insurance policies. These professionals are known as insurance brokers. In this article, we’ll explore what an insurance broker does, when you might need one, and how they are compensated.

What Is an Insurance Broker?

An insurance broker acts as an intermediary between you and an insurance company. Unlike agents who represent specific insurers, brokers work on your behalf to find the best policy that suits your needs. They have access to multiple insurance providers and can help you compare options to ensure you get the right coverage at a reasonable price.

Brokers are not affiliated with any single insurance company, which allows them to offer a broader range of choices. This independence is one of their key advantages. They use their expertise to assess your risk profile, understand your coverage needs, and match you with the most appropriate policy.

Types of Insurance Brokers

Insurance brokers can specialize in different areas, depending on the type of coverage you need. Here are some common specializations:

- Property and Casualty Brokers: These brokers handle insurance for homes, vehicles, and other personal assets.

- Life Insurance Brokers: They focus on life insurance policies, helping clients choose between term and permanent life insurance.

- Commercial Insurance Brokers: These professionals work with businesses to secure coverage for property, liability, and other business-related risks.

- Health Insurance Brokers: They assist individuals and families in selecting health insurance plans, often working with government exchanges or private carriers.

Each type of broker has specialized knowledge that can be invaluable when dealing with complex insurance needs.

When to Use an Insurance Broker

While it’s possible to buy insurance directly from carriers, there are situations where an insurance broker can provide significant value. Consider using a broker if:

- You have multiple properties or vehicles to insure.

- You need coverage for a small business.

- You want to thoroughly understand your policy, including exclusions and limits.

- You prefer a personalized relationship with someone who knows your background and needs.

- You want to shop around with multiple insurers without spending time comparing quotes yourself.

Brokers are especially useful for those with complicated insurance needs, such as landlords, business owners, or individuals with unique coverage requirements.

How Brokers Are Paid

Understanding how insurance brokers are compensated is essential to ensuring you receive unbiased advice. Brokers can earn income through two primary methods:

Commissions

Most brokers earn a commission from the insurance companies they represent. This commission is typically a percentage of the premium you pay. Importantly, the cost of the policy remains the same whether you buy it directly or through a broker, as the commission is already factored into the price.

However, it’s important to note that some insurance companies may offer bonuses or incentives to brokers for bringing in new clients. While this doesn’t necessarily mean the broker will prioritize one carrier over another, it’s worth asking about how their compensation structure works.

Broker Fees

In addition to commissions, some brokers charge a fee for their services. These fees are usually disclosed upfront and must be reasonable. For example, in New Jersey, there is a cap on broker fees for single policies, limiting them to $20.

Even with a fee, you may still save money overall. For instance, if a broker charges a $100 fee but helps you save $250 on your annual premium, you end up saving $150. However, these fees are typically nonrefundable, so it’s important to understand the terms before proceeding.

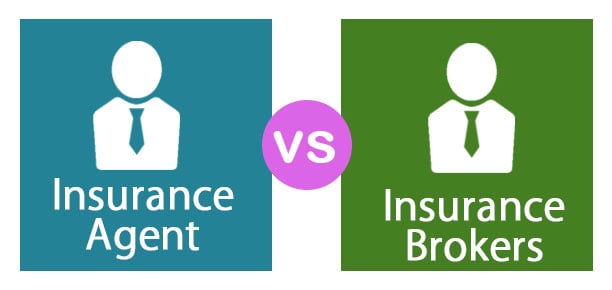

Insurance Broker vs. Independent Agent

It’s important to distinguish between an insurance broker and an independent agent. While both can help you find coverage, there are key differences:

- Representation: Brokers represent you, the buyer, while agents represent the insurance companies they work with.

- Policy Options: Brokers can access policies from multiple insurers, giving you more choices. Agents, on the other hand, are limited to the policies of the companies they are affiliated with.

- Binding Coverage: Only agents can bind a policy, meaning they can provide temporary coverage while the policy is being finalized. Brokers cannot do this.

- Fees: Brokers may charge fees, whereas agents typically only earn commissions.

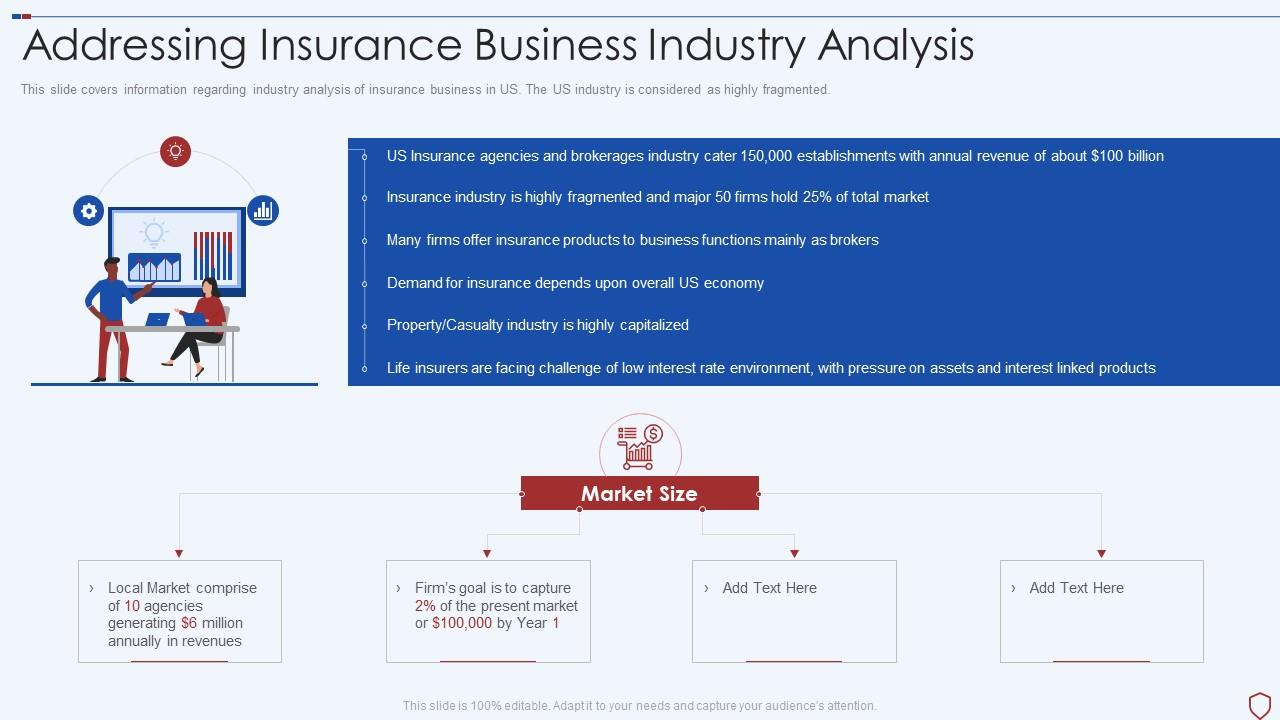

Other Ways to Buy Insurance

You don’t always need a broker to get insurance. Here are some alternatives:

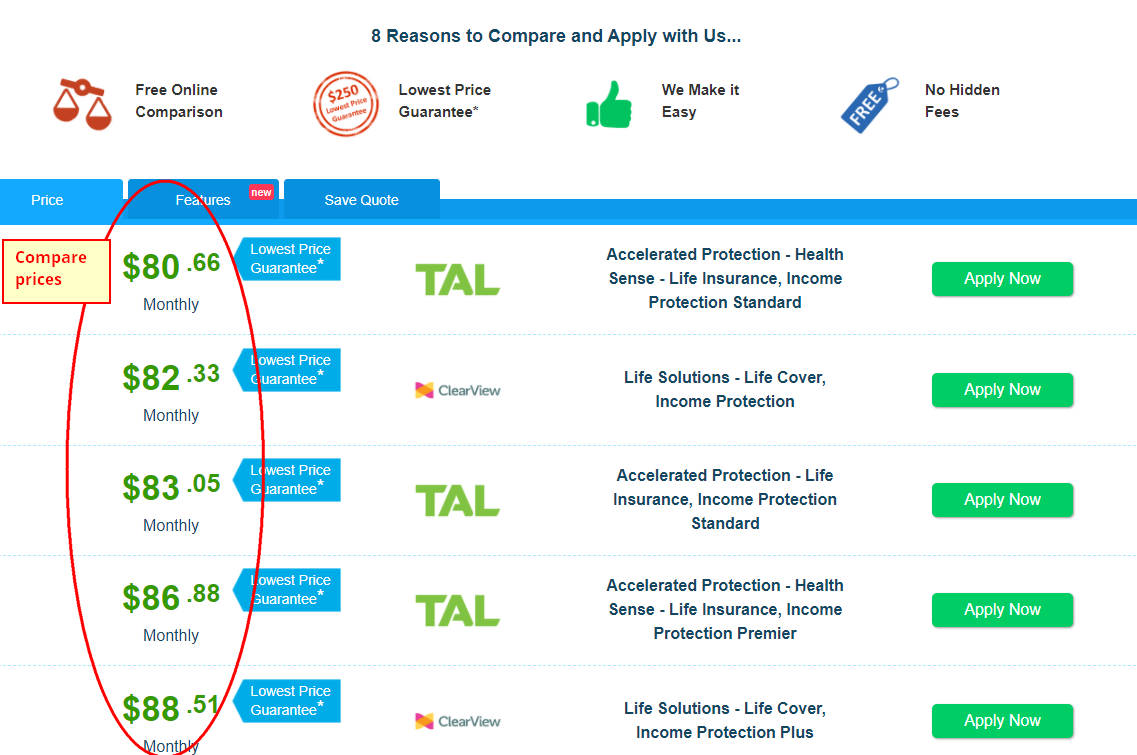

- Online Comparisons: Many websites allow you to compare rates from multiple insurers quickly.

- Direct Purchase: You can buy insurance directly from an insurer, either online or by phone.

- Captive Agents: These agents work exclusively for one insurance company.

- Independent Agents: These agents can work with multiple companies but may still have limitations based on their affiliations.

Even if you’re working with an independent agent or broker, you can still get your own quotes. Using an insurance comparison tool can help you find the cheapest price by looking at rates from multiple companies.

Conclusion

An insurance broker plays a vital role in helping individuals and businesses navigate the complex world of insurance. Whether you need coverage for your home, vehicle, or business, a broker can provide valuable guidance and access to a wide range of policies. Understanding how brokers are paid and when to use their services can help you make informed decisions and ensure you get the best coverage for your needs.