What Is Bonds Investment? A Complete Guide for Beginners

Investing in bonds can be a powerful tool for building a diversified and stable portfolio. Whether you’re new to investing or looking to expand your knowledge, understanding bonds is essential. This guide will walk you through the basics of bonds investment, including what they are, how they work, their benefits and risks, and how to get started.

What Are Bonds?

A bond is a debt security that represents a loan made by an investor to a borrower, which can be a government, municipality, or corporation. When you buy a bond, you’re essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal at maturity.

The key components of a bond include:

- Face Value (Par Value): The amount the issuer agrees to pay back at maturity.

- Coupon Rate: The fixed interest rate the issuer pays to the bondholder.

- Maturity Date: The date when the bond’s principal is repaid.

Bonds are often considered a safer investment compared to stocks because they offer predictable income and the potential to preserve capital. However, they are not without risk, as discussed later in this guide.

Types of Bonds

There are several types of bonds, each with its own characteristics and risk profiles. Understanding these can help you make informed investment decisions.

- Corporate Bonds

- Issued by corporations to raise capital.

- Divided into investment-grade and high-yield (junk) bonds.

-

Investment-grade bonds are safer but offer lower returns, while high-yield bonds carry higher risk but provide higher interest rates.

-

Municipal Bonds (Munis)

- Issued by states, cities, and other local governments.

- Often tax-exempt at the federal level and sometimes at the state level.

-

Include general obligation bonds, revenue bonds, and conduit bonds.

-

U.S. Treasuries

- Issued by the U.S. Department of the Treasury.

- Considered among the safest investments due to the backing of the U.S. government.

- Include Treasury Bills (T-Bills), Treasury Notes (T-Notes), Treasury Bonds (T-Bonds), and Treasury Inflation-Protected Securities (TIPS).

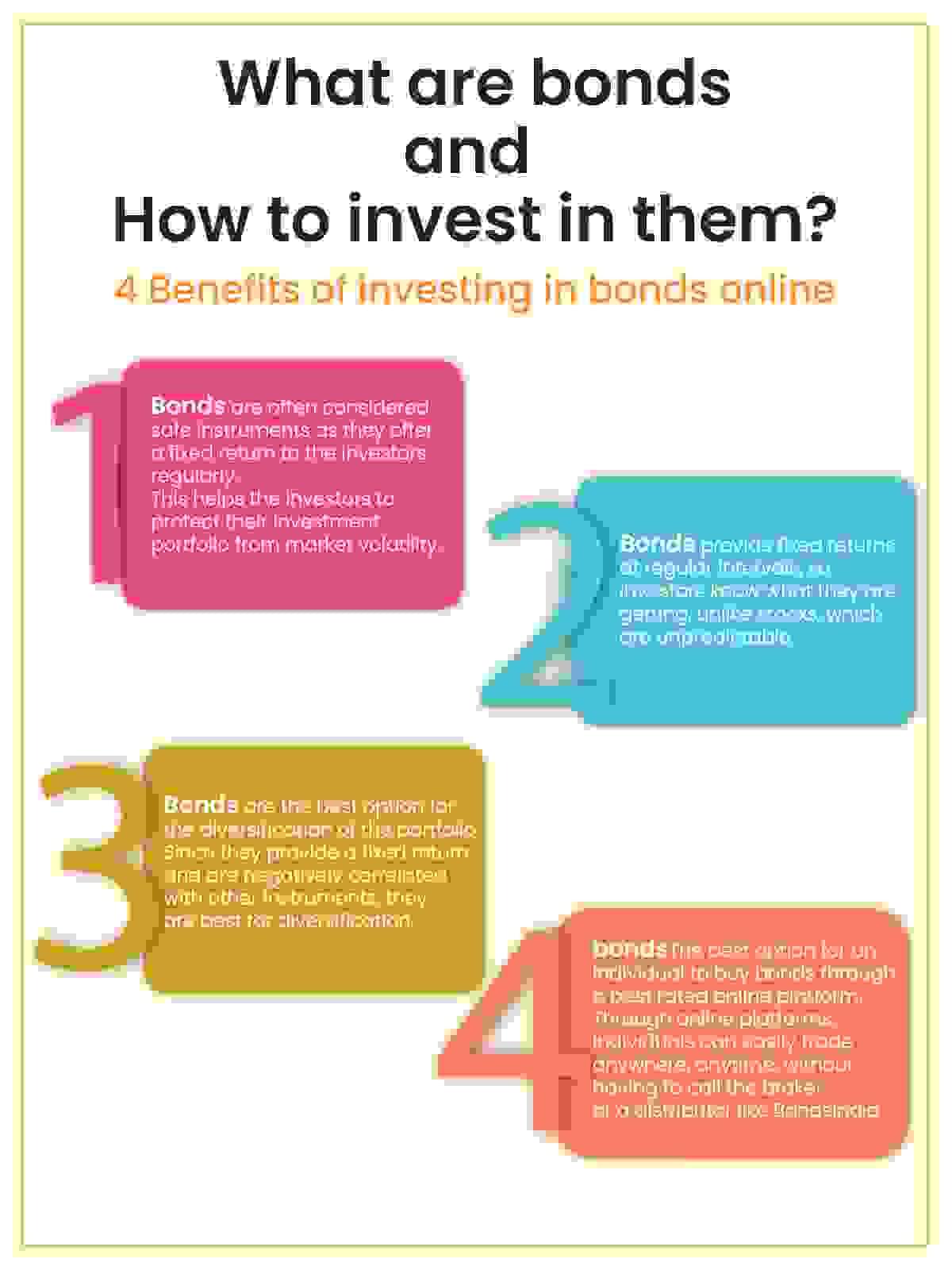

Benefits and Risks of Bonds

Bonds offer several advantages, but they also come with certain risks. Here’s a breakdown of both:

Benefits:

- Predictable Income: Bonds typically pay interest on a regular schedule, providing a steady stream of income.

- Capital Preservation: If held to maturity, bondholders receive the full principal amount.

- Diversification: Bonds can help reduce the overall risk of a portfolio by offsetting the volatility of stocks.

Risks:

- Credit Risk: The risk that the issuer may default on interest or principal payments.

- Interest Rate Risk: Bond prices move inversely with interest rates. Rising rates can decrease the value of existing bonds.

- Inflation Risk: Inflation can erode the purchasing power of fixed interest payments.

- Liquidity Risk: Some bonds may be difficult to sell quickly without a price discount.

- Call Risk: The risk that the issuer may redeem the bond before its maturity date.

How to Invest in Bonds

There are multiple ways to invest in bonds, depending on your goals and preferences:

- Bond Exchange-Traded Funds (ETFs)

- A convenient way to gain exposure to a diversified portfolio of bonds.

-

Examples include Vanguard’s Total Bond Market ETF (BND) and BlackRock’s iShares Core U.S. Aggregate Bond ETF (AGG).

-

Direct Purchase Through a Brokerage

- You can buy individual bonds from other investors or directly from the U.S. government via the TreasuryDirect website.

-

Many brokerages offer access to newly issued bonds.

-

TreasuryDirect

- A direct channel to purchase U.S. government bonds without paying fees to intermediaries.

Bond Price vs. Bond Yield

Understanding the relationship between a bond’s price and yield is crucial for making informed investment decisions.

- Price: The amount you pay for a bond.

- Yield: The return you receive from the bond’s interest payments.

For example, if you buy a $100 bond with a 4% annual yield, you’ll receive $4 in interest each year. However, if market interest rates rise, the value of your bond may decrease, as newer bonds with higher yields become more attractive.

Key Considerations When Investing in Bonds

Before investing in bonds, consider the following factors:

- Can the Borrower Pay Its Bonds?

- Evaluate the creditworthiness of the issuer using ratings from agencies like Moody’s, S&P, and Fitch.

-

For corporate bonds, review the company’s financial health, including operating income and interest expenses.

-

Is Now the Right Time to Buy Bonds?

- Bond prices are influenced by interest rates. Rising rates can lead to falling bond prices.

-

Consider strategies like bond laddering to manage interest-rate risk.

-

Which Bonds Are Right for Your Portfolio?

- Diversify your bond portfolio by including different types of bonds (corporate, municipal, and government).

- Stagger maturities to mitigate interest-rate risk.

Conclusion

Bonds investment offers a valuable way to build a balanced and secure portfolio. By understanding the different types of bonds, their benefits and risks, and how to invest, you can make informed decisions that align with your financial goals. Whether you’re looking for steady income, capital preservation, or diversification, bonds can play a critical role in your investment strategy.