What You Need to Know About Mortgage Loans in 2024

Mortgage loans are a cornerstone of the American housing market, enabling millions of individuals and families to achieve the dream of homeownership. As we navigate through 2024, understanding the various types of mortgage loans available is more important than ever. Whether you’re a first-time homebuyer or looking to refinance, this guide will provide you with essential information to make informed decisions.

Understanding the Different Types of Mortgages

There are several types of mortgages, each designed to meet specific financial needs and circumstances. Here’s a closer look at the most common options:

Conventional Mortgages

Conventional mortgages are the most widely used type of loan and are offered by private lenders such as banks and credit unions. These loans are not backed by the government, which means they often have stricter lending requirements. For instance, borrowers typically need a credit score of at least 620 and a debt-to-income (DTI) ratio of up to 50%. Conventional loans can be further divided into conforming and non-conforming loans. Conforming loans adhere to the standards set by Fannie Mae and Freddie Mac, while non-conforming loans, like jumbo loans, exceed these limits.

Fixed-Rate Mortgages

Fixed-rate mortgages offer stability with an interest rate that remains constant throughout the life of the loan. This consistency allows borrowers to budget effectively without the worry of fluctuating payments. Fixed-rate mortgages typically come in 15- or 30-year terms, making them ideal for those planning to stay in their homes long-term. These loans can include conventional, jumbo, and government-backed options.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages (ARMs) feature an interest rate that can change over time based on market conditions. These loans usually start with a fixed rate for an introductory period (often 5, 7, or 10 years), after which the rate may adjust annually. ARMs can be beneficial for borrowers who plan to move within a few years or when interest rates are high. However, they carry the risk of increased payments if rates rise.

Jumbo Loans

Jumbo loans are non-conforming conventional mortgages designed for high-value properties. They exceed the limits set by Fannie Mae and Freddie Mac, which in 2024 are $806,500 for single-family homes in most areas and up to $1,209,750 in high-cost regions. These loans are available in both fixed-rate and adjustable-rate formats and are suitable for those purchasing expensive homes.

Government-Backed Loans

Government-backed loans, including FHA, VA, and USDA loans, are designed to make homeownership more accessible. These loans offer lower down payment requirements and more flexible qualification criteria.

- FHA Loans: Insured by the Federal Housing Administration, FHA loans require as little as 3.5% down and are ideal for first-time buyers.

- VA Loans: Available to eligible military personnel and veterans, VA loans often do not require a down payment or private mortgage insurance.

- USDA Loans: Designed for moderate- to low-income borrowers in rural areas, USDA loans can allow for no down payment.

Choosing the Right Mortgage for Your Needs

Selecting the right mortgage involves considering your financial situation, long-term goals, and lifestyle. Here are some key factors to consider:

Assess Your Affordability

Lenders determine how much you qualify for based on your income, credit score, and debt-to-income ratio. However, it’s crucial to distinguish between what you qualify for and what you can afford. Consider all monthly expenses, including property taxes, homeowners insurance, and potential maintenance costs, to ensure your mortgage payment fits comfortably within your budget.

Understand Additional Costs

Beyond the principal and interest, your monthly mortgage payment may include property taxes, homeowners insurance, and private mortgage insurance (PMI). These additional costs can significantly impact your overall affordability. Be sure to factor them into your budget calculations.

Explore Loan Options

Shop around and compare different mortgage options to find the best fit for your financial situation. Conventional, government-backed, and jumbo loans each have unique benefits and drawbacks. Consider your long-term plans and financial stability when choosing a loan type.

The Mortgage Application Process

Applying for a mortgage involves several steps, from assessing your finances to submitting your application. Here’s a brief overview of the process:

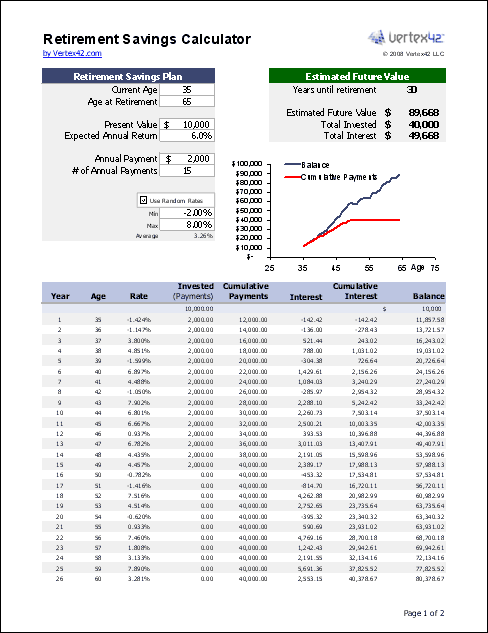

- Discover What You Can Afford: Use a home affordability calculator to determine your budget. Consider all monthly expenses, including insurance, taxes, and potential renovations.

- Get Preapproved for a Loan: A preapproval letter shows sellers that you’re a serious buyer. Lenders will assess your income, credit history, and other financial details to determine your eligibility.

- Find the Right Home: Once preapproved, start searching for a home that meets your needs and budget. Submit an offer and earnest money deposit to secure the property.

- Finalize Your Mortgage Choice: Choose a lender and loan type that aligns with your financial goals. Compare Loan Estimates to find the best deal.

- Submit Your Application: Gather necessary documents, such as tax returns, pay stubs, and bank statements, and submit your application. You’ll receive a Loan Estimate outlining the terms and fees of your loan.

Conclusion

Navigating the world of mortgage loans can be complex, but understanding the different options and processes is essential for making informed decisions. Whether you opt for a conventional, fixed-rate, adjustable-rate, jumbo, or government-backed loan, the key is to choose a mortgage that aligns with your financial situation and long-term goals. By carefully evaluating your options and considering all associated costs, you can take a significant step toward achieving homeownership in 2024.