What Is Credit Utilization and Why Does It Matter for Your Credit Score?

Credit utilization is a key factor that influences your credit score, yet many people remain unaware of its significance. Understanding what credit utilization is and how it impacts your financial health can help you make informed decisions about managing your credit. In this article, we will explore the concept of credit utilization, its importance in credit scoring, and strategies to manage it effectively.

Understanding Credit Utilization

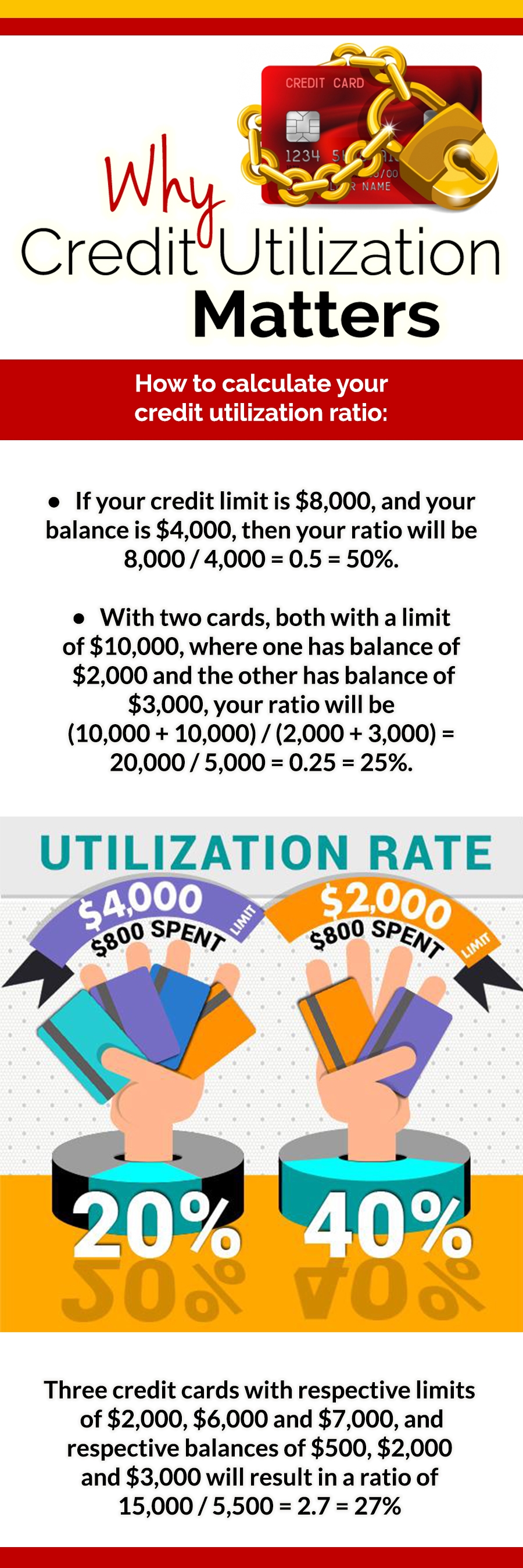

Credit utilization refers to the percentage of your available credit that you are currently using. It is calculated by dividing your credit card balances by your credit card limits and multiplying by 100 to get a percentage. For example, if you have a credit card balance of $500 and a credit limit of $2,000, your credit utilization rate would be 25% ($500 divided by $2,000 multiplied by 100).

This metric is crucial because it provides lenders with insight into how responsibly you manage your credit. A high credit utilization rate indicates that you are using a significant portion of your available credit, which can be seen as a risk factor by lenders. On the other hand, a low credit utilization rate suggests that you are not overly reliant on credit, which can be viewed favorably by lenders.

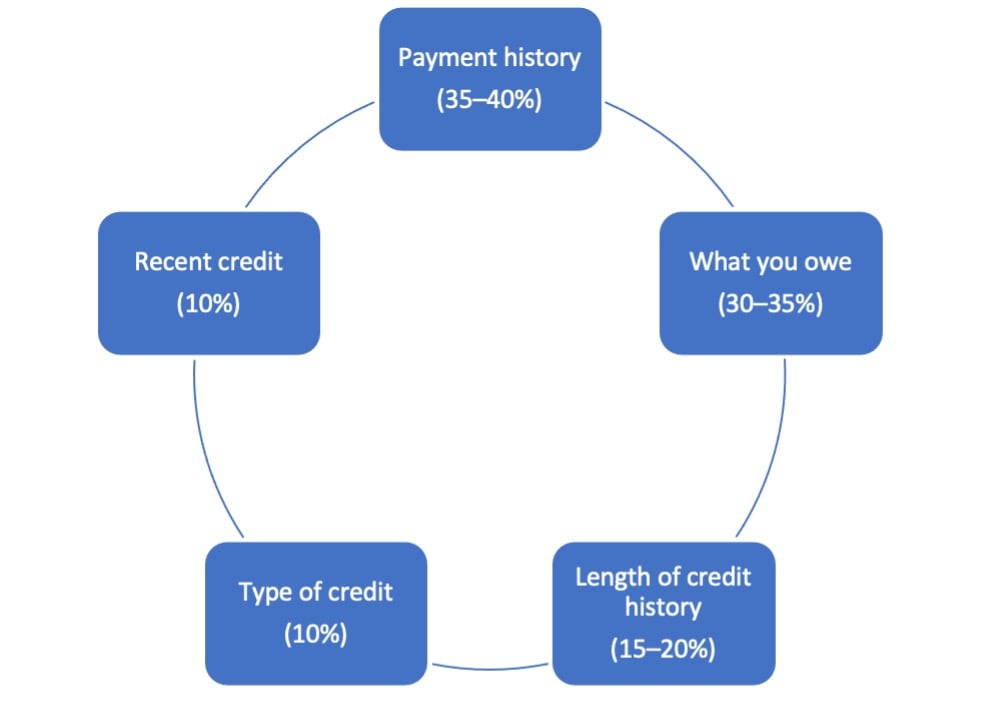

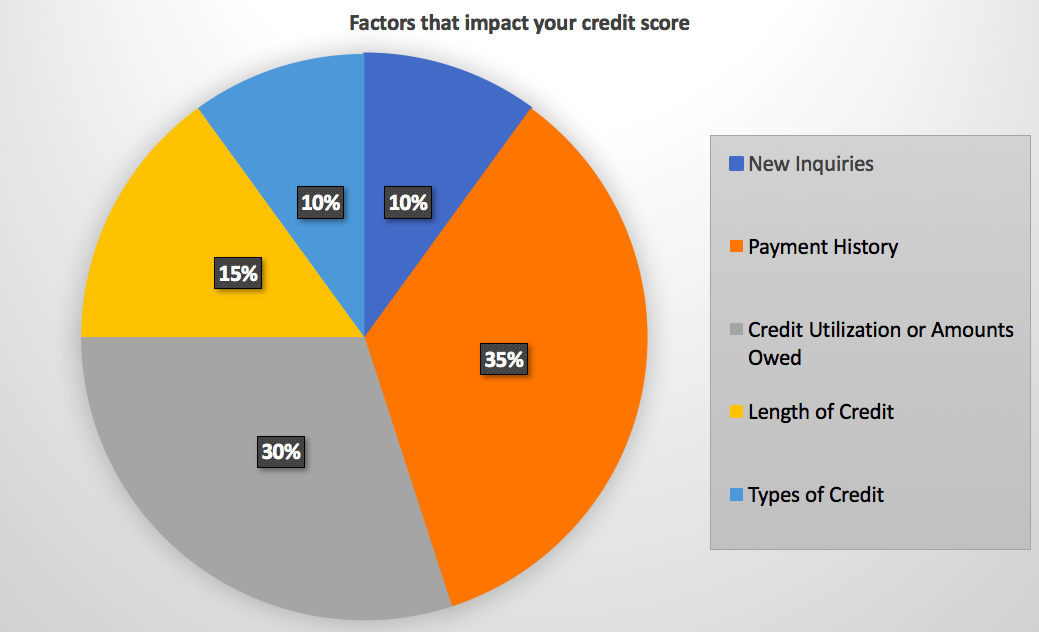

Importance of Credit Utilization in Credit Scoring

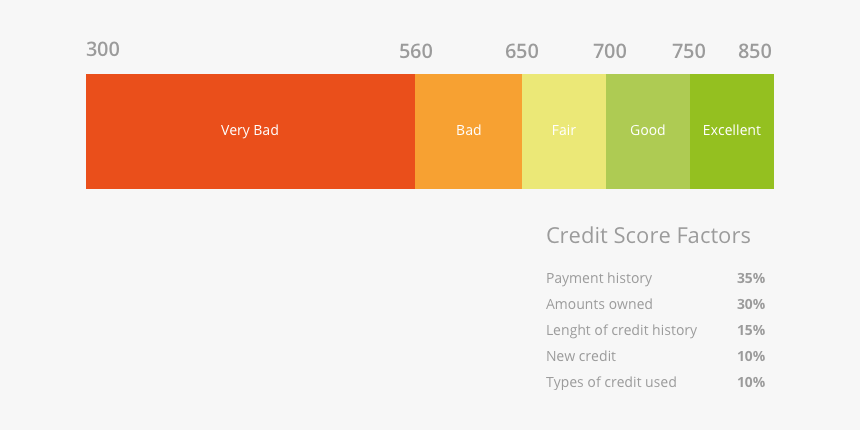

Credit utilization is one of the most significant factors that affect your credit score. According to FICO, credit utilization accounts for about 30% of your credit score, making it a critical component to consider when managing your credit.

Lenders and credit bureaus use credit utilization to assess your creditworthiness. A high credit utilization rate can negatively impact your credit score, while a low credit utilization rate can positively influence it. Maintaining a low credit utilization rate is essential for improving your credit score and demonstrating responsible credit management.

Factors Affecting Credit Utilization

Several factors can influence your credit utilization rate. Understanding these factors can help you manage your credit utilization more effectively:

- Credit Card Balances: The amount you owe on your credit cards directly affects your credit utilization. Higher balances result in a higher utilization rate, while lower balances lead to a lower rate.

- Credit Card Limits: Your credit card limits play a crucial role in determining your credit utilization rate. Higher limits allow for a lower utilization rate, while lower limits can result in a higher rate, even if your balances remain the same.

- New Credit: Opening new credit accounts can increase your overall credit limit, potentially leading to a lower utilization rate.

- Credit Card Closures: Closing a credit card account can reduce your available credit limit, which may increase your utilization rate.

- Balance Transfers: Transferring balances from one credit card to another can impact your utilization rate. If you transfer balances to a card with a lower limit, it may result in a higher utilization rate.

Strategies for Managing Credit Utilization

Managing credit utilization is essential for maintaining a healthy credit score. Here are some effective strategies to help you manage your credit utilization:

- Keep Track of Your Credit Card Balances: Regularly monitor your balances and ensure you are not carrying high balances. Paying off your balances in full each month is an effective way to keep your utilization low.

- Pay Attention to Credit Card Limits: Be aware of your credit card limits and try to stay well below them. Keeping your balances significantly lower than your limits can help maintain a low utilization rate.

- Avoid Opening Multiple Credit Accounts: Opening multiple accounts within a short period can increase your overall credit limit and potentially lead to a higher utilization rate. Limit the number of new accounts you open and manage your credit responsibly.

- Be Cautious with Balance Transfers: While balance transfers can help consolidate debt, be mindful of the impact on your utilization. Transferring balances to a card with a lower limit can result in a higher utilization rate.

- Avoid Closing Credit Card Accounts: Closing a card can reduce your available credit limit, increasing your utilization rate. Keep accounts open, especially those with a long history and no annual fees.

- Request Credit Limit Increases: If you have been managing your credit responsibly, request a credit limit increase from your issuer. A higher limit can lower your utilization rate, but use it wisely and avoid overspending.

- Diversify Your Credit Accounts: Having a mix of different types of credit accounts, such as credit cards, mortgages, and loans, can positively impact your score. However, avoid opening too many accounts and manage them responsibly.

- Pay Attention to Timing: Credit issuers typically report balances at the end of each billing cycle. Make payments before the cycle ends to reflect lower balances on your report.

- Use Credit Responsibly: Ultimately, the key to managing utilization is to use credit responsibly. Make timely payments, keep balances low, and avoid maxing out your cards to maintain a healthy utilization rate.

Common Misconceptions About Credit Utilization

There are several common misconceptions about credit utilization that can lead to confusion. Let’s debunk some of these:

- Closing credit cards improves utilization: Closing accounts can actually increase your utilization rate by reducing your available credit. It is generally advisable to keep accounts open, especially those with a long history and no fees.

- Using cash instead of credit improves utilization: Using cash does not impact your utilization rate, as it is based on credit card balances relative to limits. Whether you use cash or credit, it doesn’t affect your utilization.

- Maxing out cards and paying immediately is good: Maxing out cards can result in a high utilization rate, even if you pay off the balance immediately. It is best to keep balances low and avoid relying on maxing out as a strategy.

- Paying only the minimum is sufficient: Making minimum payments keeps accounts current, but it may not be enough for managing utilization. Paying in full each month helps maintain a low utilization rate and improve credit health.

Impact of Credit Utilization on Your Credit Score

Credit utilization has a significant impact on your credit score. It is one of the key factors that credit bureaus consider when calculating your score. A high utilization rate can negatively affect your score, while a low rate can positively influence it.

A high utilization rate, generally considered to be over 30%, indicates that you are using a significant portion of your available credit, which can be viewed as a risk by lenders. It may suggest that you are relying heavily on credit and may have difficulty managing debts, resulting in a lower score. Conversely, a low utilization rate, typically below 30%, shows that you are using a smaller portion of your available credit, which is viewed positively by lenders and can lead to a higher score.

It’s important to note that utilization is calculated both on an individual card basis and across all cards. Therefore, managing the rate on each card as well as the overall rate is essential for maintaining a healthy score.

Conclusion

Credit utilization is a crucial factor in managing your credit health and maintaining a good credit score. By keeping your balances low, avoiding maxing out cards, diversifying your accounts, and using credit responsibly, you can effectively manage your utilization rate. Being aware of common misconceptions and making informed decisions can help you avoid negative impacts on your credit score.

Frequently Asked Questions (FAQs)

Can I close credit card accounts to improve my credit utilization?

Closing accounts may not always improve your utilization. It can actually increase your rate by reducing your available credit. It’s generally advisable to keep accounts open, especially those with a long history and no fees.

Should I pay off my credit card balances in full each month?

Paying in full helps maintain a low utilization rate and improves your credit health. Making minimum payments may not be sufficient for effective utilization management.

How often should I check my credit card balances and limits?

Regular monitoring is recommended to ensure you’re not carrying high balances and staying below limits. Checking monthly or before the end of each billing cycle can help manage utilization effectively.

Can I request a credit limit increase to lower my utilization rate?

Yes, if you’ve managed your credit responsibly, you can request a limit increase. A higher limit can lower your rate, but use it wisely and avoid overspending.

Does using cash instead of credit cards impact my utilization?

Using cash doesn’t affect your utilization rate, as it’s based on credit card balances relative to limits. Whether you use cash or credit, it doesn’t impact your utilization rate.