What Is Peer-to-Peer Lending? A Complete Guide for Borrowers and Investors

Peer-to-peer (P2P) lending has emerged as a revolutionary way for individuals to borrow and lend money without the involvement of traditional financial institutions like banks. This innovative approach allows borrowers to access funds quickly and often with more favorable terms, while investors can earn returns by funding these loans. As the financial landscape continues to evolve, understanding how P2P lending works is essential for both potential borrowers and investors.

How Peer-to-Peer Lending Works

P2P lending operates through online platforms that connect individual lenders with borrowers. These platforms act as intermediaries, facilitating the loan process while charging fees for their services. The process typically involves the following steps:

- Application: A borrower applies for a loan through a P2P platform, providing personal and financial information.

- Assessment: The platform evaluates the borrower’s creditworthiness and assigns an interest rate based on their risk profile.

- Funding: Investors review the loan listings and choose which ones to fund. Some platforms allow borrowers to auction their loans, enabling lenders to bid on the interest rate they are willing to accept.

- Repayment: Once funded, the borrower makes regular payments, which are then distributed to the investors.

This streamlined process offers a more efficient alternative to traditional lending, where the approval and disbursement of loans can take weeks or even months.

Key Benefits of Peer-to-Peer Lending

P2P lending offers several advantages over traditional banking methods, making it an attractive option for many:

-

Easier Qualification: Borrowers with fair or poor credit scores may find it easier to qualify for P2P loans compared to conventional bank loans. This is because P2P platforms often use different criteria to assess creditworthiness.

-

Fast Approval Process: Many P2P platforms offer quick online applications, allowing borrowers to receive funding in a matter of days. Some even provide same-day funding, which can be crucial for urgent financial needs.

-

Flexible Terms: Borrowers can often customize their loan terms, including payment schedules and interest rates. This flexibility can be particularly beneficial for those with unique financial situations.

-

Higher Returns for Investors: Investors can earn higher returns compared to traditional investments like savings accounts or certificates of deposit (CDs). By investing in multiple loans, investors can diversify their portfolio and potentially increase their earnings.

Risks and Considerations

While P2P lending presents numerous benefits, it also comes with its own set of risks and considerations that both borrowers and investors should be aware of:

-

Credit Risk: Since P2P loans are often unsecured, there is a higher risk of default. Borrowers with lower credit scores may struggle to repay their loans, which could lead to losses for investors.

-

Lack of Insurance: Unlike traditional bank loans, P2P loans are not insured by the government or any financial institution. This means that investors could lose some or all of their principal if a borrower defaults.

-

Regulatory Environment: The regulatory landscape for P2P lending is still evolving. Different jurisdictions may have varying rules and requirements, which can affect the availability and structure of P2P loans.

-

Transparency and Trust: It is crucial for borrowers and investors to thoroughly research and understand the terms of any P2P loan. Reading customer reviews and checking the platform’s reputation can help mitigate potential risks.

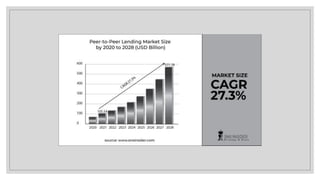

The Growing Popularity of P2P Lending

The rise of P2P lending can be attributed to several factors, including technological advancements and changing consumer preferences. As more people seek alternatives to traditional banking, P2P lending has gained traction, especially among younger generations who are more comfortable with digital platforms.

According to the Federal Reserve Bank of New York, U.S. household debt has been on the rise, reaching $17.69 trillion in the first quarter of 2024. This increase highlights the growing need for accessible and flexible financing options, which P2P lending can provide.

Moreover, the convenience and speed of P2P lending make it an appealing choice for those looking to consolidate debt, finance major purchases, or cover unexpected expenses. For investors, the opportunity to earn higher returns by supporting individuals and small businesses aligns with the broader trend of seeking alternative investment avenues.

Conclusion

Peer-to-peer lending represents a significant shift in the financial industry, offering a viable alternative to traditional banking. By connecting borrowers directly with lenders, P2P platforms provide a more efficient, accessible, and flexible way to obtain and invest money. While there are risks involved, the potential rewards for both borrowers and investors make P2P lending an attractive option in today’s economic landscape.

As the market continues to evolve, it is essential for individuals to stay informed about the latest developments and best practices in P2P lending. Whether you’re looking to secure a loan or explore new investment opportunities, understanding the intricacies of P2P lending can empower you to make informed decisions that align with your financial goals.